New partnership on gas pipelines between Algeria and Italy formed

Eni and Snam have entered into an agreement for the sale by Eni to Snam of a 49.9% stake (directly and indirectly owned) in certain companies operating two groups of international gas pipelines connecting Algeria to Italy. In particular, the perimeter of the transaction includes the onshore gas pipelines running from the Algeria and Tunisia borders to the Tunisia coast (TTPC), and the offshore gas pipelines connecting the Tunisian coast to Italy (TMPC)[1].

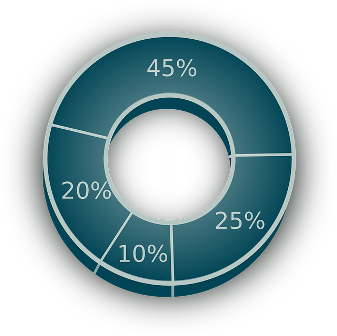

Pursuant to the agreement, Eni will contribute its entire ownership interests in the two pipelines to a newly incorporated Italian company (NewCo) in which Eni will continue to hold a 50.1% stake, whereas the remaining 49.9%[2] will be sold to Snam for a purchase price equal to 385 million euros. Snam will fund the payment of the purchase price with its own financial resources.

The transaction will create synergies among the parties’ respective areas of expertise in gas transport on a strategic route for the security of the natural gas supply in Italy, enabling potential development initiatives within the hydrogen value chain from North Africa. The transaction supports Eni’s broader strategy to optimize its portfolio and accelerate growth in sectors related to the energy transition. Snam will benefit from its position on a strategic route for the security of natural gas supplies to Italy and the opportunity to support potential developments within the hydrogen value chain also by means of natural resources in North Africa.

The agreement also provides for an earn-in and earn-out mechanism to be calculated on the basis of the revenues that will be generated by the target companies. The target companies generated a net income (100% of Eni’s stake) of around 90 million euros in 2020.

Information Source: Read More

Oil and gas, press , | Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar