Oando to acquire Eni’s nigeria subsidiary, NAOC Ltd

London, 04 September, 2023, (Oilandgaspress) – Eni announces the signing of an agreement with Oando PLC – Nigeria’s leading indigenous energy solutions provider listed on both the Nigerian and Johannesburg Stock Exchange – for the sale of Nigerian Agip Oil Company Ltd (NAOC Ltd), the wholly Eni-owned subsidiary focusing on onshore oil & gas exploration and production in Nigeria, as well as power generation.

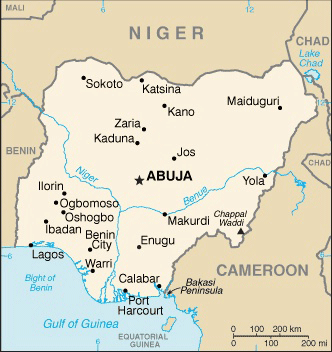

NAOC Ltd is present with interests in Nigeria across 4 onshore blocks (OML 60, 61, 62, 63), which it operates on behalf of NAOC JV (operator NAOC Ltd 20%, Oando 20%, NNPC E&P Limited 60%), in the Okpai 1 and 2 power plants (with a total nameplate capacity of 960MW), and in two onshore exploration leases (OPL 282 and OPL 135, respectively 90% and 48%) for which it also holds operatorship.

NAOC Ltd participating interest in SPDC JV (Shell Production Development Company Joint Venture – operator Shell 30%, TotalEnergies 10%, NAOC 5%, NNPC 55%) is not included in the perimeter of the transaction and will be retained in Eni’s portfolio.

Following the transaction completion with Oando PLC, Eni will maintain its presence in Nigeria through Nigerian Agip Exploration (NAE) and Agip Energy and Natural Resources (AENR), reiterating the company’s commitment to its employees health and safety, as well as to the environment. Eni continues to operate in the country focusing on operated offshore activities. Participations in operated-by-others assets, both onshore and offshore, and Nigeria LNG will remain in Eni portfolio too.

The transaction is consistent with Eni 2023-2026 Plan. The Upstream will supplement the core organically led growth with inorganic high-grading activity, adding resources with incremental value while divesting resources that can offer greater value and opportunities to new owners.

The closing of this transaction is subject to, inter alia, the authorization of all relevant local and regulatory authorities.

Information Source: Read More

Energy Monitors , Electric Power , Natural Gas , Oil , Climate , Renewable , Wind , Transition , LPG , Solar , Electric , Biomass , Sustainability , Oil Price , Electric Vehicles, Crude Oil Markets, Crude Oil, Supply Analytics,