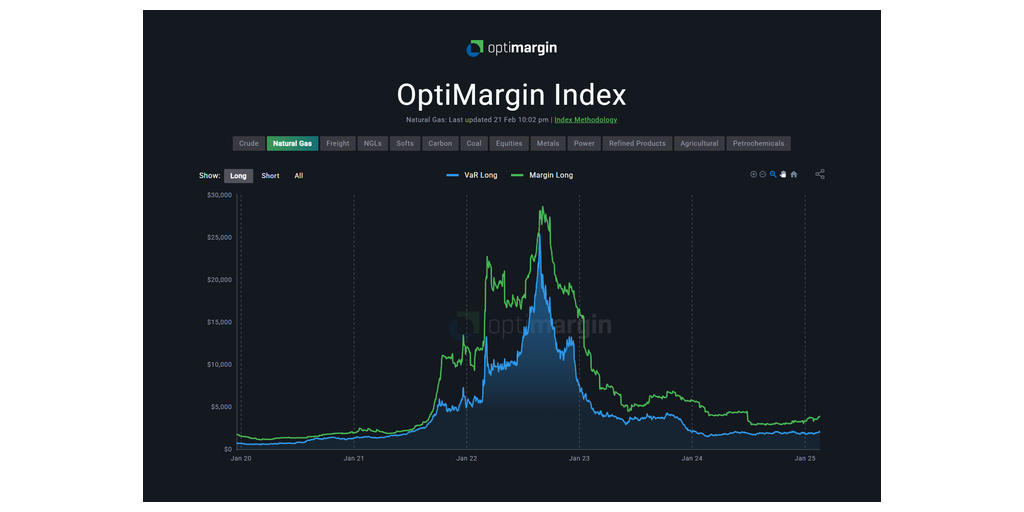

OptiMargin Unveils 15 Sector Indices for Margin and VaR Transparency

LONDON–(BUSINESS WIRE)–#OptiMargin–OptiMargin, leader in risk software, has released fifteen margin and Value-at-Risk (VaR) indices, delivering unprecedented transparency across key industry sectors: Equities, Crude, Refined Products, Natural Gas, Power, Freight, NGLs, Coal, Petrochemicals, Carbon Emissions, Agriculturals, Precious Metals, Base Metals, Industrial Metals and Softs. Covering 137 leading contracts from 18+ exchanges, the indices standardize multiple currencies and dozens of contract units, enabling fungible comparisons.” Contracts are ranked by market share and rebalanced quarterly. Full results are available at https://optimargin.com/index

“Natural gas, for example, starkly reflects the European energy crisis triggered by the 2022 Russian invasion of Ukraine and the resulting geopolitical uncertainty,” said Bernardo Dore, Chief Data Scientist. “This volatility is even more pronounced in the Power index, with both subsiding toward December 2022. The OptiMargin Natural Gas index includes Henry Hub (U.S.), TTF (Dutch), PEG (French), PVB (Italian), UK NBP (British), JKM LNG (Japan-Korea), and Alberta NIT (Canadian) contracts. All are weighted, ranked, and standardized across varying contract units, sizes, currencies, and exchanges to provide the most accurate, near real-time sector assessment of risk and margin.”

“Margin data is complex, unpredictable, and non-linear; traders struggle to get a ‘feel’ for such opaque information, often leading to negative convexity,” said Phil Motuzko, CTO. “OptiMargin’s methodology enhances transparency and sector-level context through standardized, fungible data—translating margin prediction and risk management into tangible bottom-line results.”

ABOUT OPTIMARGIN

OPTIMARGIN SOFTWARE CO. DEVELOPS MARGIN AND RISK ANALYTICS SOFTWARE FOR INSTITUTIONAL AND RETAIL TRADERS, INCLUDING PENSION FUNDS, TIER 1 BANKS, MONEY MANAGERS, COMMODITY TRADING ADVISORS, HEDGE FUNDS, COMMERCIAL HEDGERS, RISK MANAGERS, HIGH-NET-WORTH INDIVIDUALS, AND REGISTERED INVESTMENT ADVISORS THE COMPANY OFFERS MARGIN AUDIT, ATTRIBUTION ANALYSIS, HISTORICAL DATA INSIGHTS, FUTURE FORECASTING, STRESS TESTING, PRE- AND POST-TRADE ANALYTICS, MARGIN OPTIMIZATION, AND COMPRESSION. FOR A FULL LIST OF SUPPORTED EXCHANGES, VISIT WWW.OPTIMARGIN.COM.

Contacts

Robert Fox