NET Power to Combine with Rice Acquisition Corp. II to Accelerate Decarbonization of Natural Gas Power Generation

- NET Power’s proven technology generates near zero-emissions utility-scale power, delivering the world’s first scalable solution that achieves the energy trifecta: clean, reliable, low-cost power.

- Implied pro forma enterprise value of $1.459 billion and will be publicly listed under the ticker symbol “NPWR”.

- $235 million of committed investments — with participation from the Rice family, Occidental, Constellation, 8 Rivers, HITE Hedge, and NGP — are expected to fund corporate operations through planned commercialization in 2026.

- Experienced energy executive Danny Rice will join NET Power as its new CEO upon closing of the transaction. Mr. Rice led Rice Energy and Rice Midstream Partners to over $10 billion of exits.

- Growing project pipeline and planned utility-scale plant deliveries starting in 2026 position NET Power to capture substantial market share and reduce global emissions on a gigatonne scale.

DURHAM, N.C.–(BUSINESS WIRE)–Rice Acquisition Corp. II (NYSE: RONI) (“RAC II”), a special purpose acquisition company focused on supply-side decarbonization solutions, and NET Power, LLC (“NET Power”) today announced a definitive agreement to enter into a business combination (the “transaction”) to accelerate deployment of NET Power’s proprietary technology that delivers clean, reliable, and low-cost power from natural gas. After the business combination, the company will be named NET Power Inc. (the “combined Company”). The transaction is expected to close in the second quarter of 2023 and the combined Company will be listed on the NYSE under the ticker symbol “NPWR”.

Upon closing of the transaction, Ron DeGregorio, current CEO of NET Power and 40-year power and energy veteran who successfully led NET Power through technology validation and establishment of key supplier partnerships, will be succeeded by Danny Rice, current director of RAC II and former CEO of Rice Energy, Inc., to lead NET Power through commercialization and beyond. The leadership team and board of directors of the combined Company have decades of experience in operations, engineering, management, and investment in energy and power generation.

“We have long believed that if you can use natural gas, generate reliable electricity, and capture the resulting emissions, you would change the world. For over a decade, NET Power has worked tirelessly to prove its game-changing technology, which we did through our demonstration facility in La Porte, Texas. Following the strategic investment and partnership with Baker Hughes to deliver key turbomachinery for future NET Power plants, this transaction properly capitalizes NET Power and enables the company to commercialize this revolutionary technology. The Rice Group is a logical strategic partner, and I am excited to hand the reins to Danny to lead NET Power,” said retiring CEO Ron DeGregorio.

Incoming CEO Danny Rice said, “Today, around 60% of global power generation comes from coal and natural gas-fired power plants that produce reliable and low-cost power. However, these plants collectively emit nearly 14 billion tonnes of CO2 per year, accounting for approximately 37% of total global emissions. By replacing these plants with NET Power’s proven technology, we can eliminate nearly 100% of these emissions while providing reliable and low-cost power that people deserve. I’m excited to help NET Power deliver the energy trifecta and become the global leader in clean power generation.”

Vicki Hollub, President and CEO of Occidental, said, “We are excited to support this transaction, which will further NET Power’s commercialization plans and help achieve decarbonization goals globally. We first invested in NET Power because we believe the technology can accelerate Oxy’s efforts to reduce emissions in our existing operations and ultimately supply emissions-free power to the Direct Air Capture (“DAC”) sites and sequestration hubs we are developing.”

Occidental is advancing feasibility studies to incorporate NET Power plants into DAC hubs being developed by its 1PointFive subsidiary, where approximately 30 – 40 plants could provide enough clean power for a DAC program capturing 100 – 135 million tonnes of CO2 per year.

Rod Christie, Executive Vice President of Industrial & Energy Technology at Baker Hughes, said, “Our strategic partnership focused on technology development and accelerating market positioning and deployment of the NET Power solution presents a clear path to commercialize near-zero emission natural gas power around the world. The combination of NET Power with Rice Acquisition Corp. II further reinforces the path towards making that progress a reality.”

Cam Hosie, CEO of 8 Rivers, said, “This transaction enables NET Power’s technology to become a cornerstone of the clean energy future. 8 Rivers is proud to have supported NET Power from the beginning, and we will continue to support NET Power’s global deployment by leveraging our commercial and project management expertise while driving deployments through our net-zero solutions business, Zero Degrees.”

Investment Highlights

- Opportunity: Power generation is the largest source of global emissions, totaling approximately 14 billion tonnes annually, primarily from coal and natural gas-fired power plants. Global decarbonization requires lower-carbon power generation solutions but today’s lower-carbon solutions are unreliable, unaffordable, or limited by scale. NET Power was designed with the operational flexibility to complement wind and solar in markets with high renewable penetration and the baseload reliability to meaningfully decarbonize markets predominantly powered by carbon-emitting coal and natural gas-fired power plants. Replacing retiring power plants and meeting new demand from electrification would equate to approximately 17,000 NET Power plants globally with over 1,300 plants in the U.S. alone.

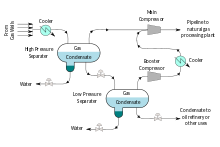

- Technology: NET Power’s proprietary process combines oxy-combustion (combustion of natural gas with pure oxygen) with a supercritical CO2 power generation cycle to generate electricity. This patented, high-efficiency cycle inherently captures over 97% of CO2 which can then be utilized or sequestered, transforming natural gas into clean baseload power. NET Power is designed to generate reliable power with a carbon intensity similar to solar or wind coupled with a short-duration battery at a levelized cost of electricity of approximately $21-$40 per megawatt hour. A single utility-scale 300 MW NET Power plant would generate enough electricity for over 220,000 homes per year in the U.S. Learn more about the technology at: https://netpower.com/technology.

- Business: NET Power is an asset-light technology licensor with rights to a substantial and growing intellectual property portfolio. Each technology license is expected to generate approximately $65 million of present value (PV10) net to NET Power.

-

Momentum: The company realized several key milestones over the past year, including:

- Proving the Technology: In November 2021, the company’s demonstration facility in La Porte, Texas synchronized to the grid, proving the oxy-combustion and supercritical CO2 process.

- Preparing for Commercialization: In early 2022, the company formed a strategic partnership with Baker Hughes to design and manufacture key plant equipment including turboexpanders.

- Compelling Economics: Passage of the Inflation Reduction Act in 2022 increased the 45Q tax credit for CO2 sequestration. Under the revised 45Q, a NET Power plant, which is designed to capture up to 820,000 tonnes of CO2 per year, becomes more economic to deploy than carbon-emitting coal and natural gas-fired alternatives.

- De-risking Commercialization: In November, NET Power announced its plan to develop and build its first utility-scale project (Serial Number 1, or “SN1”) with the support of its strategic shareholders. The project, located at an Occidental hosted site near Odessa, Texas, targets 300 MW of near zero-emissions power and is designed to significantly de-risk the commercialization of NET Power’s technology. Learn more about the project at: https://www.prnewswire.com/news-releases/net-power-announces-its-first-utility-scale-clean-energy-power-plant-integrated-with-co2-sequestration-301669970.html.

-

Industry-leading Strategic Partners: NET Power’s shareholders, representing approximately 70% of pro forma ownership (assuming no redemptions), are leaders in the energy industry, with deep experience across energy production, energy transportation, power generation, manufacturing, operations, sales, services, and CO2.

- Occidental (NYSE: OXY), NET Power’s largest shareholder, is an international energy company with 50 years of experience in large-scale CO2 transportation, use and storage. Occidental is applying its carbon management experience to advance new low carbon initiatives to help achieve net-zero emissions in its operations and help others do the same. As previously announced, Occidental will host NET Power’s first utility-scale plant (SN1) at its operations near Odessa, Texas in the Permian Basin.

- Baker Hughes (NASDAQ: BKR) is an energy technology company and is jointly developing and marketing NET Power’s suite of integrated equipment and technologies, including supercritical CO2 turboexpanders.

- Constellation (NASDAQ: CEG) is the largest provider of carbon-free power in the U.S. with more than 32,000 MW of generating capacity. Constellation has operational and market experience with large scale generation assets.

- 8 Rivers Capital, LLC is a full-service net zero solutions provider leading the invention and commercialization of sustainable, infrastructure-scale technologies for the global energy transition. 8 Rivers invented NET Power’s oxy-combustion thermodynamic cycle and now provides project development support for NET Power.

Transaction Highlights

- Business combination of RAC II and NET Power at pro forma enterprise value of $1.459 billion.

- Assuming no redemptions, the transaction is expected to provide NET Power with approximately $535 million of cash net of transaction fees, consisting of $347 million of cash in trust of which $10 million is subject to a non-redemption agreement, and $225 million of PIPE commitments. Total committed investment of $235 million is comprised of $100 million from the Rice Family and affiliates through a $90 million PIPE commitment and $10 million non-redemption agreement, and PIPE commitments of $100 million from Occidental, $5 million from 8 Rivers, $5 million from Constellation, and $25 million from other investors.

- Net proceeds of $200 million secured through the committed investments are expected to fully fund corporate operations through commercialization of SN1 with expected commissioning in 2026. Net proceeds above $200 million are expected to advance and support commercialization, including funding of SN1.

- Existing NET Power shareholders are rolling 100% of their equity into the combined Company and will own approximately 70% of the pro forma equity assuming no redemptions.

- The business combination, which was recommended to RAC II’s board of directors (the “RAC II Board”) by RAC II’s management team, has been unanimously approved by the RAC II Board and is expected to close in the second quarter of 2023, subject to certain closing conditions, including receipt of approval by holders of a majority of the shares held by RAC II’s shareholders. The business combination was also recommended to NET Power’s board of directors (the “NET Power Board”) by NET Power’s management team and has been unanimously approved by the NET Power Board.

Advisors

Guggenheim Securities, LLC acted as lead financial advisor to RAC II. Barclays Capital Inc. also served as financial advisor to RAC II. Kirkland & Ellis LLP served as legal counsel to RAC II. Credit Suisse Securities (USA) LLC acted as financial advisor and capital markets advisor to NET Power. Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C. served as legal counsel to NET Power. Barclays Capital Inc. and Citigroup Global Markets Inc. acted as capital markets advisors to RAC II. Barclays Capital Inc. and Citigroup Global Markets Inc. acted as lead placement agents and Credit Suisse Securities (USA) LLC acted as co-placement agent on the PIPE. Vinson & Elkins L.L.P. served as legal counsel to the capital markets advisors and placement agents.

Investor Presentation

For more information, please view the investor presentation on the NET Power website at https://netpower.com/investor-relations/. A recorded presentation from management discussing the business combination will also be available here on December 14th at 7:03 am Eastern Time and a transcript of this webcast will be filed by RAC II with the SEC.

About NET Power

NET Power is a clean energy technology company with a mission to globally deliver the “Energy Trifecta”: Reliable, Clean, and Low-Cost power. The company invents, develops and intends to license technology that provides reliable, on-demand natural gas power with life cycle emissions that are approximately 90% below today’s combined cycle natural gas systems and in line with renewables coupled with batteries. The technology also delivers a levelized cost of energy that is below both combined cycle gas turbines with carbon capture and renewables coupled with batteries. Founded in 2010 and headquartered in Durham, North Carolina, NET Power has received strategic investments from key industry partners including Occidental, Baker Hughes, Constellation, and 8 Rivers.

About Rice Acquisition Corp. II

RAC II is led by Daniel Rice IV and Kyle Derham, former executives of Rice Energy, Inc. (“RICE”) and Rice Midstream Partners (“RMP”). In 2018 and 2019, RICE and RMP merged with EQT Corporation (NYSE: EQT) and EQT’s midstream affiliates for over $10 billion to become the largest U.S. natural gas producer. Rice Acquisition Corp. led a 2021 business combination with Archaea Energy LLC and Aria Energy LLC to create Archaea Energy, Inc. (NYSE: LFG), an industry-leading renewable natural gas platform that BP p.l.c. (NYSE: BP) agreed to acquire for a cash consideration of $4.1 billion in October 2022, generating a 2.6x return on investment for LFG PIPE investors in approximately one year. Daniel Rice currently serves on the board of EQT and Archaea Energy, Inc. The RAC II website is https://ricespac.com/rac-ii/.

Forward-Looking Statements

This communication may contain certain forward-looking statements within the meaning of the federal securities laws with respect to the combined Company and the proposed transaction between NET Power and RAC II. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “seek,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “could,” “will,” “would,” “will be,” “will continue,” “will likely result” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (i) conditions to the completion of the proposed business combination and PIPE investment, including shareholder approval of the business combination, may not be satisfied or the regulatory approvals required for the proposed business combination may not be obtained on the terms expected or on the anticipated schedule; (ii) the occurrence of any event, change or other circumstance that could give rise to the termination of the business combination agreement between the parties or the termination of any PIPE investor’s subscription agreement; (iii) the effect of the announcement or pendency of the proposed business combination on NET Power’s business relationships, operating results, and business generally; (iv) risks that the proposed business combination disrupts NET Power’s current plans and operations; (v) risks related to diverting management’s attention from NET Power’s ongoing business operations; (vi) potential litigation that may be instituted against RAC II or NET Power or their respective directors or officers related to the proposed transaction or the business combination agreement or in relation to NET Power’s business; (vii) the amount of the costs, fees, expenses and other charges related to the proposed business combination and PIPE investment; (viii) risks relating to the uncertainty of the projected financial information with respect to NET Power or the combined Company; (ix) NET Power’s history of significant losses; (x) the combined Company’s ability to manage future growth effectively; (xi) the combined Company’s ability to utilize its net operating loss and tax credit carryforwards effectively; (xii) NET Power’s ability to continue as a going concern if the transactions contemplated herein are not completed; (xiii) the capital-intensive nature of NET Power’s business model, which may require the combined Company to raise additional capital in the future; (xiv) barriers the combined Company may face in its attempts to deploy and commercialize its technology; (xv) the complexity of the machinery NET Power relies on for its operations and development; (xvi) the combined Company’s ability to establish and maintain supply relationships; (xvii) risks related to NET Power’s arrangements with third parties for the development, commercialization and deployment of technology associated with NET Power’s technology; (xviii) risks related to NET Power’s other strategic investors and partners; (xix) the combined Company’s ability to successfully commercialize its operations; (xx) the availability and cost of raw materials; (xxi) the ability of NET Power’s supply base to scale to meet the combined Company’s anticipated growth; (xxii) risks related to NET Power’s or the combined Company’s ability to meet its projections; (xxiii) the combined Company’s ability to expand internationally; (xxiv) the combined Company’s ability to update the design, construction and operations of the NET Power technology; (xxv) the impact of potential delays in discovering manufacturing and construction issues; (xxvi) the possibility of damage to NET Power’s Texas facilities as a result of natural disasters; (xxvii) the ability of commercial plants using NET Power’s technology to efficiently provide net power output; (xxviii) the combined Company’s ability to obtain and retain licenses; (xxix) the combined Company’s ability to establish an initial commercial scale plant; (xxx) the combined Company’s ability to license to large customers; (xxxi) the combined Company’s or NET Power’s ability to accurately estimate future commercial demand; (xxxii) the combined Company’s ability to adapt to the rapidly evolving and competitive natural and renewable power industry; (xxxiii) the combined Company’s ability to comply with all applicable laws and regulations; (xxxiv) the impact of public perception of fossil fuel derived energy on the combined Company’s business; (xxxv) any political or other disruptions in gas producing nations; (xxxvi) the combined Company’s ability to protect its intellectual property and the intellectual property it licenses; (xxxvii) the ability to meet stock exchange listing standards following the consummation of the proposed business combination; (xxxviii) changes to the proposed structure of the proposed business combination that may be required or appropriate as a result of applicable laws or regulations, including recent proposals by the U.S. Securities and Exchange Commission (the “SEC”) or as a condition to obtaining regulatory approval of the proposed business combination; (xxxix) the impact of the global COVID-19 pandemic on any of the foregoing risks; and (xl) such other factors as are set forth in RAC II’s periodic public filings with the SEC, including but not limited to those described under the headings “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in its Annual Report on Form 10-K for the fiscal year ended December 31, 2021, its subsequent quarterly reports on Form 10-Q, and in its other filings made with the SEC from time to time, which are available via the SEC’s website at www.sec.gov. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and NET Power and RAC II assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither NET Power nor RAC II gives any assurance that either NET Power or RAC II, or the combined Company, will achieve its expectations.

Important Information about the Transaction and Where to Find It

This press release relates to a proposed business combination transaction involving NET Power and RAC II. In connection with the transaction, RAC II intends to file with the SEC a registration statement on Form S-4 that will include a proxy statement and prospectus (the “Proxy Statement/Prospectus”). This document is not a substitute for the Proxy Statement/Prospectus. The definitive Proxy Statement/Prospectus (if and when available) will be delivered to RAC II’s shareholders. RAC II may also file other relevant documents regarding the proposed transaction with the SEC. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, SECURITY HOLDERS OF RAC II AND OTHER INTERESTED PARTIES ARE URGED TO READ THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT RAC II, NET POWER, THE TRANSACTION AND RELATED MATTERS.

Investors and security holders of RAC II may obtain free copies of the Proxy Statement/Prospectus, when available, and other documents that are filed or will be filed with the SEC by RAC II through the website maintained by the SEC at www.sec.gov or at RAC II’s website at www.ricespac.com/rac-ii.

Participants in the Solicitation

RAC II and NET Power and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies from RAC II’s shareholders in connection with the transaction. A list of the names of such directors and executive officers and information regarding their interests in the proposed transaction between RAC II and NET Power will be contained in the Proxy Statement/Prospectus, when available. You may obtain free copies of these documents as described in the preceding paragraph.

No Offer or Solicitation

This press release shall not constitute a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the business combination. This press release shall also not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Contacts

Investor Relations:

Kyle Derham

Media Relations:

Amy Rosenberg

amy.rosenberg@fleishman.com

917-439-9309