Top Energy/Automotive News As Reported; New funding , recycling ,batteries,contracts, consumer products

London, 15 June, 2023, (Oilandgaspress) : Rystad Energy modeling projects that annual battery storage installations will surpass 400 gigawatt-hours (GWh) by 2030, representing a ten-fold increase in current yearly additions. Battery energy storage systems (BESS) are a configuration of interconnected batteries designed to store a surplus of electrical energy and release it for upcoming demand.

Rolls-Royce concludes 2.5-million-kilometre testing programme of all-electric Spectre

Rolls-Royce Motor Cars’ genre-defining all-electric super coupé, Spectre, has now concluded an historic and unique undertaking: a 2.5-million-kilometre testing programme simulating more than 400 years of use. In the most demanding development process in the marque’s 119-year history, Spectre has endured temperatures ranging from -40°C to +50°C, and in conditions spanning from Arctic snow and ice to deserts, high mountain passes and the world’s megacities.

En route, every one of Spectre’s 141,200 digital sender-receiver relations and 25,000 performance-related functions has been minutely observed, analysed and tuned by Rolls-Royce engineers, a process representing over 50,000 collective driven hours of highly skilled work. This has resulted in thousands of iterative improvements in everything from Spectre’s acoustic performance, composure under cornering and steering precision to its charge time, electric range and torque delivery; each small in itself, but with an immense overall cumulative effect on the client experience. Read More

Rolls-Royce Motor Cars marks the 110th anniversary of its success in the Alpine Trial in 1913 – an event whose significance in Rolls-Royce’s legend cannot be overstated. It was this challenge, held over eight days and 2,600km, that established Rolls-Royce’s reputation as ‘the best car in the world’ – a crown it retains to this day. Rolls-Royce looks back on the characters, cars and conditions that helped make automotive history.

A DAUNTING CHALLENGE – AND UNMISSABLE OPPORTUNITY

From its foundation in 1904, Rolls-Royce immediately earned an enviable reputation for quality and reliability. This was cemented in a faultless performance by the new 40/50 hp, or Silver Ghost as it came to be known, in the 1907 Scottish Reliability Trials, followed by a peerless demonstration at the famous 1911 London to Edinburgh Top Gear Trial and Brooklands 100mph Run.

These endeavours earned Rolls-Royce the soubriquet ‘the best British car’. However, for energetic, ambitious managing director Claude Johnson, who described himself as the hyphen in Rolls-Royce, this was merely the beginning. He wanted to conquer the European market and knew that success in a high-profile continental event was the key. The 1913 Alpine Trial would provide precisely the opportunity he was looking for.

PERFECTLY PREPARED

Johnson personally selected a Rolls-Royce Works Team, with Eric Platford – one of the company’s most trusted employees and former mechanic to Charles Stewart Rolls himself – as manager. The specially prepared Silver Ghosts would be driven by Curt Friese, the marque’s representative in Austria, experienced Alpine driver Jock Sinclair, and EW Hives, a senior member of the Experimental Department at Derby and the first man to drive the Silver Ghost at 101mph.

Johnson also invited an enthusiastic privateer Silver Ghost owner, James Radley, to act as the team’s pacesetter.

The Works cars were meticulously prepared for the hazards of a springtime crossing of the Alps. Then as now, these included extreme temperatures, high altitudes, punishing gradients and vertiginous descents – but all without the benefit of the modern road surfaces of today. Read More

Hyundai Motor America and Ann & Robert H. Lurie Children’s Hospital of Chicago hosted a child safety seat check at this year’s Move for Kids walk and rally for patients, families, and neighbors at Busse Woods Forest Preserve in Elk Grove Village, Illinois. The event is part of the partnership previously announced in February as Hyundai continues its support of the hospital’s Buckle Up Child Passenger Safety Program. According to the National Highway Traffic Safety Administration, about 46 percent of car seats and booster seats are installed incorrectly or improperly used. Research shows that properly buckling up children in safety seats is lifesaving, reducing the risk of serious and fatal injuries by 80 percent. At the Move for Kids event, families received free child safety seat checks, where certified technicians inspected for expiration dates, manufacturer recalls, and proper fit for the children. Some families even received replacement seats if needed. Additionally, Hyundai Hope, the corporate social responsibility initiative for Hyundai Motor America, Patrick Hyundai, and the Women@Hyundai employee resource group donated $10,000 and supplies to the infant supply drive for the hospital, supporting families in need. Read More

Funding for Industrial Thin-Film PV Research

U.S. Department of Energy (DOE) Solar Energy Technologies Office (SETO) issued a notice of intent (NOI) to release a funding opportunity announcement (FOA) of up to $36 million for research, development, and demonstration projects on two major thin-film photovoltaic (PV) technologies: metal halide perovskites and cadmium telluride (CdTe).

Perovskites are a promising new PV technology that have the potential for high efficiencies and quicker, cheaper production. CdTe is a commercial PV technology that makes up more than a third of U.S. solar installations with opportunities for innovation and growth across its supply chain. Advancing perovskite and CdTe technologies will help scale domestic solar manufacturing capacity, strengthen the solar supply chain, and speed solar deployment. The FOA is expected to be released in September 2023 and is expected to be restricted to for-profit lead applicants.

$20 million of this opportunity will fund projects on industrial perovskite PV research and development to enable future commercialization by reaching specific thresholds of efficiency, long-term reliability, manufacturability, and economic viability. Quantitative guidelines within the NOI describe what a competitive application is expected to include for a given funding level. This information is being communicated through the NOI so potential applicants can take advantage of the intervening time before a FOA is released to identify and fill possible gaps in their capabilities. $16 million of this opportunity will fund projects to advance CdTe PV research, development, demonstration, and commercialization across the materials, equipment, installation, and performance monitoring supply chain to improve the competitiveness of the domestic CdTe PV industry. Read More

San Leon Energy announces proposed refinancing

San Leon, the independent oil and gas production, development and exploration company focused on Nigeria, announces a further update in relation to its proposed refinancing and its current financial situation.

Update on refinancing discussions and outstanding creditors

Since the announcement by the Company on 8 July 2022 of the proposed transactions with Midwestern Oil & Gas Company Limited (“Midwestern”) and the Company’s further conditional investments in Energy Link Infrastructure (Malta) Limited (“ELI”) (together the “Proposed Transactions”) the Company has had continuing discussions in relation to securing an alternative US$50 million loan facility to be applied towards the Proposed Transactions and to satisfy the Company’s working capital requirements. Details of the Proposed Transactions were announced by the Company on 8 July 2022 and set out in the Admission Document published by the Company on 8 July 2022 (the “Admission Document”).

As previously announced, the proposed refinancing discussions have not progressed as fast as the Board expected and, although the discussions are now at a very advanced stage, the Company has not yet been able to access the funding from such an alternative loan facility. However, with significant progress having been made in the past weeks, the Board is still optimistic that a conclusion will be reached and expects to provide an update to shareholders in due course.

As announced on 24 March 2023 (and previously), pending completion of the proposed refinancing, the Company has received only very limited cash inflows. The Company currently has approximately US$10.5 million of unpaid creditors, including directors, employees, professional advisers and tax authorities. San Leon has sought to maintain a regular dialogue with both its creditors and major shareholders and keep them informed of the status of the proposed refinancing, but there is understandably some pressure from creditors for settlement of amounts due to them and the continuing support of creditors cannot be guaranteed indefinitely. However, the Board is confident that, following the proposed refinancing being successfully concluded, all creditors will be settled in full shortly afterwards.

Assets update

Further to the announcement by the Company on 3 April 2023, the spread mooring of the FSO (floating storage and offloading) vessel for ELI has been completed (spread mooring is a multi-point mooring system that moors vessels to the seabed using multiple mooring lines). ELI is now in the process of finalising the renewal of necessary administrative regulatory permits to commence full terminal operations. The importance of this milestone is that it places ELI, once it receives the funds from the Further ELI Investments from the Company (details of which are set out in the Admission Document), in a position to export crude oil and thereby generate near-term cashflows which, in turn, will enable it in time to repay San Leon’s investment and loans.

San Leon reminds shareholders and investors that, notwithstanding its short term cashflow constraints, the Company’s current unaudited balance sheet has a significant asset base with, inter alia, over US$115 million and US$20 million owed by Midwestern Leon Petroleum Limited (the “MLPL Loan”) and ELI respectively. Although the MLPL Loan would be extinguished as part of the Proposed Transactions (and is currently subject to a conditional payment waiver with Midwestern until the sooner of completion of the MLPL Reorganisation) it otherwise remains a valid obligation, with interest continuing to accrue on the principal amounts waived pending completion of the MLPL Reorganisation, and therefore a significant asset of the Company. Read More

Semco Maritime and PTSC M&C awarded contract for Baltica 2 offshore substations

The PGE Group and Ørsted have awarded an engineering, procurement and construction (EPC) contract for four 375 MW offshore substations for the Baltica 2 project to a consortium consisting of Semco Maritime and PTSC Mechanical & Construction (PTSC M&C) supported by primary sub-contractors ISC Consulting Engineers and Hyundai Electric. The Baltica 2 offshore wind farm project is located in the Southern part of the Baltic Sea approx. 40 kms off the Polish coast and scheduled for commissioning by end of 2027. The offshore wind farm will have a capacity of approx. 1.5 GW and will be Poland’s largest-ever renewable energy project with 107 wind turbines producing enough green energy to cover the power consumption of approx. 2.4 million Polish households.

The contract includes design, engineering, procurement, construction, and commissioning of the four offshore substations, which will be manufactured at PTSC M&C’s yard in Vungtau, a port city in south Vietnam, which is the heart of the country’s offshore oil and gas industry. Semco Maritime will design, procure and install high and medium voltage, SCADA and auxiliary systems supported by ISC Consulting Engineers and Hyundai Electric. The contract will be executed in 2023-2026. Read More

Tlou Energy Drilling and Operations update

The Company is currently drilling the Lesedi 6 gas production pod. The pod will comprise one vertical production well (Lesedi 6P) intersected by two lateral wells (Lesedi 6A and Lesedi 6B) drilled horizontally through the target reservoir section for several hundred metres. Lesedi 6P – Vertical Production Well This well has been drilled to a depth of 589m and intersected 6m of the target lower Morupule coal. Well casing was cemented in place, with fiberglass casing at the target coal seam underreamed to expose the coal to the well bore to facilitate dewatering and gas flow.Core-hole drilling

The objective of the core-hole is to provide additional geological control in the vicinity of the Lesedi 6 gas production pod.

In addition to providing coal and gas content data, the core-hole accurately determined the top and bottom of the target coal seam close to where the lateral section of Lesedi 6A and Lesedi 6B will enter the coal. This is important data for drilling of the lateral section of each well. The core-hole was completed and logged after reaching a total depth of 535m and intersecting 6m of coal. 18 coal samples were taken and placed in desorption canisters for further analysis.

Work on the transmission lines to connect Tlou’s Lesedi power project to the existing power grid is progressing. Overall progress to date is ~73%. This work is expected to be completed in 3Q23. The 100 Km line includes planting wooden and steel pole structures. Most of the wooden poles have been erected and work has begun on the steel structures. Line stringing is also underway with ~30km of the phase conductor and ~67km of the GSW earth wire complete. Read More

Neste has made the final investment decision to commence construction of upgrading facilities for liquefied plastic waste at its Porvoo refinery in Finland. With the investment of 111 million euros, Neste will build the capacity to upgrade 150,000 tons of liquefied waste plastic per year. Upgrading is one of the three processing steps turning liquefied waste plastic into high-quality feedstock for new plastics: pretreatment, upgrading and refining. The investment is part of a broader project (PULSE*), which has received an EU Innovation Fund grant of 135 million euros if fully implemented and is targeting a total capacity of 400,000 tons per year. Pretreatment and upgrading of liquefied waste plastic play an important role in Neste’s approach to chemical recycling. They allow the company to increase flexibility for processing lower-quality plastic waste and scale up processing the liquefied waste plastic into high-quality petrochemical feedstock in its existing refinery in Porvoo.

“We have developed our capability to process circular raw material at the Porvoo refinery over the recent years and are now set to build a respective facility. The new facility processing 150,000 tons of liquefied waste plastic, is planned to be finalized in the first half of 2025,” states Markku Korvenranta, Executive Vice President in Neste’s Oil Products. The project will see Neste building new assets at the Porvoo refinery, but also leveraging existing assets through retrofitting, to scale-up chemical recycling fast and efficiently. The upgraded liquefied waste plastic will then be processed in the conventional refinery in which it will replace a portion of the fossil resources processed at the Porvoo refinery. Required preparation works at the Porvoo refinery were successfully completed during the first half of 2023, enabling the construction work to commence without any delay. Read More

TechnipFMC Awarded Contract by Woodside

TechnipFMC has been awarded a significant(1) contract by Woodside Energy(2) (LON: WDS) to engineer, procure, construct, and install flexible pipes and umbilicals for the Julimar Phase 3 development, offshore Western Australia. The Company will tie back four subsea gas wells in the Carnarvon Basin to the existing Julimar subsea infrastructure producing to the Wheatstone platform, using high pressure, high temperature (HPHT) flexible pipe and steel tube umbilicals.

Jonathan Landes, President, Subsea at TechnipFMC, commented: “We have a strong history of solid project execution with Woodside as demonstrated by the successful delivery of the Pyxis, Lambert Deep, and Greater Western Flank Phase 3 projects. We look forward to continuing this collaborative relationship with this award on Julimar Phase 3 as part of our framework agreement.” Read More

BW Energy starts production from second Hibiscus / Ruche well

BW Energy is pleased to announce that production has safely started from second well of the Hibiscus / Ruche Phase 1 development in the Dussafu licence offshore Gabon. Production performance from the well has been in line with expectations and is currently stabilised at approximately 6,000 barrels per day.

The DHIBM-4H well was drilled as a horizontal well from the BW MaBoMo production facility to a total depth of 4,800 metres into Gamba sandstone reservoirs on the Hibiscus field. Following completion, the Borr Norve jackup has commenced drilling operations on the third production well (DHIBM-5H). “We continue to progress the Hibiscus / Ruche drilling campaign with excellent HSE performance. We still have several wells to complete which will deliver successive production growth in Gabon through 2023 and into early 2024,” said Carl Krogh Arnet, the CEO of BW Energy. The drilling campaign targets four Hibiscus Gamba and two Ruche Gamba wells which are expected to add approximately 30,000 barrels per day of total oil production when all wells are completed in early 2024. The oil produced at Hibiscus / Ruche is transported by pipeline to the BW Adolo FPSO for processing and storage before offloading to export tankers. Separately, the commissioning and testing of the second gas lift compressor is ongoing on the BW Adolo. The compressor, which will support production from the six Tortue wells, is expected to commence its final commissioning phase in the next few weeks and, once fully operational, will add another 3,000 barrels per day. Read More

Aerospace and Defence Industries Association of Europe (ASD).

Micael Johansson’s appointment comes at a time when defence and security in Europe are more important than they have been in decades, and where the European defence industry is seen as a crucial component for maintaining peace in the region. “It is an honour to be elected to this position by my CEO peers and the national associations of ASD. I very much look forward to helping to steer ASD in these challenging times for Europe, together with the newly elected ASD President and Chairman of the board, Airbus CEO Guillaume Faury,” says Micael Johansson, President and CEO of Saab.

“Through my role as Vice Chairman of the board at ASD, I will be able to advocate for ASD’s interests, drive concrete initiatives, and foster the technological advancements necessary to address emerging security challenges in Europe,” says Micael Johansson. ASD is a prominent organisation representing European aerospace, defence and security industries, mainly in relation to EU institutions, but also on a global level in relation to other international bodies of importance to the sector. It serves as a collective voice for more than 3,000 companies, ranging from small and medium-sized enterprises to larger corporations, operating in various domains such as aerospace, defence, space and security. ASD members together employ 879,000 people and generated a turnover of €238 billion in 2021. ASD works closely with policymakers, institutions, and other stakeholders to foster a secure and innovative defence industry ecosystem in Europe. Read More

Nine Just Stop Oil supporters arrested Just Stop Oil supporters are on the roads marching in their eighth week of daily action in the capital to demand that the UK Government halt all licences and consents for new oil, gas and coal projects. [1] At around 8am, 54 Just Stop Oil supporters, in four groups, began marching on roads in Ealing and Battersea, including Hanger Lane and Battersea Bridge. Nine supporters were arrested for failing to comply with a section 12 notice issued on a march at Hanger Lane. All the marches finished by 8:45am. Read More

KBR Awarded Feasibility Study to Support Next Generation Green Refinery

KBR announced today it has been awarded a feasibility study contract by Southern Rock Energy Partners to support the development of a first-of-its-kind refinery in Cushing, Oklahoma. Southern Rock’s proposed 250,000bpd refinery will be powered by solar, wind, waste heat and geothermal energy and consume hydrogen and oxygen as a fuel source, making it a truly cutting-edge refinery with the goal of becoming net zero carbon, and the first truly green refinery in the United States. Under the terms of the contract, KBR will provide expert consulting services, including a feasibility study in the formative stages of the project, and key technical information for the individual process units. KBR will focus on incorporating best practices into the design that will reduce emissions of greenhouse gases (GHG) with the potential for future reduction of GHG for a sustainable operation. “KBR is pleased to support Southern Rock Energy Partners to reach their sustainability goals through our consulting capabilities,” said Jay Ibrahim, KBR President, Sustainable Technology Solutions. “This win is indicative of KBR’s strategic commitment to supporting our customers through the energy transition.” KBR was recently recognized for its deep commitment to sustainability with a AAA designation in MSCI’s 2023 ESG Ratings and a spot on USA Today’s 2023 list of America’s Climate Leaders. Read More

According to GWEC’s data, recently completed wind power projects in China, the USA, Morocco and Europe have pushed the capacity across the 1TW threshold as the industry delivers on the ever-growing ambitions of governments around the world. The spread and diversity of these projects highlights the global reach of modern wind technology, which has developed rapidly in the last forty years from the early innovative designs developed in family back gardens by pioneers and visionaries like Henrik Stiesdal, who established the basis for the modern wind turbine – known as “the Danish Concept”, in the late 1970s. Read More

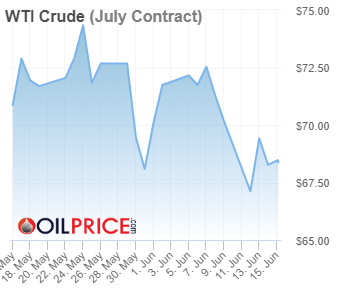

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $68.39 | Down |

| Crude Oil (Brent) | USD/bbl | $73.37 | Down |

| Bonny Light | USD/bbl | $73.58 | Up |

| Saharan Blend | USD/bbl | $74.05 | Down |

| Natural Gas | USD/MMBtu | $2.35 | Up |

| OPEC basket 14/06/23 | USD/bbl | $74.88 | Up |

Watson Farley & Williams (“WFW”) has advised Investec Aviation Finance (“Investec”) on its acquisition of a Boeing 787-10 aircraft from Aergo Capital. The aircraft is under a long-term lease to Singapore Airlines. Investec underwrote the acquisition which was supported by debt and equity co-investment from longstanding institutional business partners. Aergo Capital originally acquired the aircraft, along with a 2019-built A350-900, from Singapore Airlines in 2021. Both aircraft were financed by Shariah-compliant Islamic funding with Dubai Islamic Bank in a transaction arranged by Flying Solutions. Founded in 1991 and dual-listed on the London and Johannesburg stock exchanges, Investec is an international banking and asset management group, operating primarily in Europe, Southern Africa and the Asia-Pacific region. Aergo Capital is an aircraft leasing and trading company founded in 1999.

The WFW London Aviation team that advised Investec was led by Global Aviation Sector Co-Head Jim Bell, working closely with Of Counsel Jane Keith, Senior Associate Liam Clozier and Associates Alexander Kyriacou and Fawad Rashid. Jim commented: “We are very pleased to have supported our long-term partners, Investec, on this transaction”. Read More

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 02 June 2023 | 695 | -1 |

| Canada | 02 June 2023 | 136 | +39 |

| International | May 2023 | 965 | +18 |

Oil and Gas News Undiluted !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,