Energy News to 31/10/22. OPEC daily basket price stood at $94.73/bl, 27 Oct. 2022

Oil prices fell on Monday after weaker than expected factory activity data out of China and on concerns of China’s widening COVID-19 curbs.

State Energy Data System (SEDS) estimates for jet fuel for data year 2021 are available at SEDS Updates. Data highlights for 2021 include:

U.S. consumption of jet fuel grew from 2.2 quadrillion British thermal units (Btu) in 2020 to 2.8 quadrillion Btu in 2021, a 27% increase. The top consuming states were California, Florida, and Texas. The price of jet fuel in the United States rose from $9.79 per million Btu in 2020 to $14.51 per million Btu in 2021, a 48% increase. Prices ranged from $13.82 per million Btu in Michigan to $15.73 per million Btu in Utah. U.S. jet fuel expenditures grew from $22 billion in 2020 to $41 billion in 2021, an 88% increase. Read More

Oil and Natural Gas Corporation (ONGC) plans to build a 1 GW solar power plant in Rajasthan as a key step toward establishing a foothold in the green energy space.

The company has approached the state government about 5,000 acres of land for its proposed 1 GW plant, highlighted the sources.

The project is expected to cost Rs5,000 crore and will take about three years to complete after the land is allocated.

The proposed plant will help meet the company’s internal electricity demand while also allowing it to supply power in the market. Read More

3D printed lithium metal battery with high energy density

The researchers from Dalian Institute of Chemical Physics under the Chinese Academy of Sciences use 3D printing technology to make titanium carbide-based scaffolds for lithium metal to deposit as the cathode, which achieves an outstanding areal capacity of 30 milliampere hour per square centimeter and a cycle lifespan of over 4,800 hours without producing lithium dendrite.

The 3D printed anode was made by porous lithium iron phosphate (LiFePO4) lattices with mass loading reaching 171 mg per square centimeter, effectively improving the electrochemical performance of the battery. This technical route offers a viable strategy for developing batteries with long lifespans and high energy density, according to the study. Read More

The first phase of a mega power storage project has been put into operation in the northeastern Chinese city of Dalian, its developer said.

With a storage capacity of 400 MWh, the Dalian Concurrent Energy Storage Power Station is designed to increase the utilization of clean energy and ensure grid stability, according to the Dalian Institute of Chemical Physics (DICP) under the Chinese Academy of Sciences.

The utility works like a “power bank,” said Li Xianfeng, deputy director of the DICP, adding that during off-peak electricity hours, the batteries of the utility will be charged by renewable energy sources, while at peak electricity hours, the chemical energy in the batteries can transform into electricity for use.

“Given the volatile and intermittent generation of clean energy including wind and solar power, this project can increase clean energy utilization and ensure grid stability,” said Li.

The current capacity of the power station can meet the daily electricity demand of some 200,000 residents. The capacity will be doubled to 800 MWh once the project is completed. Read More

China’s shipbuilding industry continued to lead globally in the first three quarters of this year, boasting the biggest international market share in terms of output and new and holding orders, official data showed.

The country’s shipbuilding output reached 27.8 million deadweight tonnes in the period, accounting for 45.9 percent of the total globally, according to the Ministry of Industry and Information Technology.

New orders in China’s shipbuilding sector took up 53.6 percent of the overall orders globally, while its holding shipbuilding orders accounted for 48 percent of the global total, the ministry said. Read More

Tritium DCFC Limited, a global leader in direct current (DC) fast chargers for electric vehicles (EVs), announced its partnership with EV supply equipment manufacturer DC-America. DC-America is now offering its versatile charging station infrastructure equipped with Tritium’s industry-leading fast chargers, creating an efficient and effective EV charging system. This solution is expected to be both compliant with federal Buy America standards and eligible for National Electric Vehicle Infrastructure (NEVI) Formula Program funding. Read More

Wheat short jumps ahead of latest Ukraine supply worry Ole Hansen, Head of Commodity Strategy at Saxo 31 October 2022

Summary: Our weekly Commitment of Traders update highlights future positions and changes made by hedge funds and other speculators across commodities and forex during the week to Tuesday, October 25. A week where financial markets received a boost from speculation the Fed was considering a pause. The dollar traded softer with commodities predominantly trading in the black with exceptions being soft commodities and not least wheat where short selling accelerated just ahead of today’s price spike on renewed Ukraine supply worries.

This summary highlights futures positions and changes made by hedge funds across commodities and forex during the week to Tuesday, October 25. A week where financial markets received a boost from speculation the Fed was considering a pause to assess to the economic impact of already implemented rate hikes and quantitative tightening measures. Both the S&P and especially the Nasdaq traded higher ahead of earnings from the big technology companies while bond yields climbed and the dollar traded softer. Commodities traded predominantly in the black led by energy and industrial metals with heavy and continued selling of softs and wheat being the main outliers.

Commodities

The Bloomberg Commodity index traded up 1% on the week with strength in crude oil and industrial related metals attracting fresh buying from speculators. Overall, however, the combined net long held by money managers across the 24 major commodity futures tracked in this report remains relatively low at 1 million contracts compared with 2.2 million around the time of the Russian invasion of Ukraine. A slump that has been driven by the current lack of trends and strong momentum across many commodities, as well as concerns about the short-term outlook as the markets continue to focus on a slowing global economy.

Biggest changes made by funds this past were buying of crude oil, soybean meal and corn, as well as cattle and hogs while sellers concentrated their efforts in gold, wheat, sugar and cocoa. Read More

Ofgem has issued Delta Gas and Power Ltd with a Final Order, compelling it to pay £530,809.20 plus interest in outstanding Renewables Obligation payments.

Delta is a non-domestic supplier, serving 1,690 business customers in the UK.

Delta failed to pay into the buy-out fund or present the required number of Renewable Obligation Certificates by 31 August and 1 September 2022 respectively, and is now compelled to pay by the late payment deadline of 31 October 2022 with accrued interest. If they do not pay, Ofgem may take further enforcement action including revoking their supply licences. Renewables Obligations (RO) is a government scheme in England, Scotland, Wales and Northern Ireland, designed to support large-scale renewable electricity projects in the UK. As a key part of the ambition to reach net zero by 2050, the scheme places an obligation on UK electricity suppliers to source an increasing proportion of the electricity they supply from renewable sources. Ofgem administers the schemes on behalf of government.

It is crucial to protect the integrity of the RO scheme and uphold this where there is non-compliance, to incentivise the uptake of renewable electricity within the UK. Read More

Europe is set to increase its reliance on oil imports from the United States after the EU embargo on Russian seaborne crude imports enters into force in early December, Claudio Descalzi, chief executive of Italy’s energy group Eni, told Bloomberg in an interview on Monday.

The embargo on Russian crude imported by sea kicks in on December 5.

Supply to Europe will decline by around 2 million barrels per day (bpd), Descalzi told Bloomberg on the sidelines of the ADIPEC energy conference in Abu Dhabi. The hit to Europe will be big, Eni’s chief executive added.

The U.S. has been exporting record volumes of crude oil and petroleum products recently, and Europe has become a major destination for American petroleum exports, especially after the Russian invasion of Ukraine. Read More

British firm, backed by London-listed mining giant Glencore, could enter administration as soon as Monday, the Financial Times first reported, citing people familiar with the matter. The company, which has been developing a £3.8bn gigafactory in north-east England, has been in emergency fundraising talks for several weeks.

Britishvolt was reportedly trying to raise £200m or to sell the company outright, having undergone talks with India’s Tata Motors, which owns Jaguar Land Rover.

A Britishvolt spokesperson said: “We are aware of market speculation. We are actively working on several potential scenarios that offer the required stability. We have no further comment at this time.” Read More

Inflation in the eurozone is expected to have reached a new record high of 10.7% in October.

If confirmed later in November by Eurostat, the bloc’s official statistics agency, this would be the first inflation reading crossing the 10% threshold.

The increase was fuelled by energy prices which Eurostat estimates were 41.9% higher than in the same month last year. Prices for food, alcohol and tobacco are meanwhile believed to have risen by 13.1% year-on-year. Read More

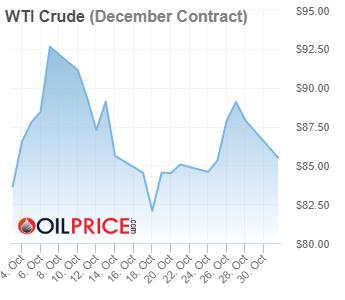

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $85.48 | Down |

| Crude Oil (Brent) | USD/bbl | $94.54 | Down |

| Bonny Light | USD/bbl | $94.74 | Down |

| Saharan Blend | USD/bbl | $95.61 | Down |

| Natural Gas | USD/MMBtu | $6.25 | Up |

| OPEC basket 27/10/22 | USD/bbl | $94.73 | Up |

U.S. Rig Count is down 3 from last week to 768 with oil rigs down 2 to 610, gas rigs down 1 to 156 and miscellaneous rigs unchanged at 2.

Canada Rig Count is up 2 from last week to 212, with oil rigs up 1 to 145, gas rigs up 1 to 67.

Baker Hughes Rig Count

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 28 October 2022 | 768 | -3 |

| Canada | 28 October 2022 | 212 | +2 |

| International | September 2022 | 879 | +19 |

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, energy monitors,