Oil mega deals lift October M&A to highest level in 17 months

London, 02 November 2023, (Oilandgaspress) – Worldwide M&A announcements totalled US$2.38 trillion during the first ten months of 2023, down 20% compared to the same period in 2022 and the lowest January to October total in a decade according to LSEG Deals Intelligence. The number of deals declined 8% compared to last year but reached the third highest level year-to-date since our records began in 1980.

US$319 billion worth of M&A transactions were recorded globally during the month of October 2023, one-third more than the value recorded during the previous month and marking the third consecutive monthly increase in global dealmaking. Boosted by the announcements that Exxon Mobil would buy Pioneer Natural Resources and that Chevron would buy Hess, October recorded the highest monthly global M&A total since May 2022.

US$1.31 trillion worth of deals involved a target in the Americas during the first ten months of 2023, 6% less than a year ago and the lowest year-to-date total since 2020. Asia Pacific M&A declined 27% to a decade-low of US$493 billion, while European M&A declined 40% to US$452 billion, the lowest level since 2013.

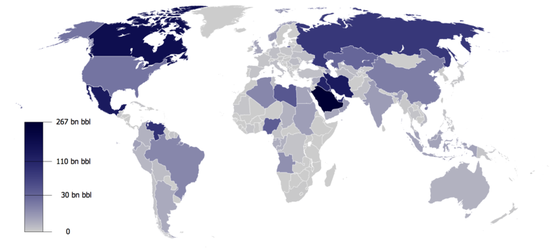

Energy & Power was the leading sector during the first ten months of 2023, with deals totalling US$424 billion, accounting for 18% of total global M&A. Deals involving targets in the oil & gas sector reached US$261 billion, the highest level since 2015.

Energy & Power, Healthcare, Materials and Consumer Staples were the only sectors to see an increase in the value of M&A from last year, while Technology was the only sector to see an increase in the number of deals.

Sixty-two mega deals, valued at US$5 billion or more, were recorded during the first 10 months of 2023, seven less than last year at this time and the lowest January to October total since 2013. The combined value of these deals is US$814 billion, down 12% year-on-year.

Despite a 2% increase in the number of deals, the value of Private Equity-backed M&A declined 39% from last year at this time. Private Equity-Backed M&A accounts for 19% of total global M&A so far during 2023, compared to 24% last year at this time.

Jim Mitchell, Head of Americas Oil Research at LSEG, comments: “The mega mergers and the host of smaller mergers on the exploration and production side within the oil and gas industry are occurring principally for the reason of efficiency.

“Efficiency in capital deployed and efficiency of drilling locations. Essentially, even at these elevated oil prices, it is more efficient to buy proven reserves than it is to test and develop new reserves.”

Information Source: Read full article

Energy ,Petrol , Electric Power , Natural Gas , Oil , Climate , Renewable , Wind , EV , LPG , Solar , Electric , Electric Vehicles, Hydrogen, Oil Price ,Crude Oil, Supply, Biomass , Sustainability,