Origin sells 10% interest in Australia Pacific LNG for $2.12bn

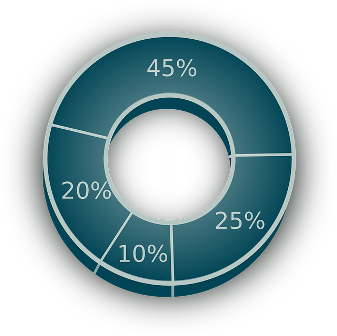

Origin Energy Limited (Origin) has executed an agreement with global energy investor, EIG, to sell a 10 per cent shareholding in Australia Pacific LNG for $2.12 billion. Following completion of the sale, the Australia Pacific LNG joint venture shareholders will comprise ConocoPhillips (37.5 per cent), Origin (27.5 per cent), Sinopec (25 per cent) and EIG (10 per cent).

Origin will retain its existing seats on the Australia Pacific LNG board. EIG will have one board seat, with voting rights commensurate with its 10 per cent shareholding. The divestment will not change Origin’s role as upstream operator, responsible for the upstream exploration, development, and production activities.

Based on an estimated completion timing of 31 December 2021, the net proceeds of the sale are expected to be approximately $2.0 billion1 after adjustments and transaction costs. Following the sale, Origin’s guidance for cash flow from Australia Pacific LNG for the 2022 financial year is unchanged at greater than $1 billion2, net of Origin oil hedging. The dilution of 10 per cent in the second half is estimated to be broadly offset by the improved commodity price outlook.

Information Source: Read More

Oilandgaspress.com | Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar