Supply shortages and margin calls drive latest surge

The decision by the West to sanction Russia has generated a great deal of self-sanctioning across markets, and with that we are seeing an increased dislocation between the price of “offline” Russian produced raw materials compared with those sourced from other producers. These developments have taken us to the next and increasingly dangerous phase where sanctions on the world’s single-largest commodity producer may threaten financial stability.

The turmoil across markets continues following Russia’s invasion of Ukraine, not least across the commodity sector where tougher US and European sanctions leading to a great deal of self-sanctioning has increasingly cut off supplies from Russia, thereby impacting several key commodities from gas and oil to several industrial metals and key crops such as wheat. Ukraine, often called the breadbasket of Europe given its extensive fertile lands, which are naturally suited to grain production, has seen is supply chain breakdowns with closed harbors preventing exports of key food commodities such as wheat, barley and corn.

With a great deal of self-sanctioning unfolding, we are increasingly seeing Russian produced raw materials being treated as toxic, and not to be touched. An example of this being yesterday’s announcement from Shell, that they would stop all spot purchases of Russian crude oil. The decision comes as a response to the uproar that followed the company’s decision last Friday to buy a deeply discounted cargo of Russian crude oil.

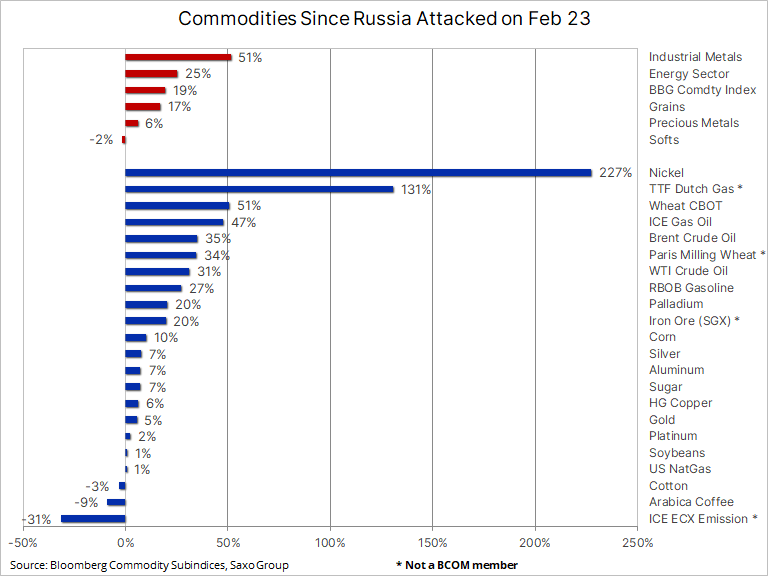

As a result of these developments, the price gains across individual commodities have become very extreme as per the below table.

The decision by the West to sanction Russia has generated a great deal of self-sanctioning in markets such as gas and oil that was not covered by the announced sanctions, and with that we are seeing an increased dislocation between the price of “offline” Russian produced raw materials compared with those sourced from other producers. These developments have taken us to the next and increasingly dangerous phase where sanctions on the world’s single-largest commodity producer may threaten financial stability.

As Zoltan Pozsar in a recent update from Credit Suisse puts it: “The aggressor in the geopolitical arena is being punished by sanctions, and sanctions-driven commodity price moves threaten financial stability in the West. Is there enough collateral for margin? Is there enough credit for margin? What happens to commodities futures exchanges if players fail?”.

This is the phase we have now entered and whether you are long on Russian or non-Russian commodities, any short futures position held against these will require the ability to post margin to cover your exposure. Commodities tend to trade relatively calm with price swings being determined by the supply and demand outlook as well as speculative interest across individual commodities.

Moves like those we have witness during the past few weeks have upended the markets and suddenly producers who have been hedging, i.e. selling futures to cover future production of metals, energy and agriculture commodities, have increasingly been caught out with futures exchanges demanding more and more collateral to prevent their short positions from being stopped out.

Source: Saxo Group

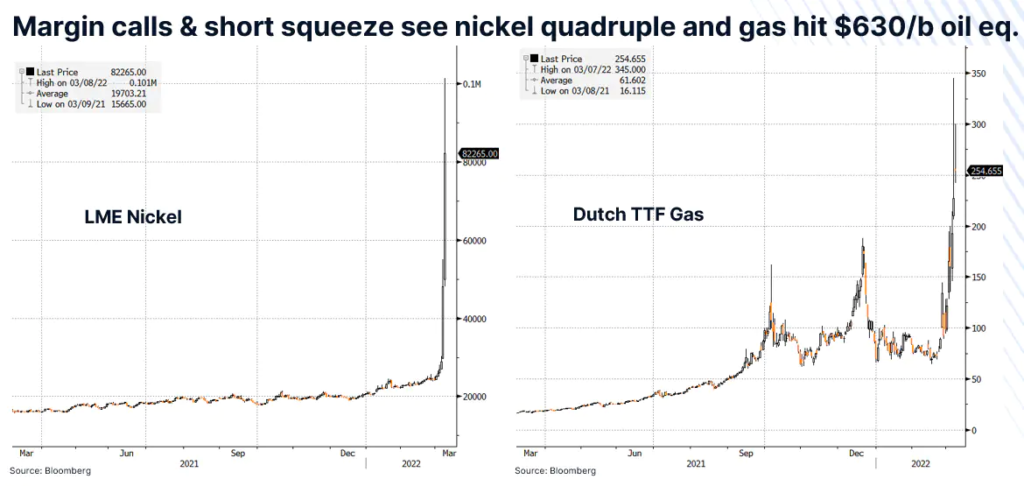

It is most likely these mechanics that in recent days have seen gas prices in Europe at one point hitting a price of $630 per barrel of crude oil equivalent, nickel seeing a four-fold increased to $101,000 per tons before trading was suspended on the London Metal Exchange and five days in a row with limit up conditions in CBOT wheat.

In other words, these dramatic movements are unlikely to be driven by speculators but instead market insiders who have tried to manage their revenues through the use of futures to offset price movements and lock in gains on future production. Others, as in the case with nickel, may have bought nickel from a Russian company and subsequently hedge the price risk via futures. Not only are they now stuck with an extraordinary margin call but may also not receive the physical metal that triggered the selling in the first place.

All in all, a situation, as Zoltan mentioned, that could threaten the financial stability of the West. We are already seeing headlines about major losses due to margin calls at otherwise very profitable companies, and it is a situation that until resolved will continue to keep across market volatility very elevated.

Read More By–> Ole Hansen, Head of Commodity Strategy at Saxo Bank