Crédit Agricole Assurances buys stake in TotalEnergies Renewable Portfolio

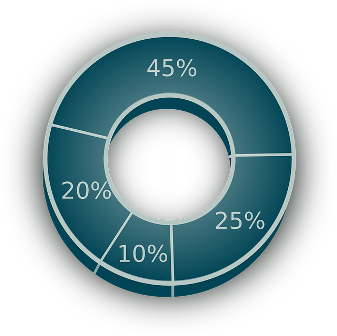

As part of its strategy of profitable growth in renewable energies, TotalEnergies is selling to Crédit Agricole Assurances 50% of a 234 MW portfolio of renewable projects, including 23 solar power plants with a capacity of 168 MW and 6 wind farms with a capacity of 67 MW. Of the 29 power plants in the portfolio, 25 are already operational (180 MW) and the four others (54 MW) will be commissioned in the first half of 2023.

This transaction implies an enterprise value of the portfolio of $ 300 million (100%) equivalent to a multiple of 16 EBITDA.

This partial sale to Crédit Agricole Assurances allows TotalEnergies to accelerate project cash flows and improve the return on invested capital, in line with its business model for renewable energy development.

TotalEnergies’ teams will continue to ensure the asset management, operation and maintenance of the 29 power plants. They will provide enough energy for 200,000 people and will prevent the emission of some 96,000 tons of CO2 per year for thirty years.

“This partial sale demonstrates the strength of our business model, which ensures a return on invested capital in renewable energies of more than 10%. We are pleased to partner with Crédit Agricole Assurances and support its investment in the energy transition. With its strong teams and business model, TotalEnergies intends to continue its development in France where we aim to reach 4 GW of renewable generation capacity by 2025,” said Vincent Stoquart, Senior Vice President, Renewables at TotalEnergies.

“This transaction is in line with our strategy as a long-term institutional investor in the acceleration of renewable energies, in favor of the energy transition and a low-carbon economy. In line with the Crédit Agricole Group’s climate commitments, this transaction will increase our investments in renewable energies and help us reach an installed capacity of 14 GW by 2025,” said Florence Barjou, Head of Investments at Crédit Agricole Assurances.

Information Source: Read More “

Energy Monitors , Electric Power , Natural Gas , Oil , Climate , Renewable , Wind , Transition , LPG , Solar , Electric , Biomass , Sustainability , Oil Price , Electric Vehicles,