San Leon Energy Update on investment in Oza Field, Nigeria

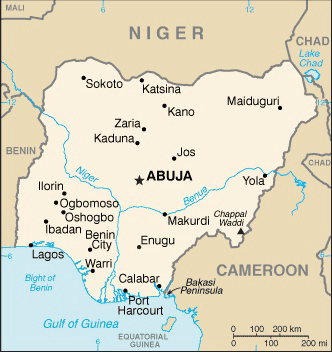

Further to its previous announcements, San Leon, the independent oil and gas production, development and exploration company focused on Nigeria, is pleased to provide an update on the funding arrangements by Decklar Petroleum Limited (“Decklar”) to develop the Oza Oil Field in Nigeria. When fully disbursed, the funding is expected to be sufficient to re-establish oil production and provide development funding for the Oza Oil Field.

Update Regarding Funding Arrangements

The due diligence required to finalise the term debt to Millenium Oil and Gas Company Limited, Decklar’s local partner, arranged with a Nigerian bank and the trading subsidiary of a large multinational oil company active in Nigeria has progressed and the final report by the independent technical consultant that they contracted, which is based on a review of reserve and production data and financial projections, has been issued. The definitive loan documents are now being finalised and are anticipated to be issued by the end of the first week of February 2021.

The details of the funding plans for the development of the Oza Oil Field were included in the Company’s announcement of 1 September 2020. In particular, San Leon has entered into a subscription agreement (the “Subscription Agreement”) with Decklar. The Subscription Agreement entitles San Leon to purchase US$7,500,000 of 10% unsecured subordinated loan notes of Decklar (the “Loan Notes”) and 1,764,706 ordinary shares of Decklar (“Decklar Shares”) (representing 15% of the enlarged share capital of Decklar) for a cash consideration of US$7,500,000 and N1,764,706 (c.US$4,600) respectively. Aside from an initial deposit of US$750,000, the balance of San Leon’s proposed investment in Decklar is being held in escrow and will be released upon satisfaction (or waiver) of the final conditions precedent contained in the Subscription Agreement. A further announcement will be made in due course in relation to the completion of the Subscription Agreement.

In addition, and as previously announced, Decklar and San Leon have entered into an option agreement that, at San Leon’s sole discretion, entitles San Leon to purchase an additional US$7,500,000 of Loan Notes and 2,521,008 Decklar Shares (representing an additional 15% of the enlarged share capital of Decklar, together with a gross-up of the original 15% so as to provide San Leon with a total of 30% of the enlarged share capital of Decklar) for a cash consideration of US$7,500,000 and N2,521,008 (c. US$6,500), respectively, at any time until the date that is forty-five (45) days after the well test results of the first development well on the Oza Oil Field have been delivered to San Leon.

Update Regarding Oza Field Preparation

Well site and drilling location preparation for the Oza-1 well re-entry and first horizontal development well have progressed, and the Company is pleased to report that these steps have now been completed. The road to the well site location has been rebuilt and construction of a concrete drilling pad, concrete mud pit, buildings and related infrastructure have also been completed. Long lead time items needed for the Oza-1 re-entry have been secured and a drilling rig currently located near the field has been identified and contracted.

Information Source: Read Full Release ..–>

Press release by: