October 02, 2024 Latest Crude Oil, Gas Price

London, (Oilandgaspress) –– OPEC+ will unlikely deviate from the current plan when ministers gather in the virtual space today, and it will start easing production restrictions to the extent of 180,000 bpd per month from December. Libyan crude oil should make an almost imminent re-appearance in the national market as an agreement to appoint the new head of the central bank was reached. The global manufacturing sector is still sedated, and it is unclear when it will feel better. Euro zone factory activity contracted further and in Asia, the picture is not rosier either.

The winds of economic slowdown or rising supply, however, pale in significance when it comes to the Middle East. Oil prices rallied out of sight yesterday afternoon on reports that Iran was preparing to launch a missile attack on Israel. The claims turned out substantiated and the assault came possibly as a response to the Israeli ground offensive in Lebanon. It is the most serious escalation in the latest chapter of the conflict.

At one point oil jumped as much as $3.45/bbl over Friday’s settlement. Anyone with a short position took the only reasonable step there was to take and covered. Do yesterday’s events warrant a protracted rally? Iran says its attacks were over but Israel and its unconditional ally, the US, threaten to retaliate and this could include damaging or obliterating Iran’s oil facilities, according to Axios. Further escalation is more than plausible hence the odds of assaults by Iran or its proxies, akin to the September 2019 strike on Saudi oil processing facilities, which knocked out half of the country’s production for a brief period, or the closure of the Strait of Hormuz are increasing. Any of these events would irretrievably send oil prices considerably higher. One can only hope that common sense will prevail but at the same time it is blatantly obvious that the end is anything but nigh, alas.

Discernible Lack of Upside Conviction in 3Q

Any seasoned investor would testify that the secret of being successful in trading is to anticipate and then correctly interpret events. Uncertainty is what moves markets and provides opportunities. These unforeseen developments, however, have been becoming increasingly challenging to read and the depth and the potential repercussions of the major driving forces have precipitated erratic trading conditions, which sometimes result in irrational price movements. The world has never had to deal with two parallel military conflicts with unpredictable outcomes at the doorstep of oil-producing regions. At the same time, tension between former trading partners is also on the rise culminating in an economic war. The upcoming US election is another ‘known unknown’ and could easily upend the most rational and reasonable analysis of financial markets. The role of central banks to fulfil their mandates to stabilize economies has gained considerable significance – and often came under criticism. At this stage, the pace and the impact of the energy transition is anything but determinable. There is a plethora of black swan events to digest, often with seemingly opposing conclusions.

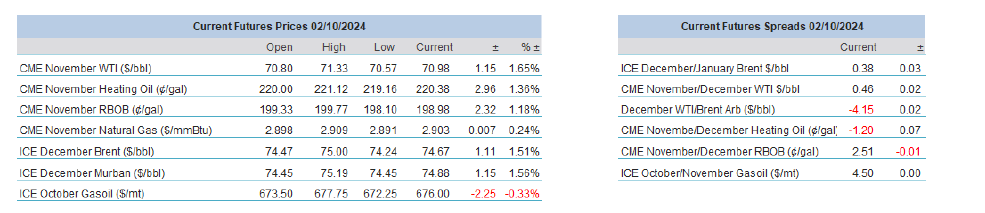

When looking back at the major developments that shaped the third quarter of the year, the unsettled political and economic outlook is obvious. Relationships between different asset classes have soured and trading decisions are frequently based on headlines since the future is inconsistent. Amidst this chaos, and relative to equities, oil underperformed. The latest quarter of the year was supposed to be the one that saved the oil market as healthy summer demand in the northern hemisphere was expected to provide a price boost. Instead, every major oil futures contract produced double-digit negative returns in the July-September period. The CME Heating Oil and the ICE Gasoil contracts were the bellwethers of this move south with quarterly losses of more than 16% when monthly rollovers are included. The M1/M7 backwardation in WTI and Brent narrowed considerably since the last day of June. The monthly premiums of around 60-70 cents/bbl were relegated close to just a few cents as the curves are flattening. Physical Brent, the most important crude oil benchmark, halved the premium it had fetched against the forward contract in the last 3 months.

Everywhere one looks, the impression is that the supply side of the oil equation is responsible for this bleak performance. The IMF and the OECD are upbeat on the global economy, and they predict an expansion of 3.2% in 2024 and 3.3% in 2025. It, therefore, will not come as a surprise that the MSCI All-Country Index returned 6.21% in 3Q 2024. The S&P 500 index nearly matched this achievement with an advance of 5.53%. This solid performance is chiefly the function of the lowering of interest rates in several developed countries and regions. Consequently, the dollar weakened considerably, its index occasionally fell below the 100 level. The well-publicized troubles of the Chinese real estate and manufacturing sectors sporadically raised anxiety. At the end of September, the central bank announced a massive stimulus package. The Shanghai Composite Index finished the quarter 12.44% higher.

Commodity indexes in which oil is the dominant component, outperformed crude oil and products. The S&P GSCI index retreated 5.26% in the previous 3 months and would have possibly produced a positive return had it not been for its energy sub-index losing 12.23%. Again, it suggests a healthy economic backdrop as demand for raw materials seems resolute.

Yet, oil consumption between June and September was downgraded by 100,000 bpd for 2024 and by 180,000 bpd for 2025 when averaging out the three main forecasts. The OPEC+ effort to tighten the oil balance never bore fruit and it seems that the producer group now will go ahead with the planned unwinding of supply constraints in search of market share. Economic growth forecasts and the unbroken optimism in equity markets do not align with the underwhelming oil sector. Either stocks will come lower, or oil must soon start playing catch-up.

The outlook is anything but unambiguous. The US is the bulwark of economic optimism and last week’s Chinese stimulus also greatly alleviated concerns. Its long-term impact, however, is questionable at this point and incoming economic data will be scrutinized – chiefly consumer spending and the potential revival of factory activity. Whether the upbeat economic momentum will be maintained is not clear. Those who believe in economic cycles might conclude that the latest move higher, which started after the pandemic, has shaky legs to stand on after 5 years of ascent. Once inflation targets are reached and interest rates stabilize, growth will stall, and oil will find it progressively difficult to break above $80/bbl – unless Chinese economic revival starts supporting oil demand again or the Middle East is engulfed in flames.

Overnight Pricing

| Oil and Gas Blends | Units | Oil Price | Change |

| Crude Oil (WTI) | USD/bbl | $71.52 | Up |

| Crude Oil (Brent) | USD/bbl | $75.20 | Up |

| Bonny Light 30/09/24 , CBN | USD/bbl | $73.40 | — |

| Dubai | USD/bbl | $73.51 | Up |

| Natural Gas | USD/MMBtu | $2.92 | Up |

| Murban Crude | USD/bbl | $75.38 | Up |

| OPEC basket 01/10/24 | USD/bbl | $71.34 | Down |

Baker Hughes Rig Count: U.S. -1 to 587 Canada +7 to 218

U.S. Rig Count is down 1 from last week to 587 with oil rigs down 4 to 484, gas rigs up 3 to 99 and miscellaneous rigs unchanged at 4.

Canada Rig Count is up 7 from last week to 218, with oil rigs up 8 to 152, gas rigs down 1 to 65 and miscellaneous rigs unchanged at 1.

The Worldwide Rig Count for August was 1,735, up 22 from the 1,713 counted in July 2024, and down 53, from the 1,788 counted in August 2023.

| Region | Period | Rig Count | Change |

| U.S.A | 27 September 2024 | 587 | -1 |

| Canada | 27 September 2024 | 218 | +7 |

| International | August 2024 | 931. | -3 |

Oil and Gas News Undiluted !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

OilandGasPress.com is a website that provides news, updates, and information related to the oil and gas industry. It covers a wide range of topics, including exploration, production, refining, transportation, distribution, and automotive market trends within the global energy sector. Visitors to the site can find articles, press releases, reports, and other resources relevant to professionals and enthusiasts interested in the energy, oil and gas industry.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: on Twitter | Instagram

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,