Energy News to 10 June 2022. OPEC daily basket price stood at $123.21/bl, 09 June 2022

Russia-Ukraine war will bring benefits for GCC oil and gas producers but poses some risks to Turkish companies in terms of credit quality erosion, according to Moody’s. WTI for July delivery gained 91 cents to settle at $119.41 a barrel in New York. Brent for August settlement rose $1.06 to $120.57 a barrel.

ExxonMobil stock saw a more than 2% boost in share prices on early Wednesday trading, marking a significant comeback for an oil giant that has recently fallen out of favor with Wall Street.

Trading at $105.47, up 2.04%, by 11:46 am EST Wednesday, Exxon shares are now above the $100 mark for the first time since 2014. Exxon now appears to be experiencing a reversal of fortunes after years of dealing with the fallout from its handling of climate issues and investors fears of what an energy transition will mean for the supermajor. Exxon has gained over 66% since the beginning of the year, buoyed by post-pandemic demand recovery followed by Russia’s invasion of Ukraine and subsequent Western sanctions that have shaken global energy markets. Read More

In a combination that creates a maritime security tech giant, global multi-national companies Dryad Global a maritime intelligence market leader and International Maritime Security Associates, INC (IMSA), a maritime technology company are to merge.

IMSA Global, a provider of cutting-edge technology solutions in maritime risk information, cybersecurity and tracking technology is to merge with Dryad Global to provide real-time maritime security, analysis and risk intelligence solutions direct to clients at their desks on land or in the bridge at sea.

The companies decided that, in light of recent industry shifts, such as the preference for end-to-end offerings, and holistic, digitised security offerings the time was appropriate to combine the strengths of both organisations and create the ultimate best-in-class maritime risk partner to better serve international maritime customers in both the governmental and commercial sectors.

Together Dryad Global and IMSA Global will expand their product portfolio to offer the industry-leading ARMS Fleet Manager platform to all clients. The ARMS technology is the first of its kind shipboard based real-time, geo-specific maritime risk information system delivered via intuitive and accessible tablet-based interface. Read More–>

Iran’s Seizure Of Greek Tankers Threatens Regional Maritime Security. Iran’s Islamic Revolutionary Guard Corps revealed on Friday that it had seized two oil tankers belonging to Greece, which has accused Tehran of piracy for its taking of Delta Poseidon and Prudent Warrior. The Gulf Cooperation Council and the US are working together to enhance regional maritime security against such threats. Read More

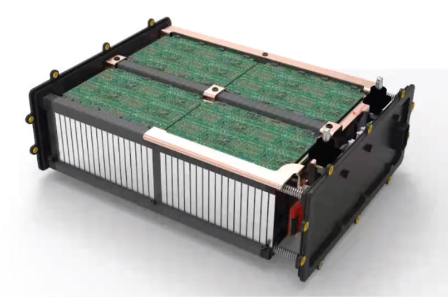

Advanced Cell Engineering (ACE), a developer and licensor of next-generation high energy density battery cell technology, has filed a patent application with the U.S. Patent and Trademark Office for its very large format (VLF) cell. The patent filing represents a key milestone in the company’s “Project Magnus,” in which ACE will finalize cell design and chemistry for a highly efficient, 1-meter cell-to-pack prismatic cell. This is ACE’s fourth patent application in the last six months.

The VLF cell, when coupled with ACE’s patented Advanced LFP (lithium iron phosphate) chemistry, will enable EV manufacturers to build vehicles offering greater range. Advanced LFP offers significantly higher energy density in any cell format than the existing LFP offerings on the market today. When used in the VLF cell, ACE’s Advanced LFP technology will achieve even greater energy density thanks to the cell’s very efficient design. Read More

GE (NYSE-GE) and Swiss Export Risk Insurance (SERV), Switzerland’s export credit agency (ECA), announced their collaboration agreement to support GE’s global energy customers looking to accelerate the energy transition. Through the joint agreement, SERV will mobilise diversified and competitive financing through insurance and guarantees to enable energy projects across the emerging and developing markets to decarbonise the energy sector and increase electrification.

The GE-SERV agreement will help facilitate the significant capital investments required on large-scale, capital-intensive energy projects with existing and breakthrough technologies. As nations look at ways to meet their net-zero targets, GE will enable Swiss exports through a broad range of power generation technologies, encompassing a mix of gas and renewable energy fuels, to support emerging and developing countries by mobilising critical energy transition capital to get projects off the ground. Read More

GE (NYSE: GE) and the largest electric utility in the United States, Florida Power & Light Company (FPL), celebrated the start of commercial operation for the world’s first GE 7HA.03 gas turbines at the FPL Dania Beach Clean Energy Center (Dania Beach), located near Fort Lauderdale, Florida. GE 7HA.03 gas turbine is the largest, most efficient, and flexible 60 Hertz (Hz) gas turbine currently in operation globally. Powered by two GE 7HA.03 gas turbines, Dania Beach is now delivering up to approximately 1,260 megawatts (MW), the equivalent electricity needed to power approximately 250,000 homes. This modernization led to a 70% emissions reduction compared to the previous site and will help ensure FPL is able to reliably and affordably deliver 24/7 electricity in the rapidly growing state of Florida – particularly in the highly populated areas of Miami-Dade and Broward counties. Read More

Applying academic research to help accelerate low-carbon innovation, Princeton’s ZERO lab has created a new coalition, bringing together corporations and researchers focused on scalable clean energy technologies. The consortium, aligned with the corporate membership program Princeton E-ffiliates Partnership, includes founding members Google, GE and ClearPath. The consortium aims to help leaders from diverse parts of the energy sector accelerate novel clean energy technologies. Jenkins provided a rationale for why he recruited these first members.

Google was the first global corporation to pledge to match the energy demand from its data centers and offices around the world with local carbon-free power on an hour-by-hour basis, referred to as 24/7 carbon-free electricity procurement. The company also has a longstanding track record of investing in clean technology startups and using its purchasing power to transform markets for clean electricity. More

Sercel announced the sale of a 15,000 channel WiNG system to Smart Seismic Solutions (S3), a French seismic and geophysical survey contractor.

This new sale comes after S3 successfully deployed WiNG in Europe on a series of extensive clean energy and mineral projects (helium, geothermal energy and salt). Convinced by the performance of Sercel’s land nodal system, S3 aims to utilize best-in-class equipment and supply its clients with leading solutions for seismic surveys mainly focused on projects with a positive environmental impact.

Featuring QuietSeis®, Sercel’s ultrasensitive broadband digital sensor, WiNG nodes deliver optimal data quality for unsurpassed subsurface imaging. In addition, when equipped with Sercel’s field-proven Pathfinder transmission management technology, WiNG provides operators with real-time visibility of the spread, ensuring the most comprehensive and efficient quality control. Read More

Enverus Intelligence Research, a subsidiary of Enverus, the leading global energy data analytics and SaaS technology company, has released its latest FundamentalEdge report focusing on its five-year supply, demand and price outlook. The report confirms that nearly three months into the Ukraine war, oil and gas markets remain tight with Brent oil trading well above $100/bbl and Henry Hub gas above $8/MMBtu. This edition of FundamentalEdge dives into the company’s medium-term expectations for supply, demand and price for both commodities as well as risks to our forecasts.

“We see a tangible risk that oil markets will become volatile again later this year and into 2023 when the stock releases end. The release of oil from the Strategic Petroleum Reserve buys time for producers in the U.S. to push harder and for Iran nuclear diplomacy to bear fruit,” said Bill Farren-Price, lead report author and director of Enverus Intelligence Research.

Al Salazar, co-author of the report and senior vice president of Enverus Intelligence Research, added, “Neither LNG tightness nor a limited capacity to switch power generation from gas to coal seem likely to change quickly in the near term. This in turn implies that prices are likely to remain elevated until U.S. supply infrastructure becomes able to accommodate supply growth sometime next year or demand buckles under the weight of soaring prices.”

Key takeaways from the report:

The sharp rally in Henry Hub gas prices has exceeded all early year price forecasts and reflects strong LNG demand as Europe faces up to Russian supply risks as well as limitations for gas-to-coal switching in the U.S. power generation sector.

Enverus Intelligence Research has nearly halved its early 2022 demand growth expectation for oil to 1.65 MMbbl/d and see further headwinds from rising interest rates and a marked slowdown in the Chinese economy as the country battles a new COVID outbreak in major industrial and population centers. Read More

Russia’s invasion of Ukraine has not only led to a humanitarian catastrophe, but also a deep regional slowdown and substantial negative global spillovers. As a result, the world economy is expected to experience its sharpest deceleration following an initial recovery from global recession in more than 80 years. Global growth is projected to slow from 5.7 percent in 2021 to 2.9 percent in 2022, as the war in Ukraine disrupts activity and trade in the near term and as policy support is withdrawn amid high inflation

The cumulative losses to global activity relative to its pre-pandemic trend are expected to continue

mounting over the forecast horizon, especially among EMDE commodity importers. Read More

| Oil and Gas Blends | Units | Oil Price $ | |

| Crude Oil (WTI) | USD/bbl | $120.79 | Down |

| Crude Oil (Brent) | USD/bbl | $122.34 | Down |

| Bonny Light | USD/bbl | $129.40 | Up |

| Saharan Blend | USD/bbl | $128.68 | Up |

| Natural Gas | USD/MMBtu | $9.00 | Up |

| OPEC basket 09/06/22 | USD/bbl | $123.21 | Up |

High oil prices are continuing to cause pain at the pump for US drivers. The EIA forecast retail gasoline prices in 2022 to average $4.07/gal, up 25 cents from its prior estimate in May. The agency put retail diesel prices at an average $4.69/gal over the same period, down 3 cents from May.

The EIA attributed rising gasoline and diesel prices to refining margins at or near record highs amid low inventory levels. But it forecast gasoline wholesale margins — the price difference between wholesale gasoline and Brent crude — to fall 36 cents to an average 81 cents/gal over May and the third quarter, and diesel wholesale margins to decline 46 cents to $1.07/gal during the same period. The EIA expects fuel prices to ease in 2023, though it raised its expectations by 15 cents for retail gasoline prices to $3.66/gal and by 8 cents for diesel to $4.14/gal in 2023. Read More

The average price of charging an electric car on a pay-as-you go, non-subscription basis at a publicly accessible rapid charger in Great Britain has increased by 21% to 44.55p per kilowatt hour (kWh) since September, figures analysed by the RAC’s new Charge Watch initiative in association with the national FairCharge campaign show.1

The 7.81p per kWh increase, from 36.74p at the end of last summer, means that the average cost to complete an 80% rapid charge of a typical family-sized electric car with a 64kWh battery has increased by £4 over this period, from £18.81 to £22.81 now (cars revert to slower charging speeds beyond 80% to preserve battery health).2

In stark contrast, the cost of filling a 55-litre family car from empty to 80% has increased by a huge £14.54 since last September, from £59.67 to £74.21 – a 24% increase.

The RAC’s analysis shows that it now costs on average 10p per mile to charge at a rapid charger, up from 8p per mile last September.

This is nearly half the cost per mile compared to filling a petrol-powered family car, the cost of which has risen from 15p per mile since the end of last September to a staggering 19p per mile now.3

The cost per mile for a similarly sized diesel-powered car is even higher at nearly 21p

The average price of charging at the quickest ultra-rapid chargers – which have a power output of 100kW-plus and can deliver a charge to a compatible vehicle in as little as 20 minutes – has increased by a greater margin of 16.76p per kWh, from 34.21p per kWh in September to 50.97p in May.

This means the cost to charge a vehicle to 80% has risen from £17.51 to £26.10. This, however, is still £48 cheaper than filling a petrol-powered car to 80%, although electric car drivers do not get quite as many miles from an 80% charge as drivers of petrol cars do from an equivalent fill-up of a tank. Read More

The Financial Stability Board (FSB) and International Monetary Fund (IMF) today published a report to mark the completion of the second phase of the G20 Data Gaps Initiative (DGI-2). This report also lays out priorities for a new initiative led by the IMF to address gaps relating to emerging policy needs.

The report finds that significant progress has been made in addressing data gaps identified during the global financial crisis of 2007-08 through the two phases of the Data Gaps Initiative, including in the development of conceptual frameworks, and improvements in data coverage, timeliness, and periodicity. Building on the close collaboration among the participating economies and international organizations, the peer pressure mechanism, and explicit support from the G20, policy makers now have a better understanding of the risks and vulnerabilities their economies face. The data improvements have helped them to develop effective policy responses including, for example, to the COVID-19 pandemic.

However, despite the progress made during the initiative, challenges remain for some participating economies in fully closing data gaps related to some DGI-2 recommendations. In particular, challenges remain on: securities financing transaction data, securities statistics, sectoral accounts, international investment position, international banking statistics, cross-border exposures of non-bank corporations, public sector debt statistics, and commercial property price indices. Participating economies and international organizations will continue to address these remaining challenges. Implementation will be monitored, on an annual basis, as in DGI-2, and the findings will be published on the DGI webpage.

Building on the success of DGI-2, participating economies and international organizations support further work to address data gaps relating to emerging policy needs. The IMF staff, in close cooperation with the FSB and the Inter-Agency Group on Economic and Financial Statistics, and in consultation with participating economies, have developed a high-level workplan for the new initiative. The workplan covers 14 recommendations under four main statistical and data priorities: (i) climate change; (ii) household distributional information; (iii) fintech and financial inclusion; and (iv) access to private sources of data and administrative data, and data sharing. It will be submitted to G20 Finance Ministers and Central Bank Governors later this year and its recommendations are expected to be implemented within five years after the launch. Read More

World Energy Transitions Outlook 2022

This report was developed under the guidance of Rabia Ferroukhi and Dolf Gielen and was led by Ute Collier and Ricardo Gorini. The executive summary was written by Elizabeth Press. The chapters were authored by Arina Anisie, Emanuele Bianco, Herib Blanco, Francisco Boshell, Xavier Casals, Jinlei Feng, Carlos Guadarrama, Diala Hawila, Seungwoo Kang, Álvaro López-Peña, Divyam Nagpal, Bishal Parajuli, Gandhi Pragada, Gayathri Prakash, Faran Rana, Michael Renner, Gondia Sokhna Seck, Emanuele Taibi and Aakarshan Vaid.

Valuable input, support and comments were provided by IRENA colleagues and external consultants: Josefine Axelsson, Antonio Barbalho, Adam Brown, Simon Benmarraze, Gerardo Escamilla, Isaac Elizondo Garcia, Bilal Hussein, Ines Jacob, Ulrike Lehr, Rodrigo Leme, Arvydas Lebedys, Sandra Lozo, Omar Marzouk, Asami Miketa, Paula Nardone, Elena Ocenic, Roland Roesch, Michael Taylor, Martina Lyons and Nicholas Wagner.

Feedback on the report from the following expert reviewers is highly appreciated: Doug Arent (NREL), Morgan Bazilian (Payne Institute), Stephanie Bouckaert (IEA), Ha Bui (Cambridge Econometrics), Suani Coelho (University of Sao Paulo), Samuel Carrara (EC-JRC), Toby Couture (E3 Analytics), Michalis Christou (EC-JRC), Laura Cozzi (IEA), Uwe Fritsche (International Institute for Sustainability Analysis and Strategy), Duncan Gibb (REN 21), Sebastian Helgenberger (IASS Potsdam), David Jacobs (IET – International Energy Transition GmbH), Nathalie Ledanois (REN21), Takeshi Kuramochi (NewClimate Institute), Toshimasa Masuyama (Ministry of Agriculture, Forestry and Fisheries, Japan), Ignacio Perez-Arriaga (MIT Energy Initiative), Debajit Palit (The Energy and Research Institute), Lea Ranalder (REN21), Lucio Scandizzo (University of Rome), Christine Eibs Singer (Catalyst Off-Grid Advisors), Charlie Smith (Energy System Integration Group), Stefan Schurig (Foundations Platform F20), Daniela Thrän (Helmholtz Centre for Environmental Research – UFZ),Evangelos Tzimas (EC-JRC), and Brent Wanner (IEA). Read More

U.S. Rig Count at 574, Canada Rig Count at 117,International Rig Count is up 11 rigs to 817

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 03 June 2022 | 727 | — |

| Canada | 03 June 2022 | 117 | +14 |

| International | May 2022 | 817 | +11 |

Northvolt–Hydro battery recycling joint venture Hydrovolt has commenced commercial recycling operations in Fredrikstad, southern Norway.

Hydrovolt is Europe’s largest electric vehicle battery recycling plant, capable of processing approximately 12,000 tons of battery packs per year (around 25,000 EV batteries). With the plant now online, a sustainable solution for handling Norway’s entire volume of electric vehicle batteries being retired from the market, or reaching end-of-life, is now available.

Integrated with a novel process design, Hydrovolt can recover and isolate some 95% of the materials in a battery including, plastics, copper, aluminium and black mass (a compound containing nickel, manganese, cobalt and lithium). Several novel concepts designed to maximise recovery of materials are found within the plant, including a dust collection system which ensures valuable material typically lost through mechanical recycling steps is captured.

Hydrovolt is exploring an expansion of recycling capacity within Europe, with a long-term target to recycle approximately 70,000 tons of battery packs by 2025 and 300,000 tons of battery packs by 2030, equivalent to approximately 150,000 EV batteries in 2025 and 500,000 in 2030. Read More

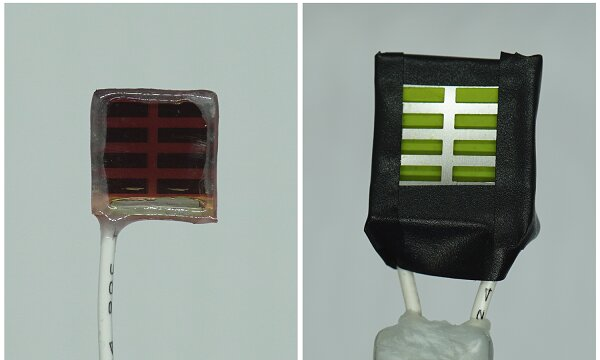

Devices made of readily available oxide and carbon-based materials can produce clean hydrogen from water over weeks, according to new research.

The findings, co-led by Dr. Virgil Andrei, a Research Fellow at St John’s College, University of Cambridge, with academics at Imperial College London, could help overcome one of the key issues in solar fuel production, where current earth-abundant light-absorbing materials are limited through either their performance or stability. Read More

The Ministry of Defence has awarded Skanska UK a £259 million contract to deliver the Vehicle Storage Support Programme (VSSP) at Ashchurch, Tewkesbury. Contracted via the Defence Infrastructure Organisation (DIO), Skanska together with the Technical Services Provider, MACE, will provide modern, sustainable and effective storage and maintenance solutions for the British Army’s land equipment fleet. The project will employ up to 400 people, a number of whom are expected to be employed from the Tewkesbury area. There will be a range of employment opportunities available including demolition, groundworks, structural steelwork and scaffolding. In addition, the project will also support 10 apprenticeships. All construction activity is expected to complete by 2027 Read More

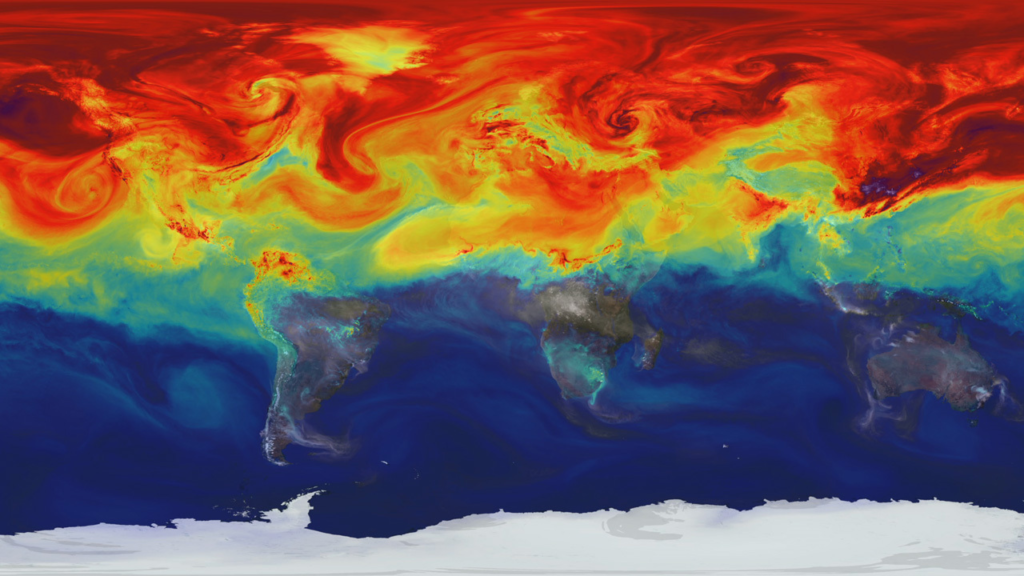

NASA and the Federal Emergency Management Agency (FEMA) have released a guide which provides resources for adapting to and mitigating impacts of climate change. The guide, Building Alliances for Climate Action, includes various perspectives, stories, insights, and resources about climate change to help individuals and organizations make informed decisions.

“NASA’s Earth observation and research supports the Biden-Harris Administration’s climate agenda, which outlines putting the climate crisis at the center of our nation’s foreign policy and national security,” said NASA Administrator Bill Nelson. “NASA is working hand in hand with FEMA to ensure communities across the U.S. and around the world have the resources they need to adapt in the face of extreme weather – which is increasing due to climate change.” The guide is a result of the Alliances for Climate Action, which NASA and FEMA co-hosted last year, a virtual series aimed at addressing rising demand for accurate, timely, and actionable information at a time of rapid global climate change. During the series, speakers shared their perspectives and paths to bolstering collective climate action. Read More

Bucks Council has permitted a planning application by Wessex Solar Energy Ltd for a major solar panel installation on a piece of land more than 23 hectares in size east of Manor Farm on Bourton Road in Buckingham.

Plans detail the installation of the new “Bourton Solar Park”, generating up to 12MW electricity and comprising up to 38,000 photovoltaic (PV) panels.

It represents a total investment of £6 million, “a proportion of which will be spent in the local area”, reports indicate. Read More

The Massachusetts Institute of Technology (MIT) has recently unveiled its new, state-of-the-art wind tunnel replacing its 80-year-old predecessor. Now the most advanced wind tunnel in the United States, MIT has high hopes for the tunnel in the future.

Wind tunnels have been around for over 150 years, with the likes of Wilbur and Orville Wright using one before their historic flight in 1903. They tested candidate wing designs in their self-built, simple open-ended wind tunnel.

Since almost everything on the Earth’s surface is surrounded by air, wind tunnels are great tools to circulate air over a stationary object in a controlled setting, allowing the operator to obtain aerodynamic data instead of moving an object through the air. When designing something that interacts with airflow, it’s critical to understand and forecast the aerodynamic forces at work in order to diagnose and correct any flaws in the design.

Wind tunnel measurements can be used to estimate how much fuel an aircraft will spend, how slowly it can land, and how long it will take to take off. They can also monitor wind loads on stationary objects like bridges and buildings, as well as aerodynamic loads on ground vehicles like cars and bicycles.

Wind tunnels are also used by scientists and engineers for basic research, such as investigating how air behaves when it interacts with an item to better understand fluid mechanics. Read More

OilandGasPress Energy Newsbites and Analysis Roundup |Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Oil and gas press covers, Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, News and Analysis