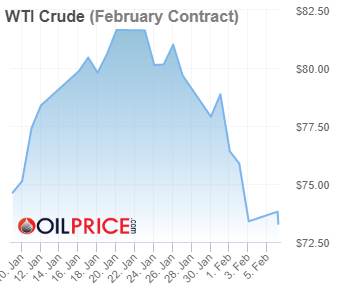

Oil and gas press monitor | 06/02, WTI Crude stood at $73.23/bl, U.S. Rig Count is down 12

As of Sunday, no Russian oil products can be imported into the European Union, per the latest sanction hit of Brussels against Moscow.

The embargo has been combined with a price cap, agreed upon with the G7 in the same way that the EU and the G7 coordinated the price cap on Russian crude last year.

The price caps were agreed at $100 per barrel of diesel, which trades at a premium to crude oil, and $45 per barrel of fuel oil and other oil products that trade at a discount to crude oil. The price cap applies to Russian fuel cargoes shipped on vessels owned by companies based in the EU or G7.

There is some concern among analysts that the end of Russian fuel deliveries will push prices in the EU higher, but the EU is hoping to avoid such a development by switching to new suppliers, mostly from the Middle East. Read More

Rolls-Royce Submarines Ltd celebrated the launch of its new Nuclear Skills Academy at an event in the House of Lords. More than 150 representatives from the Houses of Commons, House of Lords and across industry attended to hear how the British engineering firm is investing in the nuclear experts of the future. The Nuclear Skills Academy is the first of its kind and opened its doors to 200 new apprentices on 26 September last year. Its aim is to sustain nuclear capability within the UK’s submarines programme by creating a dedicated pipeline of talent at the start of their careers. Based in Derby, the Nuclear Skills Academy is supported by industry and education experts, including the University of Derby, the Nuclear Advanced Manufacturing Research Centre, the National College for Nuclear and Derby City Council. This ensures new apprentices have access to the best courses and mentors throughout their apprenticeship. Read More

Rolls-Royce Submarines has marked the launch of its nuclear skills academy at an event in the House of Lords. The Nuclear Skills Academy is the first of its kind and opened its doors to 200 new apprentices in September. The firm, based in Raynesway, Derby, has provided the power systems for the Royal Navy’s nuclear submarines for the past 60 years. More than 150 people, including representatives from industry and politics, attended the event. Read More

Further to their statement made on January 30th, Renault Group, Nissan Motor Co., Ltd and Mitsubishi Motors Corporation announce that they plan to hold a joint conference in London on Monday February 6th, 2023 at 8.30 (London time). Read More

Moody’s Investors Service (“Moody’s”) has today downgraded the ratings of Dangote Cement Plc (Dangote) and Seplat Energy Plc (Seplat) to Caa1 from B3 and has confirmed the ratings of IHS Holding Limited (IHS) at B3. All three non-financial corporates are domiciled in, or have substantial exposure to Nigeria and the rating action follows Moody’s downgrade of Nigeria’s long-term issuer rating to Caa1 from B3 and a change in outlook to stable from ratings under review. Moody’s also lowered Nigeria’s local currency country ceiling to B2 from B1 and the foreign currency country ceiling to Caa1 from B3 Read More

Moody’s newest view of European energy big picture

Companies’ resilience, mild weather and policy effectiveness (to replace Russian gas) have been key to keeping energy situation safe. We estimate that policy effectiveness and companies’ resilience contributed to around 75% of the improvement in the energy situation in 2022

- European gas storage at the end of 2022 stood at 82% (around the highest level since 2015). It will likely stay above the secure winter level as projected by the IEA at the end of March. Even if drawdown in gas storage is the similar to the worst case seen between 2015 and 2020, Europe’s gas storage level will still be around 37% at the beginning of April, – which is above the 33% target level to adequately cope with a cold winter next year

- Energy supply in the winter of 2023-24 will be tight since Russian gas flows will be, at best, around 20% of 2022 energy flows assuming no further cuts. Second, China redirected contracted LNG flows to Europe in 2022 on weaker Chinese demand, partly because of the zero-COVID policy, but this likely will not recur this year

- Natural gas prices have fallen 80% from their peaks. But Europe’s energy mix still needs to be fundamentally changed, combined with prolonged geopolitical uncertainty this will keep the prices well above historical levels at least over the next three years

- Further on, LNG market will likely tighten – and this is a central challenge for 2023 and beyond. Global LNG supply is likely to increase by only 30 bcm in 2023 (around a half of Russian pipeline gas deliveries to the EU in 2022). Over the next 5 years increase is expected from North America and the Middle East. However, after declining investment during Covid, most of the additional production will actually occur after 2025. Nevertheless, rapid build-up of LNG re-gasification capacity in Germany, Italy and the Netherlands creates additional potential imports. Both onshore and floating storage and re-gasification units will be crucial. In addition, LNG import capacity in the EU and the UK will expand 34%, or 6.8 billion Bcf/d between 2021 and 2024, double the increase in LNG import capacity of 2.8 Bcf/d between 2012 and 2021

- We expect a limited impact of the price cap on Russian seaborne oil because it is very close to where Russian crude is trading

- Untargeted policies will likely distort price signals, reducing incentives to lower energy consumption and increase energy efficiency by households and companies Read More

NeoGreen Hydrogen Corp. announced the recent signing of a long term 75MW baseload Power Purchase Agreement (“PPA”) with the ANDE, the national electricity company of Paraguay.

Overview:

• The Project will be built in Tres Fronteras, an area where Brazil, Paraguay and Argentina converge, close to the Iguazu and Parana rivers.

• The project will produce green fertiliser for supply to both the domestic market and regional customers by river export.

• A PPA has been agreed with the ANDE at the lowest commercial rate, enabling the production of affordable green ammonia using electricity produced from Itaipú Hydroelectric Dam.

• Initial design concept is estimated to produce 10,000 MT per year of green hydrogen that will be converted into ammonium nitrate for use as part of NPK fertiliser blends.

• Production planned for the domestic market will provide Paraguay with price stability and import substitution for its significant agricultural sector.

• NeoGreen’s project will provide an estimated US$400 million of inward investment and generate local employment in both the construction and operational phases.

• Final Investment Decision (“FID”) for the Project is expected by Q4 2023 and green hydrogen and ammonia production is targeted for mid 2026. Since signing the Cooperation Agreement with the ANDE in November 2021, NeoGreen has worked with its consortium partners and with Mott MacDonald, the global engineering, management, and development consultancy, to finalize a number of studies. NeoGreen now looks forward to moving the Tres Fronteras project towards Front End Engineering and Design (“FEED”) stages. NeoGreen has been cooperating with Atria Logistica, the largest river and port logistics company in the Paraguay-Paraná waterway, and NeoGreen plans to build its industrial plant in close proximity to Atria’s Tres Fronteras port, an ideal location to supply much of Paraguay’s main soya producing areas. Additionally, the newly constructed bridge to Brazil is adjacent to their facility, which will further facilitate access to large Brazilian markets. The access to this port facility also opens up a number of regional export opportunities for NeoGreen in the future and the port is the intended location of a new fertilizer mixing plant. Read More

The Sunrise Joint Venture (SJV), comprising TIMOR GAP (56.56%), Operator Woodside Energy (33.44%), and Osaka Gas Australia (10.00%), hereby jointly affirms its commitment to undertake a concept select program for the development of the Greater Sunrise fields. The SJV will consider all of the key issues for delivering the gas, for processing and LNG sales, to TimorLeste compared to delivering the gas to Australia. The studies will incorporate and update previous work by utilising the latest technologies and cost estimates while also considering the socio-economic, capacity building, safety, environmental, strategic and security benefits of the various options. The studies will include evaluation of which option provides the most meaningful benefit for the people of Timor-Leste. The SJV is aiming to complete the concept select program

expeditiously given the benefits that could flow from developing the Sunrise fields. TIMOR GAP President and CEO Antonio de Sousa said he was pleased that TIMOR GAP’s efforts have substantially contributed towards realising the long-awaited goal of developing Greater Sunrise. “This path forward is a significant commitment to our stakeholders, to the aspirations of those who made sacrifices to achieve independence for the Democratic Republic of Timor-Leste, and to the future of our people and Timor-Leste. It offers a clearer path to prosperity, equality, peace, stability, and sustainability for current and future generations,” he said. Woodside Energy CEO Meg O’Neill said the development of new technologies and growing demand for safe and reliable LNG meant it was the right time to bring forward the concept select program. Read More

Africa Oil Corp. announced that the Company repurchased a total of 751,093 Africa Oil common shares during the period of January 30, 2023 to February 3, 2023 under the previously announced share buyback program. The launch of Africa Oil’s normal course issuer bid (share buyback) program, announced by the Company on September 22, 2022, is being implemented in accordance with the Market Abuse Regulation (EU) No 596/2014 (MAR) and Commission Delegated Regulation (EU) No 2016/1052 (Safe Harbour Regulation) and the applicable rules and policies of the Toronto Stock Exchange (“TSX”), Nasdaq Stockholm, and applicable Canadian and Swedish securities laws.

During the period dated January 30, 2023 to February 3, 2023, the Company repurchased 333,000 Africa Oil common shares on the TSX and/or alternative Canadian trading systems. The repurchases were carried out by Scotia Capital Inc. on behalf of the Company. During the same period, the Company repurchased 418,093 Africa Oil common shares on Nasdaq Stockholm, and these repurchases were carried out by Pareto Securities on behalf of the Company.

All common shares repurchased by Africa Oil under the share buyback program will be cancelled. During the period dated January 30, 2023 to February 3, 2023, the Company cancelled 677,783 common shares repurchased under the share buyback program. Read More

Nel Hydrogen Electrolyser AS, has signed a contract for 40 MW of alkaline electrolyser equipment for about EUR 12 million with HyCC for its H2eron project in Delfzijl, Netherlands. Kraftanlagen Energies & Services has been contracted for the FEED study related to the project.

SkyNRG will use the hydrogen to produce sustainable aviation fuel (SAF), made from industrial byproducts and residue streams, such as used cooking oil. HyCC recently received the environmental permit for the project, and the company is working towards a final investment decision (FID) in 2024, in close alignment with SkyNRG and its partners. “H2eron will have a great positive impact on emission reductions from the aviation sector, and we are proud to be selected as the supplier of our well-proven electrolyser technology to this exciting and important project”, says Hans Hide, Nel’s Chief Project Officer. “We are also excited to work with Kraftanlagen on this project, a professional EPC company. This allows Nel to focus on its core scope while still bringing a competitive solution for the hydrogen production system to the customer.”

“Reliable supplies of green hydrogen are key to decarbonizing sectors such as the aviation industry. We build on decades of experience in large-scale electrolysis and are excited to move to the next phase of the project with these strong partners to lay the foundation for the new hydrogen economy”, says Marcel Galjee, Managing Director of HyCC “We are proud to bring our proven EPC expertise to this lighthouse project. This project will significantly support the decarbonization of the aviation industry. It is important that large-scale green hydrogen production plants now become reality and H2eron will provide for more sustainable aviation. At Kraftanlagen, we are committed to bring these projects to execution and make green hydrogen available”, says Alfons Weber, CEO of Kraftanlagen Energies & Services. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

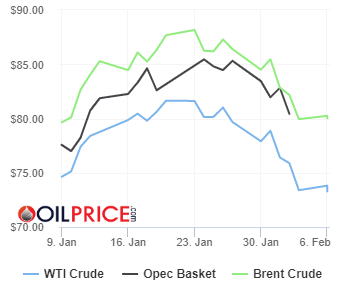

| Crude Oil (WTI) | USD/bbl | $73.36 | Down |

| Crude Oil (Brent) | USD/bbl | $80.08 | Down |

| Bonny Light | USD/bbl | $81.96 | Down |

| Saharan Blend | USD/bbl | $82.01 | Down |

| Natural Gas | USD/MMBtu | $2.99 | Up |

| OPEC basket 03/02/23 | USD/bbl | $79.36 | Down |

Equinor and SSE Renewables are carrying out early scoping work to explore options for developing a fourth phase, Dogger Bank D, of the world’s largest offshore wind farm.

Equinor and SSE Renewables each own 50% of the proposed Dogger Bank D development. The Dogger Bank D proposal would require a new development consent order to progress into construction and could add an additional 1.32 GW in fixed-bottom offshore wind capacity to the 3.6 GW already in construction with phases A, B and C of the project. Dogger Bank D would be located in the eastern zone of the Dogger Bank C lease area, more than doubling the utilisation of existing acreage. The project’s progression remains subject to agreement with The Crown Estate. The developers will release an initial scoping report in late March outlining ongoing work to explore the technical feasibility of deploying latest-available technology to bolster the UK’s renewable energy capacity. There are two options being explored for the energy generated by the offshore windfarm: a grid connection and/or green hydrogen production. The first would see power from Dogger Bank D connecting to a grid connection in Lincolnshire, where National Grid is installing new network infrastructure in response to the UK Government’s ambitions to generate 50 GW of offshore wind by 2030. Read More

Eni and Nexi announce they have signed an agreement for the development of innovative electronic and digital payment services for Eni and its companies in Italy and Europe. The collaboration entails that Nexi will be Eni’s primary partner both ensuring the best evolution of existing payment services and defining and implementing new solutions to support the energy company’s businesses, particularly Sustainable Mobility and Plenitude. To accomplish this goal, the companies will team up their best-in-class expertise in their respective markets. This partnership will enable Eni to improve the customer experience for its clients and take advantage of future opportunities arising from the evolution of payment systems and relevant regulation at the European level. In turn, Nexi will benefit from the opportunity to work with Eni to develop new business synergies and new solutions as well as to continuing to provide and enhance its digital payment services to the energy company. Read More

Flex Ltd. (NASDAQ: FLEX) announced that its subsidiary, Nextracker Inc. (“Nextracker”), has launched the roadshow for its initial public offering of 23,255,814 shares of its Class A common stock (“Common Stock”). The underwriters of the offering will also have a 30-day option to purchase from Nextracker up to 3,488,372 additional shares of Common Stock. The initial public offering price is expected to be between $20.00 and $23.00 per share. Nextracker has applied to list its Common Stock on the Nasdaq Global Select Market under the ticker symbol “NXT.”

J.P. Morgan, BofA Securities, Citigroup, and Barclays are acting as joint lead book-running managers for the offering. Truist Securities, HSBC, BNP PARIBAS, Mizuho, Scotiabank, and KeyBanc Capital Markets are acting as joint book-running managers for the offering. SMBC Nikko, BTIG, UniCredit, Roth Capital Partners, and Craig-Hallum will act as co-managers for the offering. PJT Partners is serving as independent financial advisor to Flex Ltd. in the offering. Read More

Iberdrola continues to develop its commitment to talent, excellence and employability by participating in a new edition of the ‘Energy 4 Future’ scholarships, an action that is part of the company’s social dividend.Energy 4 Future (E4F) is an initiative that is part of the Horizon 2020 MSCA-COFUND Programme and offers young researchers the opportunity to develop their projects in the field of clean energy in a network of internationally renowned universities and research centres located in Europe and the USA. Thus, once again, Fundación Iberdrola España, in collaboration with the European Commission’s Research Executive Agency (REA), is promoting this international postdoctoral research programme with joint funding of 4 million euros for 28 researchers. Last November, the meeting for the first call of the programme was held.The scholarships cover five areas of study: photovoltaics, wind energy, storage, smart grids and electric vehicles. To facilitate geographic mobility and the transfer of knowledge between academia and industry, the programme includes host periods of 18 to 21 months at universities and research centres, as well as professional stays of 3 to 6 months at Iberdrola’s headquarters in the USA, Mexico, the UK and Spain. Read More

Baker Hughes Rig Count

U.S. Rig Count is down 12 from last week to 759 with oil rigs down 10 to 599, gas rigs down 2 to 158 and miscellaneous rigs unchanged at 2.

Canada Rig Count is up 2 from last week to 249, with oil rigs up 2 to 159, gas rigs unchanged at 90.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 03 February 2023 | 759 | -12 |

| Canada | 03 February 2023 | 249 | +2 |

| International | January 2023 | 901 | +1 |

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, energy monitors,TotalEnergies, Shell, BP, Chevron