Oilandgaspress Energy Monitor. OPEC daily basket price at US$83.30/bl, 17 Jan. 2023

Britishvolt is to enter administration today in a blow for the UK’s ambitions to gain a foothold in the global EV battery market according to media reports.

Britishvolt has filed a court notice to appoint administrators, with reports of a call with staff scheduled for noon today. The majority of its 300 staff have been made redundant with immediate effect. Last week, the firm said it was in talks with a consortium of investors in order to help finance the construction of its Blythe battery factory, in a deal which would see its valuation drop more than 90%. The rescue deal would have valued the beleaguered EV battery maker at just £32 million, according to reports in the Financial Times, down from the £774 million it was valued at in a funding round in February last year The business is seen as a crucial element of the UK’s drive to grow its electric vehicle manufacturing capability. In January last year, it received an in-principle offer of government funding as part of its Automotive Transformation Fund, an £850 million programme to electrify Britain’s automotive supply chain. Read More

Centrica plc announces that Russell O’Brien will be appointed Group Chief Financial Officer (CFO) and an Executive Director on 1 March 2023. Kate Ringrose will step down as CFO and an Executive Director on 28 February 2023 and is expected to leave Centrica towards the end of 2023 after an orderly transition. Read More

An oil tanker exploded on the Mae Klong River in central Thailand. The incident occurred on Tuesday morning (local time) during maintenance work while the ship was docked in Samut Songkhram province. The toll as reported in the last hours by the Bangkok Post is one dead (confirmed), 4 injured and other workers missing. Read More

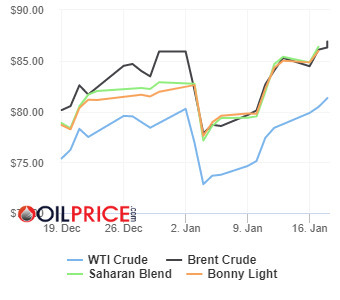

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $81.34 | Up |

| Crude Oil (Brent) | USD/bbl | $86.92 | Up |

| Bonny Light | USD/bbl | $85.97 | Up |

| Saharan Blend | USD/bbl | $86.37 | Up |

| Natural Gas | USD/MMBtu | $3.42 | Down |

| OPEC basket 17/01/23 | USD/bbl | $83.30 | Up |

BW Energy provided an update on the operations and development of the Dussafu Marin license in Gabon. The Company will publish financial figures for the fourth quarter and the annual report for 2022 on Tuesday, 28 February 2022.

Gross production from the Tortue field averaged approximately 9,600 barrels of oil per day in the fourth quarter of 2022, amounting to a total gross production of approximately 883,000 barrels of oil for the period. Production was impacted by planned field development and modification activities. Full-year production was 10,600 barrels of oil per day equalling a total gross production of approximately 3.9 million barrels of oil.

BW Energy completed one lifting in the fourth quarter at a price of USD 73 per barrel reflecting a lower realised oil price compared to Dated Brent due to temporary oversupply of Russian crude in the market and high transportation costs. Production cost (excluding royalties) for the period was approximately USD 40 per barrel due to the lower production. Average production cost for the year 2022 was USD 36 per barrel.

BW Energy’s share of gross production was approximately 649,000 barrels of oil. The net sold volume, which is the basis for revenue recognition in the financial statement, was 745,000 barrels including 65,000 barrels of quarterly Domestic Market Obligation (DMO) deliveries with an under-lift position of 76,000 barrels at the end of the period.

BW Energy had a cash balance of USD 210 million on 31 December 2022, compared to USD 186 million at 30 September 2022. The increase is due to the payment received for the December lifting and a drawdown on the Company’s reserves-based lending (RBL) facility, offset by continued investments in the Hibiscus / Ruche development project.

At the start of the period, the Company had commodity price hedges for a remaining total volume of 0.8 million barrels for 2022 and 2023, of which approximately 15% was for 2022. These were a combination of swaps and zero-cost collars that will allow for future cash flow stability for ongoing development projects. BW Energy has recognised crude oil hedge losses in the amount of USD 5.2 million for the fourth quarter, of which USD 4.7 million were unrealised.

The drilling campaign at the Hibiscus field is progressing according to plan and in line with the schedule for first oil from the Hibiscus / Ruche development towards the end of the first quarter of 2023. Read More

Neste has been included in the Corporate Knights 2023 Global 100 Index of the most sustainable companies in the world for the 17th consecutive time. Corporate Knights analyzed 6,720 companies against global industry peers and Neste was one of the companies to make it to the top 100. Neste placed 29th in the index and the first among its industry peers.

Neste has been included in the index for longer than any other energy company in the world. Neste was assessed under the Energy sector with 413 companies and was ranked as the best in the sector.

“It is a great recognition to be among so many other sustainability leaders in this index. We have been making significant progress over the years towards our long-term sustainability commitments, and that work continues. My big thanks go to the Neste team and our partners for all the achievements in 2022,” says Minna Aila, Executive Vice President, Sustainability and Corporate Affairs at Neste. Read More

Baker Hughes Rig Count

U.S. Rig Count is up 3 from last week to 775 with oil rigs up 5 to 623, gas rigs down 2 to 150 and miscellaneous rigs unchanged at 2.

Canada Rig Count is up 38 from last week to 227, with oil rigs up 28 to 141, gas rigs up 10 to 86.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 13 January 2023 | 775 | +3 |

| Canada | 13 January 2023 | 227 | +38 |

| International | December 2022 | 900 | -10 |

Dana Incorporated announced today that the company was recognized as a “Top Employer 2023” in 12 countries in which it operates. The company was also selected as a Top Employer across Europe due to the number of countries earning honors in the region.

This prestigious award by the Top Employers Institute recognizes excellence in people practices with a particular emphasis on exceptional human resources programs – including diversity and inclusion, work environment, talent acquisition, learning, and well-being.

Dana’s operations in Belgium, China, Germany, Hungary, India, Italy, Lithuania, the Netherlands, Sweden, Switzerland, the United Kingdom, and the United States were recognized as being a Top Employer for creating an empowering environment. The company’s operations in México were separately honored by Great Places to Work. In total, these countries represent more than 80 percent of the company’s employees and sales.

“Dana is a company founded on strong values that place our people at the heart of everything we do,” said Maureen Pittenger, senior vice president and chief human resources officer for Dana. “Earning top employer awards across so many different countries is a true testament to a culture of collaboration and inclusivity. At Dana, we value others, inspire innovation, grow responsibly, and win together. These values spotlight our passion and center our actions around a common vision of powering innovation to move our world.” Read More

Africa Oil Corp. announced its full-year 2022 production results and to provide an operational update. The Company’s production is attributed to its fifty per cent shareholding in Prime Oil & Gas Coöperatief U.A. (“Prime”).

• Full-year 2022 production rates1,2,3 are in line with the mid-point of 2022 Management Guidance range. Prime recorded an average daily working interest production of approximately 23,500 barrels of oil equivalent per day (“boepd”) and net entitlement production of 25,600 boepd, in each case net to Africa Oil’s 50% shareholding. These compare with mid-range of 2022 Management Guidance figures of 24,000 boepd and 25,000 boepd for working interest and net entitlement production, respectively.

• In fourth quarter 2022, Prime was allocated three oil liftings with total sales volume of approximately 2.9 million barrels or 1.4 million barrels net to Africa Oil. Average fourth quarter 2022 realised oil sales price of $96.8 per barrel, compares to the average Bloomberg Dated Brent price of $90.5 per barrel, a premium of about 7%.

• The rig contracted to drill the Egina infill wells is expected to commence operations in February 2023, after obtaining its final regulatory approval.

• Prime and its partners made good progress on the OML130 license renewal process in late 2022 and the Company will provide an update on the renewal in due course.

• Africa Oil management expect the appraisal drilling work on the Venus discovery to commence by end of first quarter 2023.

• Farm-out process for Block 3B/4B that is on trend with Venus and Graff oil discoveries in the Orange Basin, is advancing with the aim of securing a new partner by end of first quarter 2023.

• Africa Oil returned a total of $63.3 million to its shareholders in 2022 including a total annual dividend distribution of $23.8 million and $39.5 million in share buybacks. All shares repurchased in 2022 have been cancelled. Read More

Africa Oil Corp. announced that the Company repurchased a total of 200,000 Africa Oil common shares during the period of January 9, 2023 to January 13, 2023 under the previously announced share buyback program, having recommenced the buyback trades on January 13, 2023.

The launch of Africa Oil’s normal course issuer bid (share buyback) program, announced by the Company on September 22, 2022, is being implemented in accordance with the Market Abuse Regulation (EU) No 596/2014 (MAR) and Commission Delegated Regulation (EU) No 2016/1052 (Safe Harbour Regulation) and the applicable rules and policies of the Toronto Stock Exchange (“TSX”), Nasdaq Stockholm, and applicable Canadian and Swedish securities laws.

During the period dated January 9, 2023 to January 13, 2023, the Company repurchased 100,000 Africa Oil common shares on the TSX and/or alternative Canadian trading systems. The repurchases were carried out by Scotia Capital Inc. on behalf of the Company. During the same period, the Company repurchased 100,000 Africa Oil common shares on Nasdaq Stockholm, and these repurchases were carried out by Pareto Securities on behalf of the Company.

All common shares repurchased by Africa Oil under the share buyback program will be cancelled. Read More

Sports utility vehicles will die out because those who drive oversized 4x4s are seen as ‘terrorists’, the boss of Citroen has said.

Increasing the battery size to boost the range is not always an option, he said, and predicted that governments will take action against the vehicles, a trend already happening in France, which is beginning to tax by weight. Read More

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, energy monitors,