Top Energy/Automotive News; Hot temperatures in July pushed U.S. electricity demand to near-record levels.

London, 15 August, 2023, (Oilandgaspress) : Scientists have made a groundbreaking discovery that could change the way we think about air pollution. Researchers at the University of California, Irvine, have found that a strong electric field between airborne water droplets and surrounding air can create a molecule called hydroxide (OH) by a previously unknown mechanism. This molecule is crucial in helping to clear the air of pollutants, including greenhouse gases and other chemicals.The discovery is outlined in a new paper published in Proceedings of the National Academy of Sciences, which suggests that the traditional thinking around the formation of OH in the atmosphere is incomplete. Read More

From 14 August 2023, the shares in Equinor ASA will be traded ex dividend USD 0.90 (ordinary dividend of USD 0.30 and extraordinary dividend of USD 0.60). Read More

The World Bank arbitration court awarded $77 million to Exxon Mobil in a resubmitted claim worth $1.4 billion over the nationalisation of Venezuela’s Cerro Negro and La Ceiba crude projects in 2007. The award is the result of a long legal battle that ended with the International Centre for Settlement of International Disputes deciding on July 10 that most of the $984.5 million compensation granted to Exxon already had been paid in a separate claim with the International Chamber of Commerce, which resulted in Exxon receiving $907.5 million in 2011. Read More

Sunnova Energy International announced that it has launched an underwritten public offering (the “Offering”) of $75.0 million of Sunnova’s common stock, par value $0.0001 per share (the “common stock”). Sunnova has filed a shelf registration statement on Form S-3 relating to the Offering (including a prospectus) with the Securities and Exchange Commission (the “SEC”) that became effective upon filing. The shares will be issued and sold pursuant to such effective registration statement. A preliminary prospectus supplement relating to the Offering will also be filed with the SEC. Before you invest, you should read the prospectus, the preliminary prospectus supplement and other documents that Sunnova may file with the SEC for more complete information about Sunnova and this Offering. Read More

SilverBow Resources, announced that it has entered into an agreement (the “Purchase Agreement”) to acquire Chesapeake Energy Corporation’s (“Chesapeake”) oil and gas assets in South Texas (the “Chesapeake South Texas Assets”) for a purchase price of $700 million, comprised of a $650 million upfront cash payment due at closing and an additional $50 million deferred cash payment due 12 months post close, subject to customary adjustments (the “Chesapeake Transaction”). Chesapeake may also receive up to $50 million in additional contingent cash consideration based on future commodity prices.The Chesapeake Transaction has an effective date of February 1, 2023 and is expected to close by year-end 2023, subject to satisfaction or waiver of certain customary closing conditions, including the accuracy of the representations and warranties of each party, compliance by each party in all material respects with its covenants and the satisfaction of certain consent requirements.

The Chesapeake Transaction is expected to be funded with cash on hand, borrowings under the Company’s First Amended and Restated Senior Secured Revolving Credit Agreement, dated as of April 19, 2017, and amended as of June 22, 2022 (the “Credit Facility”), among the Company, the lenders party thereto and JPMorgan Chase Bank, N.A., as administrative agent for the lenders, and the Company’s amended second lien notes (“Second Lien Notes”) led by EIG. In conjunction with the Chesapeake Transaction, the Company has secured $425 million of incremental commitments under its Credit Facility from existing and new lenders, which, subject to the closing of the Chesapeake Transaction, will increase lender commitments under the Credit Facility to $1.2 billion, and the Second Lien Notes will be upsized by $350 million, which, subject to the closing of the Chesapeake Transaction, will increase lender commitments under the Second Lien Notes to $500 million and extend the maturity date for the Second Lien Notes to December 15, 2028. Read More

Nikola Corp. shares fell in early trading after the manufacturer announced it will recall trucks and temporarily stop sales after several battery fires. The company will call back roughly 209 of its Tre trucks after a third-party investigator found a coolant leak was likely behind a blaze at the company’s Phoenix headquarters in June. While Nikola said its vehicles can remain in operation, it advised customers and dealers to park outside until a fix is ready in the coming weeks.

Nikola’s stock plunged as much as 17% before the start of regular trading Monday. Internal investigations by Nikola’s safety and engineering teams indicate a single supplier component within its battery packs are the likely source of coolant leaks that a third party found to be the probable cause of the June truck fire. Read More

Denbury Inc. has emerged from bankruptcy 3yrs ago and now four top executives are set to collect the final installment of a $121.5 million post-reorganization pay deal. Denbury’s payouts, which are tied to share performance and staying with the company, are due to the executives in December regardless of any takeover, though a sale would expedite the process. The coincidental deal with Exxon — whose offer was only marginally higher than Denbury’s stock price — highlights the lucrative compensation plan and how awards granted during a company’s darkest days can swell to extraordinary levels if its fortunes turn. that rivals some of the industry’s most generous compensation packages. Read More

A subsidiary of China National Petroleum Corp (CNPC), Daqing Drilling Engineering Co, has been awarded the contract for the development of the Rumaila oilfield in Iraq. The Rumaila oilfield in southern Iraq, near to the Kuwaiti border, will see Daqing drill wells with two rigs as part of a $194 million overall deal.

According to CNPC, it was the biggest international deal that the Chinese company had in the previous five years. Daqing has past experience in the Rumaila field, having been awarded a contract to drill 21 wells in the lucrative oil field by the oil giant bp and the Iraqi government-owned South Oil in 2010. According to Offshore Technology, Rumaila is one of the largest and most lucrative petroleum reserves in the globe and ranks fifth globally in terms of oil and gas production. Read More

On July 20, CNPC started drilling the Shendi Chuanke 1 Well in the Sichuan Basin. It is the second over 10,000-meter-deep borehole in China after the Shendi Take 1 Well in the Tarim Basin in the Xinjiang Uygur Autonomous Region. Located in the Jiange Buried Structure in the northwest of the Sichuan Basin, the well has a ground elevation of 717 meters, a designed depth of 10,520 meters, a maximum bottom hole temperature (BHT) of up to 224℃ and a maximum bottom hole pressure (BHP) of up to 138 MPa. The automated drilling rig, independently developed by China, is capable of reaching a depth of 12,000 meters. Over 90% of the equipment used in the drilling is domestically manufactured. The exploration through this well will reveal the mystery of evolution under the Sinian formation, and is of great significance in discovering ultra-deep oil and gas resources, forming China’s ultra-deep hydrocarbon reservoir theory, and enhancing China’s capability of core technology and equipment in oil and gas engineering. Read More

The production of renewable diesel at Neste’s Singapore refinery expansion has been restarted in early August according to the company’s plans. The production line at the expanded part of the refinery was shut down in June for unexpected equipment repairs.

The ramp-up of the production at the expanded part of the refinery continues and is planned to be completed by the end of the year. SAF production in Singapore is scheduled to start during the third quarter as communicated in Neste’s half-year report in July.

The Singapore refinery expansion doubles Neste’s production capacity in Singapore. With the growth projects in Singapore and Martinez, the company targets to increase its total nameplate capacity of renewable products to 5.5 million tons in early 2024. The expansion of Neste’s Singapore refinery was completed and production at the expanded part of the refinery initially started in April 2023. Read More

Vestas has received a 140 MW order to power the Halkirk II wind project owned by Capital Power in Alberta, Canada. The order consists of 31 V150-4.5 MW wind turbines. The order includes supply, delivery, and commissioning of the turbines, as well as a 10-year Active Output Management 5000 (AOM 5000) service agreement, designed to ensure optimised performance of the asset.

“We’re thrilled to partner again with Capital Power to expand their wind energy portfolios in Canada, particularly with one of the industry’s highest producing onshore wind turbines,” said Laura Beane, President of Vestas North America. “The 4 MW platform is ideally suited for Alberta’s wind environment and our strong service operations will ensure Capital Power’s projects operate at full capacity.” “We’re excited to once again partner with Vestas for the supply of wind turbine technology for our Halkirk II Wind project, another critical facet of our balanced approach to net zero by 2045,” said Steve Owens, Senior Vice President, Construction and Engineering for Capital Power. “The V150-4.5 MW wind turbines will bring our Halkirk II Wind project to life as we continue to power a sustainable future for people and planet.” Turbine delivery is expected to begin in the second quarter of 2024 with commissioning scheduled for fourth quarter 2024. Read More

Chevron Corporation and Chevron U.S.A. Inc., a subsidiary of Chevron (“CUSA”), today announced the early participation date and the consent revocation deadline have been extended to 5:00 p.m., New York City time, on August 18, 2023 (the “New Early Participation Date” and the “New Consent Revocation Deadline,” respectively) and the expiration date has been extended to one minute after 11:59 p.m., New York City time on September 1, 2023 (the “New Expiration Date”), with respect to their previously announced (i) offer to exchange (the “exchange offer”) any and all validly tendered (and not validly withdrawn) and accepted 5.750% Senior Notes due 2026 (the “Old Notes”) issued by PDC Energy, Inc. (“PDC Energy”) for 5.750% Senior Notes due 2026 to be issued by CUSA and fully and unconditionally guaranteed by Chevron (the “CUSA Notes”) and cash, and (ii) the related solicitation of consents (the “consent solicitation”) to certain proposed amendments to the indenture pursuant to which the Old Notes were issued (the “PDC Indenture”). A registration statement on Form S-4 (File Nos. 333-273642 and 333-273642-01) (the “Registration Statement”) relating to the issuance of the CUSA Notes was filed with the Securities and Exchange Commission (“SEC”) on August 3, 2023. The Registration Statement is currently undergoing review by the SEC and is not yet effective. CUSA and Chevron intend to promptly file an amendment to the Registration Statement. All other terms, provisions and conditions of the exchange offer and consent solicitation will remain in full force and effect. In exchange for each $1,000 principal amount of Old Notes that is validly tendered after the New Early Participation Date but prior to the New Expiration Date and not validly withdrawn, holders of such Old Notes will be eligible to receive the Exchange Consideration (as defined below). The settlement date of the exchange offer and consent solicitation will be September 5, 2023. Read More

Hyundai Tucson FCEV Owner Shocked by $113K Repair Bill for Hydrogen Fuel Cell. As reported by AutoBild, German IT consultant Till Westberg purchased a Hyundai ix35 seven years ago for the reasonable sum of €50,200 (~$55,000). Known as the Hyundai Tuscon in the US, the ix35 was offered with hydrogen power in limited numbers, with the gas used to generate electricity for the drivetrain via a fuel cell. Westberg drove the car for years without fault, racking up over 52,000 miles before disaster struck.His Hyundai now has no more range: the car is dead as a stone, and a fault message appears when you start it. Westberg believes that Hyundai must take back the car. There are hardly any components for fuel cells like the one in the ix35 because the technology has progressed so enormously. Read More

On Natural gas production the EIA says; Associated natural gas production growth in the Permian Basin, driven by higher oil prices, has supported U.S. dry natural gas production in 2023 despite a decline in natural gas prices. We expect production to average about 104 billion cubic feet per day (Bcf/d) through the end of 2024, compared with 103 Bcf/d in 2Q23. Flat production largely reflects continuing growth in associated natural gas production offset by declines in natural gas directed drilling. Read More

On Global oil production the EIA says; We forecast global liquid fuels production will increase by 1.4 million barrels per day (b/d) in 2023. Non-OPEC production increases by 2.1 million b/d in 2023, which is partly offset by a drop in OPEC liquid fuels production. In 2024, global production increases by 1.7 million b/d, with 1.2 million b/d coming from non-OPEC countries. Non-OPEC production growth in the forecast is led by the United States, Brazil, Canada, Guyana, and Norway. Read More

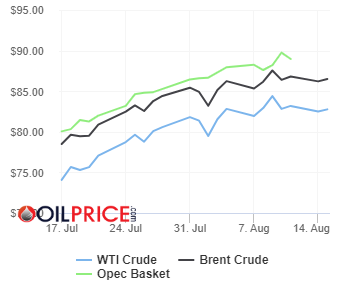

On Crude oil prices the EIA says; The Brent crude oil spot price averages $85 per barrel (b) in August in our forecast. Crude oil prices have increased since June, primarily because of extended voluntary cuts to Saudi Arabia’s crude oil production and increasing global demand. We expect these factors will continue to reduce global oil inventories and put upward pressure on oil prices in the coming months, with the Brent price averaging $86/b in the second half of 2023 (2H23), up about $7/b from our July Short-Term Energy Outlook (STEO) forecast for the same period. Rising global oil production in 2024 in our forecast keeps pace with oil demand and puts moderate downward pressure on crude oil prices beginning in the second quarter of 2024 (2Q24). Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $82.74 | Up |

| Crude Oil (Brent) | USD/bbl | $86.50 | Up |

| Bonny Light | USD/bbl | $88.07 | Down |

| Saharan Blend | USD/bbl | $87.28 | Down |

| Natural Gas | USD/MMBtu | $2.85 | Up |

| OPEC basket 11/08/23 | USD/bbl | $88.97 | Down |

Baker Hughes Rig Count:

U.S. Rig Count is down 5 from last week to 654 with oil rigs unchanged at 525, gas rigs down 5 to 123 and miscellaneous rigs unchanged at 6.

Canada Rig Count is up 2 from last week at 190, with oil rigs down 2 to 116 gas rigs up 4 to 74.

| Region | Period | Rig Count | Change |

| U.S.A | 11 August 2023 | 654 | -5 |

| Canada | 11 August 2023 | 190 | +2 |

| International | July 2023 | 961 | +2 |

Oil and Gas News Undiluted !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,