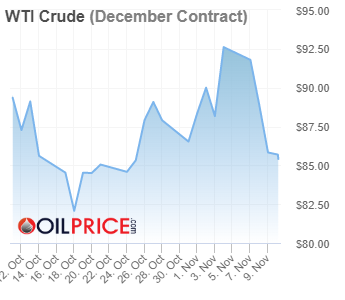

OPEC daily basket price stood at $93.22/bl, 09 Nov. 2022 , Energy News to 10/11/22

WTI for December 2022 delivery settle at $88.91 a barrel in New York

Brent for January 2023 settle at $95.36 a barrel.

During the period from October 31 to November 4, 2022, Eni acquired n. 11,130,207 shares, at a weighted average price per share equal to 13.5842 euro, for a total consideration of 151,195,223.32 euro within the authorization to purchase treasury shares approved at Eni’s Shareholders’ Meeting on 11 May 2022, previously subject to disclosure pursuant to art. 144-bis of Consob Regulation 11971/1999.

On the basis of the information provided by the intermediary appointed to make the purchases, the following are details of transactions for the purchase of treasury shares on the Euronext Milan on a daily basis: Read More

Pipeline Technique (PTL), a leading provider of welding and coating solutions to the global onshore and offshore energy sectors, has entered into a long-term agreement with Subsea7 for the provision of welding and coating services.

Under the terms of the agreement, PTL will provide Subsea7 with access to both a team of experienced specialists, and cutting-edge equipment, building upon the pre-existing and long-standing relationship between the two companies.

PTL supports customers’ projects through the consistent and progressive delivery of global rigid pipeline systems, locally tailored solutions, automation and strategic supply chain partnerships. The company has recently acquired the Oil & Gas division from Stanley Black & Decker, a major international pipeline services and equipment provider, bringing together two long term suppliers of Subsea7 and further strengthening this collaboration agreement.

Ben Mackay, Chief Operating Officer for PTL, said “By offering predictability, we can provide Subsea7 with a robust foundation for long-term planning and enhanced project performance. We look forward to contributing to more efficient operations benefitting both parties.”

PTL Chief Executive Officer, Frederic Castrec said “PTL’s close working relationship with Subsea7 spans several years, and this collaboration agreement forms the basis for its long-term continuation.” Read More

Equinor and the Wisting partners have decided to postpone the investment decision scheduled for December 2022. The maturation of the project continues, aiming for an investment decision by end of 2026.

“Equinor and partners have worked in close cooperation with the supply industry and developed a technically feasible and environmentally safe Wisting project for the Barents Sea. A development will generate substantial value for society and ripple effects in the north and nationally. In our updated investment estimate for the project, we see a cost increase due to increased global inflation and cost growth in the supply industry nationally and internationally. There is also uncertainty about the framework conditions for the project and execution capacity in the supplier market. Based on an overall assessment, we choose to postpone the investment decision,” says Geir Tungesvik, Equinor’s executive vice president, Projects, Drilling & Procurement. Read More

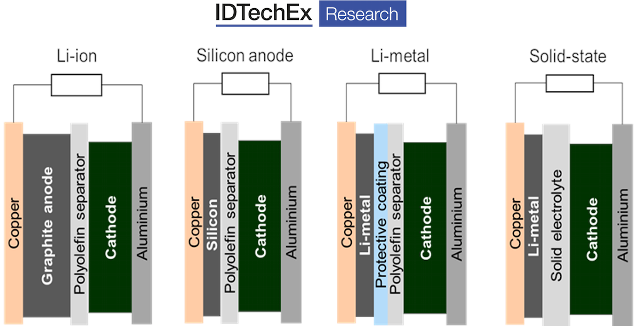

IDTechEx forecast the Li-ion market to grow to over US$430 billion by 2033, driven by demand for electric vehicles. Electric vehicles remain the key driver behind the Li-ion market and electric cars will be the largest market for Li-ion batteries over the next 10 years. Despite the ongoing effects of coronavirus, chip shortages and other supply chain issues, electric car unit sales reached 6.4 million 2021, driven by strong emissions targets and regulations. Given the rapid increase in forecast demand for Li-ion batteries, there has been significant growth in the number of gigafactories being planned and announced over the past 2-3 years. Read More

Arizona Lithium Limited , a company focused on the sustainable development of the Big Sandy Lithium Project announced a strategic equity investment of US$1.25m in Midwest Lithium AG (“Midwest”), for approximately 11.5% of Midwest. The investment by AZL is part of a broader US$2.5m capital raise Midwest is currently completing, which is expected to be used for surface exploration, ground expansions, property acquisition, permitting and working capital. The raise has been approved by Midwest’s shareholders and is expected to be completed in the coming days.

Midwest holds a significant land position in the Black Hills of South Dakota, one of North America’s only proven hard rock spodumene lithium producing districts in the US including a number of historical mines. The district holds over 24,000 pegmatite bodies of which between 2-5% are believed to carry lithium mineralisation; the pegmatites are all located around a large local granitic intrusion known as the Harney Peak Granite. Visible spodumene and other lithium minerals are easily identified around the district. The Black Hills are home to some of the first spodumene processing plants worldwide proving that spodumene in the region can be easily extracted through conventional DMS and flotation methods. The region also has a rich mining background holding one of America’s most important mines, the Homestake, which produced over 40Moz of gold over its continuous +125 year mine life, with a number of other large-scale mines and smaller quarries also operating in the area. Midwest is currently consolidating its land position and has already started mapping and geochemical programs in order to define drill targets to be pursued when drilling permits are granted. Read More

Ingeteam was selected as a technology partner by Global Power Generation (GPG), the international generation subsidiary of the Naturgy group, to equip an electricity storage project in Australia. The 10 MW, 20 MWh capacity battery system is associated with the 109 MW Berrybank 2 wind farm in Victoria, which GPG will start operating in the coming months. The battery storage facility, located in the Australian Capital Territory (ACT), will support ACT’s distribution network at the Queanbeyan substation, in partnership with the region’s transmission grid service provider, TransGrid.

This project represents a milestone for Ingeteam, as it is the first large-scale storage project in Australia for which the company has provided a comprehensive supply. In this regard, José Antonio Unanue, Director of Ingeteam’s BESS (Battery Energy Storage Systems) business, stated that “this project has been a real challenge for us, as it involved the comprehensive supply (power stations, battery containers, control system, etc.) for a project developed in the antipodes, in a very complicated context due to the numerous restrictions posed by the pandemic. The project could not have been completed without the essential contribution of our subsidiary in Australia. Which is why we in the BESS business are very pleased and proud to have successfully brought it to fruition”.

Ingeteam supplied two power conversion systems (all-in-one electricity substations integrating battery inverters, transformers, medium voltage cells, etc.), four 2.5 MW/5 MWh battery storage containers and the control system to manage the operation of the entire storage plant. Ingeteam conducted the commissioning of the plant and will also be responsible for operation and maintenance via its local subsidiary. Read More

Ingeteam’s 50th anniversary celebration was held today in the Euskalduna Palace in Bilbao, with a stirring tribute to the four families who founded the company. 50 years ago a group of four engineer friends travelling home after completing post-graduate engineering studies in Germany, decided to set up a business. Despite the tough situation at the time, they founded the company TEAM in 1972, and it later merged with Ingelectric to create Ingeteam.

The foursome – Javier Madariaga, Víctor Mendiguren, Miguel Gandiaga and Alberto Belaustegui – laid the foundations for Ingeteam to become what it is today, a company with a staff of 4,100 and four Spanish production centres, in Bizkaia, Gipuzkoa, Navarra and Albacete. It also has production facilities in Milwaukee in the United States, Brazil, Mexico and India, and sales offices in 24 countries. In short, Ingeteam is a multinational operating in all 5 continents.

The anniversary celebration was attended by the Ingeteam’s Chairwoman Teresa Madariaga and its CEO Adolfo Rebollo, together with the President of the Basque Government Iñigo Urkullu, the Head of the Bizkaia Provincial Government Unai Rementeria and the Government Delegate Denis Itxaso, among other authorities. The event also attracted participation from customers, suppliers and company employees.Over its 50 years of business, Ingeteam has succeeded in securing major contracts with the world’s top companies, winning public contracts and competing with the main technologists on a global level. Its technology is used in wind farms and photovoltaic plants worldwide, on ships and cruise liners, in desalination plants, on trains, metros and trams, in biomass, hydraulic and metallurgical plants and in mines, among other areas. Read More

Saudi Arabia’s state oil company has assured several buyers in Asia it will deliver full contracted volumes in December despite the OPEC+ decision to cut production, Reuters has reported, citing unnamed sources.

The assurance comes despite a commitment on the part of the Kingdom to reduce its production to contribute to the group-wide cut of some 1 million barrels daily, which was agreed at the latest meeting of OPEC+.

“People are scratching their heads to figure out when will the output cut be materialised, as the market has not felt a tightened supply,” one of the Reuters sources told the news agency.

At the same time, Saudi Arabia said earlier this month it would lower its official selling price for oil for Asian buyers, again for December deliveries. The price cut was deeper than traders and refiners had expected, per a Bloomberg survey. Read More

Whether it’s running lights at night for training, or trying to keep the clubhouse cool, there are different things that clubs should consider when looking to reduce the impact of the energy they use at sports stadiums and events.

Over at Melbourne City Football Club, their new training facility is being built, and work is underway with Origin to increase its solar capacity, add battery storage and EV charging stations. There’s also LED lighting, and energy efficient windows and insulation to reduce reliance on heating and cooling. It’s all about smarter, cleaner energy solutions to reduce carbon emissions.

And this new training facility is beside fields where community sporting clubs and local schools play, helping inspire a new generation across social issues including climate change and sustainability. Read More

Brookfield Asset Management Inc. led a A$18.4 billion ($11.8 billion) offer to acquire utility Origin Energy Ltd., its latest bid to add exposure to Australia’s accelerating shift away from fossil fuels. Under Brookfield’s plan, an additional A$20 billion will be invested by 2030 in Origin’s transition strategy, including adding more capacity in renewable power and energy storage, the fund said in a statement Thursday. The fund’s partner MidOcean Energy — a liquefied natural gas company owned by US-based EIG Global Energy Partners — will take control of the target’s natural gas assets, including a stake in the Australia Pacific LNG export operation. Read More

Biden has largely ignored another important type of fuel: diesel fuel, which is critical for the production and transportation of many everyday products. There’s a reason for Biden’s silence: Diesel prices remain uncomfortably high, and they’re contributing to food inflation and other consumer pain points. Around the same time gas hit $5, diesel hit a record high of $5.81 per gallon. Gas prices are now 22% below their peak, but diesel is just 8% lower. On a year-over-year basis, gas prices are up 15% while diesel is up 43%.

High diesel prices are a kind of hidden inflation, because most consumers never buy diesel. But it’s an important input in the production and transportation and of many things, including food and consumer goods shipped around the country. Inflation, at 8.2%, is still uncomfortably high, a huge reason Biden’s approval rating is underwater and Democrats seem headed for resounding defeat in the midterms. A big part of the reason is rising input costs for everyday consumer products.

The American Farm Bureau Federation sent a letter to Biden on November 4 drawing attention to the problem. Read More

US Cut Oil Output Forecast Again as Shale Growth Slows Down.The US slashed its forecast for 2023 oil production in the latest sign that world crude markets can’t rely on American shale fields to ramp up supply quickly enough to reduce high energy prices over the next year.Production is now estimated to hit 12.31 million barrels a day in 2023, according to a monthly report from the Energy Information Administration released Tuesday, a fifth straight downward revision by the government agency. Next year’s output was previously expected to surpass the record 12.315 million barrels set in 2019.

The projection suggests the pace of US shale growth, one of the few sources of major new supply in recent year, is slowing despite oil prices hovering at around $90 a barrel, about double most domestic producers’ breakeven costs. If the trend continues, it would deprive the global market of additional barrels to help make up for OPEC+ production cuts and disruption to Russian supplies amid its invasion of Ukraine. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $85.34 | Down |

| Crude Oil (Brent) | USD/bbl | $92.34 | Down |

| Bonny Light | USD/bbl | $94.10 | Down |

| Saharan Blend | USD/bbl | $95.74 | Down |

| Natural Gas | USD/MMBtu | $5.80 | Down |

| OPEC basket 09/11/22 | USD/bbl | $93.22 | Down |

Many of the world’s oil refineries are rushing to try and guarantee supplies of Middle East crude for next year, fearful of what’s to become of Russia’s giant export program.

In under a month, almost all companies in the European Union will be barred from purchasing seaborne cargoes from Russia — an attempt by the 27-nation bloc to punish the Kremlin for the invasion of Ukraine. The restrictions’ full impact will only really start to become clear once the measures enter into force, but there has been widespread speculation that Russia’s petroleum exports — among the world’s largest — will slide. Read More

Spain’s National Securities Market Commission (“CNMV”) has today authorised the voluntary cash tender offer of Siemens Energy Global GmbH & Co. KG (“Siemens Energy”) for the 32.9% of Siemens Gamesa Renewable Energy, S.A., (“Siemens Gamesa”) share capital that it does not already own (the “Offer”). Following a settlement of the offer, Siemens Energy, if it achieves at least 75% of the capital, intends to pursue a delisting of SGRE from the Spanish stock exchanges, where it currently trades as a member of the IBEX 35 index.

The offer acceptance period will be 36 calendar days and commence the day following the publication of the first required regulatory public announcement of the offer, which Siemens Energy plans to do shortly. During the acceptance period, SGRE’s shareholders who wish to do so may accept the offer by tendering their shares for EUR 18.05 per share.

The Offer price is supported by a valuation report issued by PricewaterhouseCoopers Asesores de Negocios, S.L. as independent expert and is within the valuation range determined by such independent expert. Read More

Siemens Gamesa ended a particularly complex fiscal year 2022. With the launch of the Mistral strategy program and a new operating model, Siemens Gamesa took decisive steps to mitigate ongoing headwinds and to stabilize the business for profitable growth in the long term.

The company’s performance during the fiscal year reflected market imbalances caused by persisting supply chain disruptions, heightened by geopolitical tensions and additional waves of COVID-19, as well as upward pressure on the price of inputs and shipping. There were also internal challenges. These challenges included the industrialization of the Siemens Gamesa 5.X onshore platform, where progress was slower than planned, and additional costs related to failures and repairs of components in legacy onshore platforms.

All these factors affected the manufacturing, execution and delivery of projects in progress. Based on new assumptions about market, production and project-execution conditions, the backlog of projects for delivery in future years needed to be reassessed.

In this extremely challenging situation, Siemens Gamesa signed orders for €11,598 million in the last 12 months, boosting the company’s backlog to a record €35,051 million, i.e., a €2,509 million increase year-over-year. These record figures show once again that Siemens Gamesa is well positioned to unlock the growth potential of renewables, which is driven by the need to secure energy independence and address the climate emergency.

Revenue from October 2021 to September 2022 amounted to €9,814 million (-4% year-over-year). EBIT pre PPA and before integration and restructuring costs amounted to -€581 million, with an EBIT margin of -5.9%. The numbers come as a result of supply instability and delays in project execution, the challenges around the ramp-up of the Siemens Gamesa 5.X platform, reduced manufacturing activity, and component failures and repairs in legacy onshore platforms. This impact was partially offset by the successful sale of renewable development assets in southern Europe. Read More

Toyota would be in the red by $186 billion, which is the highest debt of any corporation in the world. The latest data from StockApps.com reveals that Toyota has not only overtaken Volkswagen as the most indebted automaker but it’s become the most indebted company in the world. For the 2021-2022 fiscal year, the Japanese giant would have accumulated a net debt of $186 billion. Read More

Group Chief Executive Officer (GCEO) of the Nigerian National Petroleum Company Limited (NNPCL), Mr. Mele Kyari yesterday said he has received several death threats from people who are not happy with efforts being made by the federal government to ensure increased transparency, accountability as well as an end to crude oil theft which has seen country recording severe revenue losses. The revelation by Kyari came just as Nigeria’s oil production has started rebounding as production rose above one million barrels per day (bpd) for the first time since July this year, with daily output for October standing at an average of 1,014,485bpd. Read More

At the end of September, the Nord Stream 1 and 2 natural gas pipelines connecting Russia to Germany were damaged in an apparent act of sabotage, with some officials blaming Russia. Although the pipelines were not in use— Nord Stream 1 was shut down in March by EU sanctions against Russia, and Nord Stream 2 wasn’t yet operational—the incident highlights the risks to underwater infrastructure. “There is a vulnerability around anything that sits upon the seabed, whether that’s gas pipelines, whether that’s data cables,” Adm. Ben Key, first sea lord and chief of the British naval staff, told reporters after the incident. As the world’s reliance on underwater infrastructure, including telecommunications cables and gas pipelines, increases, the European Union’s militaries have been developing assets to counter attacks on such vulnerable infrastructure. Read More

Occidental Announces 3rd Quarter 2022 Results

Repaid $1.3 billion of debt during the third quarter, with year-to-date repayments of $9.6 billion through November 7, 2022, representing 34% reduction of total outstanding principal

Repurchased over 28.4 million shares for $1.8 billion during the third quarter, with year-to-date repurchases of 41.8 million shares for $2.6 billion through November 7, 2022

Earnings per diluted share of $2.52 and adjusted earnings per diluted share of $2.44

Cash flow from continuing operations of $4.3 billion and cash flow from continuing operations before working capital of $4.7 billion

Capital spending of $1.1 billion, resulting in quarterly free cash flow before working capital of $3.6 billion

Exceeded production guidance midpoint by 25 Mboed, with production of 1,180 Mboed

OxyChem and midstream and marketing segments exceeded guidance with pre-tax earnings of $580 million and $104 million, respectively

Increased full-year guidance for all three segments on strong third quarter results and improved outlook for OxyChem and midstream and marketing Read More

Baker Hughes Rig Count

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 04 November 2022 | 770 | +2 |

| Canada | 04 November 2022 | 209 | -3 |

| International | October 2022 | 911 | +32 |

HVS design and develop hydrogen-electric vehicles for the commercial vehicle market. We work with leading technology integrators, component suppliers and vehicle prototype design houses to deliver unique solutions to de-carbonise the medium and heavy duty commercial vehicle sectors. Showcasing its game-changing hydrogen powertrain in the form of a 5.5-tonne technology demonstrator, HVS offers a hint to its planned 40-tonne zero-emission HGV (Heavy Goods Vehicle), fulfilling the company’s objective of being the first indigenous UK designed and developed hydrogen-electric HGV on the market. Read More

Volkswagen AG announced its goal of making its data center operations net carbon-neutral by 2027. To achieve this goal, the Group has expanded its computing capacities at Green Mountain, a Norwegian operator of CO₂-neutral data centers. With this expansion, one quarter of Volkswagen’s global data center operations will run carbon-neutrally. This corresponds to annual CO₂ savings of 10,000 tons. Accelerating its decarbonization strategy, Volkswagen AG has set itself the ambitious goal to make its data centers net carbon-neutral by 2027. This would be three years earlier than foreseen in the European Green Deal, under which European data center operators agreed to make their data centers climate-neutral by 2030. To achieve this goal, Volkswagen has expanded its data center operations at Green Mountain, a Norwegian operator of CO₂-neutral data centers. All servers at Green Mountain run on 100% renewable electricity generated by hydropower and are cooled naturally by the adjacent fjord. Read More

Source Energie and Galileo have entered into a long-term joint development venture, named Source Galileo, with a plan to develop over 5 GW of offshore and onshore renewable energy and storage projects in Ireland, Norway, and the UK. Read More

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, energy monitors,TotalEnergies, Shell, BP, Chevron