PetroNor E&P release Financial Statements to 31 December 2020

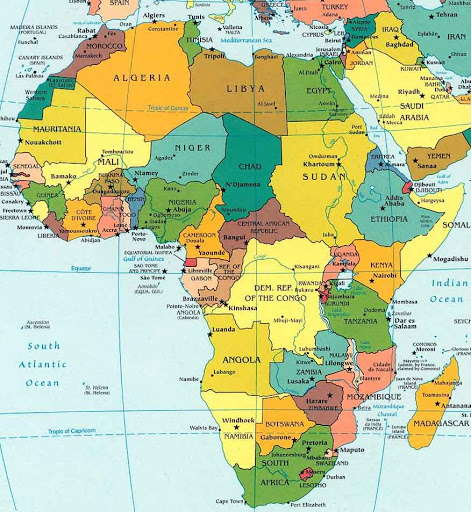

PetroNor is continuously seeking to reduce its cost base and has made good headway in this regard, even prior to the pandemic. The diversification of the portfolio will continue to be a focus as we seek to achieve our stated ambition of becoming an established, full-cycle, Pan-African operator with the appropriate blend of production, development and exploration upside.

2020 HIGHLIGHTS AND SUBSEQUENT EVENTS

Completed a capital raise of NOK 340 million in March 2021.

PetroNor has increased its indirect ownership in PNGF Sud up to 16.83% through increasing is shareholding in Hemla E&P Congo and Hemla Africa

Holding. The latter transaction is awaiting approval by the EGM 4th May 2021.

PNGF Sud production had a 4% growth in the oil production compared to 2019 with a gross field average production of 22,713 bopd in 2020.

PetroNor has re-established a highly attractive exploration portfolio in the West African margin through the entry in the Esperança and Sinapa licenses in Guinea-Bissau at highly attractive terms following the acquisition of SPE Guinea-Bissau AB from Svenska Petroleum Exploration AB.

Extension of the long stop date for the Aje transaction from 31 December 2020 to 30 June 2021, allowing extra time for completion of the regulatory approval process in Nigeria which has been delayed by the COVID-19 pandemic.

ASSETS

Republic of Congo (Brazzaville)

10.5% indirect participation interest in the license group of PNGF Sud (Tchibouela II, Tchendo II and Tchibeli-Litanzi II) through Hemla E&P Congo SA. On 25 January 2021, the indirect participation interest increased to 11.9% after 9,900 shares in Hemla E&P Congo awarded by the court in Congo were registered for the benefit of the Company.

On 12 March a transaction to increase the indirect participation interest to 16.85% by acquisition of the non-controlling interest shares in Hemla Africa

Holding AS, the transaction is subject to approval by the Extraordinary General Meeting which will be held 4 May 2021.

The Group holds a right to negotiate, in good faith, along with the contractor group of PNGF Sud, the terms of the adjacent license of PNGF Bis and a 14.7% indirect participation.

Nigeria

In 2019 acquired 13.1% economic interest in Aje Field through two transactions with Panoro Energy ASA and Yinka Folawiyo Petroleum. Started engaging with partners to streamline operations and made positive progress towards Department of Petroleum Resources in Nigeria approval for both transactions.

Guinea-Bissau

78.57% interest of the Sinapa (Block 2) and Esperança (Blocks 4A and 5A) is held by the Group through the purchase of SPE Guinea Bissau AB from

Svenska Petroleum Exploration AB in November 2020. The transaction was formally approved by Guinea-Bissau during April 2021. The remaining

equity is held by FAR Ltd.

The Gambia

In September 2020, under the terms of the settlement agreement, a new A4 licence was awarded providing a 90% interest and operatorship of the A4 licence to the Group. The remaining 10% interest of the new licence is held by the Government of The Gambia.

Senegal

The Rufisque Offshore Profond and Senegal Offshore Sud Profond license areas held by the Group are subject to arbitration with the Government of Senegal.

Information Source: Read Full Release ..–>

Press release by: