Top Energy/Automotive News; OPEC basket price at US84.82/bl

London, 27 July, 2023, (Oilandgaspress) : Shell and TotalEnergies reported a fall in second-quarter profit compared to 2022 earnings as oil and gas prices, refining margins and trading results all weakened.

During the period from July 17 to July 21, 2023, Eni acquired on the Euronext Milan no. 3,723,996 shares, at a weighted average price per share equal to 13.4669 euro, for a total consideration of 50,150,810.82 euro within the authorization to purchase treasury shares approved by the Shareholders’ Meeting on 10 May 2023, previously subject to disclosure pursuant to art. 144-bis of Consob Regulation 11971/1999.

On the basis of the information provided by the intermediary appointed to make the purchases, here below a synthesis of transactions for the purchase of treasury shares on the Euronext Milan on a daily basis: Read More

Toyota Motor Corporation (TMC) will livestream the World Premiere of the All-New Land Cruiser on August 2. The press briefing will be live streamed (with English interpretation) on this webpage. Video from the presentation will be available on-demand after the live stream. Read More

The second phase of Li Shanxi Toyota Longhua Sustainable Development Village Project was officially launched. The unveiling ceremony and volunteer activities were held in Huangtuliangnangou, Longhua County, where the project is located. Volunteers successively visited the 5G Smart Mobile Hospital for free clinics in rural areas, visited the reconstructed village ecological features and living environment design, and planted seeds by themselves under the guidance of experts Raspberry, a local native economic crop, can be used to feel Toyota’s unremitting efforts and remarkable achievements in accelerating the modernization of harmonious coexistence between man and nature, and at the same time contribute to the construction of beautiful countryside. Read More

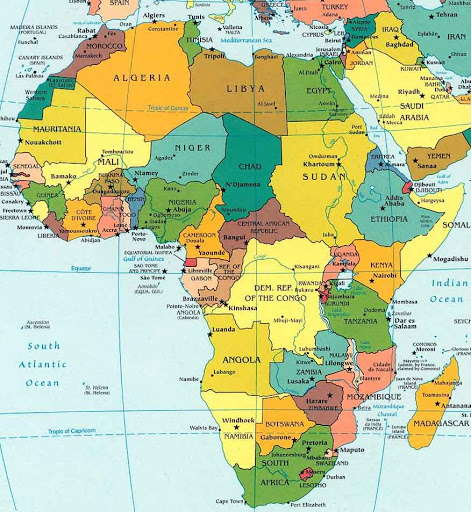

Buganda Prime Minister, Charles Peter Mayiga, concluded a fruitful 3-day field visit to Uganda’s oil and gas operational areas on July 19, 2023, expressing his satisfaction with the country’s development of its petroleum resources.

During his visit, he emphasized the importance of equitable distribution of the oil proceeds and highlighted the need for prioritizing the areas where the petroleum project is being developed. While on his tour of the Kingfisher Development Project in Kikuube district, Katikkiro Mayiga commended CNOOC Uganda Ltd for their cooperation with the local communities. He stressed the need for transparency and for the positive impact of these initiatives to be tangible to the communities even after 30 years. “I have seen first-hand how the Oil Company [CNOOC Uganda Ltd] relates with the people within the Kingfisher [Development] Project. The provision of safe drinking water, roads, quality education, and health care is quite commendable. But I implore the [Uganda] Petroleum Authority and [Uganda] National Oil Company to ensure that these projects have a positive impact on the lives of the people 30 years after today,” Katikkiro Mayiga said. Katikkiro Mayiga was impressed to find that over 95% of the employees in Uganda’s oil and gas sector were Ugandans with qualifications in various fields. He praised their expertise and commitment to their country. “Finding numerous Ugandan experts here was beyond my expectations, yet it brought me immense joy to discover that all these knowledgeable individuals are indeed proud sons and daughters of Uganda. Their expertise and unwavering commitment are truly admirable,” said Katikkiro Mayiga. The Katikkiro also toured the Tilenga Project, operated by TotalEnergies E&P Uganda, and was briefed on the progress of the project. Great progress has been made on both the Kingfisher and Tilenga projects, according to Mr. Alex Nyombi, the Director Development and Production at the PAU. Read More

The drilling of production wells for the Kingfisher and Tilenga oil production projects is continuing since the launch in January 2023. This is in preparation for the planned commencement of oil production in Uganda in 2025.

Drilling of the first well for the Kingfisher field has been completed to a total depth of about 3000 meters, and the LR8001 rig is now at the location for the second well. For the Tilenga project, the initial phase, will see the drilling of 12 development wells on the Jobi-5 well pad, which is part of the Tilenga oil fields.

The Uganda oil project envisions drilling over 450 wells on 35 well-pads, leading to an estimated production of 230,000 barrels of oil per day, at its peak once production commences. Production from the multiple fields, that include Kingfisher, Jobi Rii, Ngiri, Kasamene-Wahrindi, Gunya, Nsoga, and Kigogole, will contribute to this substantial output.

Mr. Ernest Rubondo, Executive Director at the Petroleum Authority of Uganda, said: “The drilling of production wells is proceeding as planned towards first Oil in 2025. The oil and gas activities especially the development of infrastructure worth over US$ 15 billion in the country before commencement of production, together with the expected annual revenues in excess of US$ 1 billion is beginning to significantly impact the country’s economy. Oil production in the country is expected to peak at 230,000 barrels of oil per day.

Mr. Alex Nyombi, the Director of Development and Production at the Petroleum Authority of Uganda, said: “Three rigs have been designated for the drilling operations on the Tilenga project. Presently, SINOPEC 1501 is operational at the Jobi-5 well pad, and commenced drilling operations on 28th June 2023. The second rig is undergoing final tests at the Ngiri 3 well-pad before commencing drilling, while the third rig is being assembled and is expected to commence operations in October 2023. For the Kingfisher Project the LR8001 rig has been operational since January 2023. Both rigs have noise suppressing technology, are fully automated and environmentally friendly.”

Uganda’s commitment to sustainable and responsible resource extraction is shown in the design of the drilling rigs. Employing innovative technologies and eco-conscious practices, the rigs are designed to minimise the environmental footprint, ensuring a positive impact on the ecosystem, and setting a precedent for future generations.

The proactive measures in scheduling the drilling operations will ensure at least 70 wells are in place by 2025, facilitating the projected commencement of commercial production. During the next 25 years, this development will provide a boost to investment in other sectors of the economy, bringing a potentially transformative impact for many Ugandans and the country at large.

To ensure the economic benefit from the project’s construction is spread widely, Uganda has set National Content Development targets. These mandate that at least 40 per cent of the amount spent remains within the country’s economy through the use of Ugandan goods and services and by training Ugandans to undertake the work. The government is also strengthening links between the new oil sector and existing parts of the economy, such as agriculture, tourism, manufacturing and education. As a result of the government’s initiatives, it is calculated there will be in total an $8billion boost to local businesses during the four-year construction period.

Uganda presently stands 132nd out of 221 nations in the Global Carbon Atlas with present annual emissions of just 4.9 MtCO2. Uganda presently stands 171st for GDP per capita according to the latest International Monetary Fund World Economic Outlook. France is 24th, the United Kingdom 22nd, the United States 5th and China 63rd.

Uganda’s oil projects are a collaborative effort between TotalEnergies EP Uganda B.V (TEPU), CNOOC Uganda Limited, and the Ugandan government, with the key facilities for the project encompassing the Central Processing Facility (CPF), well pads, flowlines, lake water abstraction, and other vital components.For more information or media inquiries, please contact Gloria Sebikari at corporateaffairs@pau.go.ug Read More

Energy regulator Ofgem has today (Wednesday 26 July) proposed a series of reforms to further improve standards of customer service for both businesses and households. Following extensive engagement with energy suppliers, businesses, consumers and other organisations, Ofgem is today announcing the publication of: A Non-Domestic Market Review findings and consultation: non-domestic refers to anything that is not a household. Many businesses throughout the country are struggling with energy market issues. The review summarises the challenges they face, and proposes a number of actions for the sector, Ofgem and Government to address. A Consumer Standards Statutory Consultation: There has been a decline in overall consumer satisfaction with customer service by domestic energy suppliers since 2018. Considerable work is already underway to address this. Ofgem is proposing new rules to ensure that all domestic customers, regardless of which supplier they are with, can contact their supplier and get support if they are struggling to pay.

Minimum Capital Requirements for supplier finances: Ofgem wants all energy suppliers to be financially secure to ensure consumers benefit from a stable energy market. To that end, Ofgem is today announcing a decision on the level of capital that suppliers are required to hold to ensure they are more resilient to severe but plausible market shocks. Ofgem is also proceeding with proposals to have the power to direct suppliers to ringfence a portion of their customer credit balances when it is deemed to be in the consumer interest.

Ofgem’s proposals would establish expectations to ensure all consumers receive a consistent and acceptable level of service regardless of the company they are with.

The regulator is taking these steps to drive up standards before this winter to make sure customers – particularly those in a vulnerable situation – are properly served, and to strengthen protections for business energy customers. Read More

Domestic energy supplier Outfox The Market is to pay £1.8 million for failing to provide adequate financial data and other essential information to Ofgem. The company has agreed to make the payment to Ofgem’s voluntary redress fund, which supports energy consumers in vulnerable situations, and other innovation and carbon emission-reducing investments. As energy regulator, Ofgem requires detailed information of suppliers’ financial housekeeping to ensure that companies are robust enough to absorb future price shocks in the market, thus preventing a repeat of the energy crisis of 2021 when 30 suppliers went bust. The importance of maintaining financial resilience was emphasised by Ofgem chief executive Jonathan Brearley in an open letter issued to all suppliers at the start of July this year. The regulator requested details of financial income, outgoings and capital reserves as part of a ‘stress test’ process, where a supplier must provide forecasts in three different price scenarios (when wholesale prices are lower, central or high). This is a valuable tool to assess the resilience of a supplier to absorb sudden changes in market conditions. The company was also asked to provide information essential to Ofgem’s recent series of ‘deep dive’ Market Compliance Reviews. Outfox The Market – which supplies around 100,000 energy customers in the UK – repeatedly failed to report an appropriate level of detail within the timescale required. Read More

Just a few months after the official launch of the Revuelto, the first V12 plug-in hybrid HPEV (High Performance Electrified Vehicle) supercar from the House of Sant’Agata, significant milestones have already been achieved. As of now, orders cover more than two years of production.

Revuelto is not an innovation solely in terms of performance, technical features and company strategies, it has also brought a real revolution in terms of production processes: Manifattura Lamborghini Next Level perfectly expresses the paradigm shift. The production system defined as “Manifattura 4.0” denotes an extremely high level of innovation. This means that in every process, from the making of the monocoque to the finishing stages, each individual station of the Revuelto line is distinguished by its high-tech impact which, as always at Lamborghini, supports – and never replaces – the indispensable work of humans. For the Revuelto this synthesis of manual skill and innovation represents the ideal embodiment of the production process. This approach leads to a significant reduction in the possibility of error along with greater production speed, all benefiting the quality of cars being made.

The system that manages the mechanical and technological aspects is called MES (Manufacturing Executive System) and features an innovative approach to the production process. In this system, the operator is supported in each step by the machine, but he or she can also interact with it at any time to change certain actions or stop its operation to intervene manually. In the various workstations operators are provided with a personal wristband they can use to access the system and to work via touchscreen monitors or tablets. The MES system harmoniously manages some of the most advanced and futuristic technological tools, especially the “cobots”: collaborative robots used on all the lines (engines, assembly and upholstery) that require repetitive actions, such as windshield assembly for example. In addition to being collaborative with humans in the true sense of the word, the special feature of cobots is that they make it possible to vastly eliminate the proportion of inaccuracies or errors in the activities carried out. Read More

One of the highlight vehicles at the first International VW Bus Day and the launch of the 3-row ID. Buzz EV in Huntington Beach, CA on June 2 was Lind Bjornsen’s 1955 Volkswagen Type 2 Schulwagen. These vehicles were built as traveling training vehicles for VW dealerships and Bjornsen’s is believed to be the sole survivor. The vehicle was also a standout at the Orange County Transporter Organization’s Type 2 event in Long Beach, CA the next day.

In the early 1950s, Volkswagens and Porsches were among the vehicles imported to the U.S. by Austrian businessman Max Hoffman. However, Volkswagen decided to terminate its contract with Hoffman as sole importer and began groundwork on founding Volkswagen of America in 1954. Leadership in Wolfsburg wanted a dedicated U.S. organization to tap into the biggest car market in the world.

Volkswagen would go on to succeed and dominate the import market within a decade, but the company knew that in order to succeed they had to back up their sales organization with a parts and service network to support the customers after the sale.

Through 1954, Volkswagen representatives Will Van De Kamp and Geoffrey Lange set up the dealer and distributor network. In 1955, they had Wolfsburg send their very first employees, three service tech trainers, and a couple of specially-equipped Type 2 Kombis to travel around to dealerships and train service personnel. This was the basis of Volkswagen’s Mobile Service School. Interestingly, the first two of these Kombis were delivered to Volkswagen of America before the company was officially incorporated in October of 1955. Read More

Hyundai Motor Group (the Group) announced the inauguration of its Joint Battery Research Center with Seoul National University (SNU). This collaborative effort between the Group and SNU aims to advance battery technologies and foster industry-academia cooperation to establish global leadership in the battery field.

The opening ceremony of the Joint Battery Research Center took place at Seoul National University’s main campus and was attended by esteemed guests, including Euisun Chung, Executive Chair of Hyundai Motor Group; Yong Wha Kim, President and Chief Technology Officer of Hyundai Motor Group; Heung Soo Kim, Executive Vice President and Head of Global Strategy Office of Hyundai Motor Group; and Chang Hwan Kim, Senior Vice President and Head of Battery Development Center of Hyundai Motor Group.With the opening of the Joint Battery Research Center, the Group will work with top battery experts in Korea to lay the groundwork for research and development of battery-related technologies. The Joint Battery Research Center aims to focus on advanced research into leading next-generation battery technologies that can dramatically increase EV driving distance and shorten charging time, as well as research on battery condition monitoring technology and innovative process technology. Specifically, a total of 22 joint research projects will be carried out in four divisions, including lithium metal batteries, solid-state batteries, battery management systems (BMS) and battery process technology. A total of 21 professors and master’s and doctorate-level talents from eminent Korean universities will participate in the research. 14 of the 22 research projects will be related to lithium metal and solid-state batteries, focusing their core capabilities on developing next-generation batteries. Read More

An electric motor requires much simpler maintenance than an internal combustion engine. With no friction between any moving parts or exchanges between liquids and gases, it needs neither lubricant nor exhaust. This means no oil, filter or exhaust system changes. All this can be taken off the cost of the car’s upkeep. Maintenance therefore involves far fewer mechanical elements than in a combustion-powered car. In fact, the tires, windshield washer fluid, brake pads and air conditioning filters are the only consumables that require regular changing in an electric car.Electric cars use two braking systems: first, regenerative braking, which uses the motor as a generator to charge the battery from time to time, then standard braking — with discs or drums and brake pads — which is activated afterwards. This therefore lightens the load on the mechanical braking system and tires, which means that the parts involved need to be replaced less frequently.With no manual gearbox or clutch, the transmission of an electric vehicle is much simpler: unlike a combustion engine, an electric motor delivers direct drive. When the driver presses the accelerator, the battery generates a magnetic field within a fixed part, which then causes a mobile part to rotate. In the electric vehicles produced by Groupe Renault, this latter part is a wound rotor synchronous motor, which increases the energy efficiency of the motor. All breakdowns related to the traditional transmission are therefore avoided, reducing the overall costs of maintenance. The battery of an electric vehicle is one of its most important components. The motor is powered by what’s called a traction battery. It defines the range of the electric vehicle, sometimes in the hundreds of kilometers depending on the model. When it comes to the durability of a lithium-ion battery in an electric vehicle, Groupe Renault, pioneer in electric mobility, estimates its automotive life span at 10 years. But this doesn’t mean that the battery can no longer work. On the contrary, it still has a good dozen years to be used in its “second life” in other fields from stationary electricity storage to vehicle electrification, local distribution of green energy and more. Read More

Renault Group continues to grow in value-creating segments

Renault Group worldwide sales amounted to 1,133,667 vehicles in the first half of 2023, up 13% versus 2022 H1. In Europe, Group sales were up 24% in a market up 17%.

The Renault brand recorded a 12% growth, with more than 772,000 vehicles sold in the first half of 2023. In Europe, the Renault brand increased its sales by 21% to 503,242 units, back on the podium as the second best-selling brand and number one in France.

Dacia’s sales were up 24% to more than 345,000 units in the first half of 2023, thanks to the success of its range.

Alpine also confirmed its growth: with more than 1,800 vehicles sold, registrations were up by 9%. The last six months have been marked by the successful launches of two limited editions: the Alpine A110 San Remo 73 and the Alpine A110 R Le Mans.

The Group’s sales policy focused on value creation, is continuing to concentrate on the most profitable channels: sales to retail customers, high trim versions and the C segment. The share of sales to retail customers represents 65% in the Group’s five main European countries.

Retail sales account for more than half of the sales of the Renault brand, in Europe.

Dacia takes the 2nd place in the European retail market, up 29% on the first half of 2022. With 138,978 units sold, Dacia Sandero is up 23.5% on the first half of 2022 and remains the best-selling vehicle for retail customers in Europe.

In the C segment in Europe, the Renault brand recorded growth of 42% on the first half of 2022 thanks to the success of Arkana, Austral and Megane E-TECH electric:

Renault Arkana recorded almost 42,000 sales, 55% of which were E-TECH versions.

Renault Austral recorded almost 40,000 sales, of which 65% were hybrid versions and 60% top-of-the-range versions.

Renault Megane E-TECH electric has recorded more than 23,000 sales, with more than 70% of sales for high trim versions and 80% for the most powerful engine. Megane E-TECH electric is the best-selling electric vehicle in the C segment in France.

Renault Group pursues its electrification offensive:

Sales of Renault brand electrified passenger cars2 rose by 18%3, now accounting for 37% of the brand’s passenger car sales in Europe. Full electric vehicles represent 11% of passenger car sales in Europe.

Dacia Jogger Hybrid 140, which has been on sale since January 2023, accounts for more than 25% of the sales mix. Dacia Spring, full electric, has sold more than 27,000 units in Europe on the first half and is still one of the best-selling electric vehicles in Europe.

The Group’s order backlog in Europe represents 3.4 months of sales at the end of June 2023. It would remain above the target of 2 months throughout the year, even with a market down 30% compared with 2019. Read More

BW Energy, as the operator of the Dussafu Marin license in Gabon, provides an update today on its operations and development. The Company will publish financial figures for the second quarter and first half year of 2023 on Wednesday, 23 August 2023. Gross production from the Tortue field averaged approximately 15,200 barrels of oil per day in the second quarter of 2023, amounting to a total gross production of approximately 1.4 million barrels of oil for the period. Production was positively impacted by first oil from the two initial Hibiscus / Ruche wells during the quarter and higher uptime on the BW Adolo after maintenance and development activities in the previous quarter.

BW Energy completed one lifting in the second quarter at a price of USD 75 per barrel. Production costs (excluding royalties) for the period was approximately USD 35 per barrel. The reduction compared to the previous quarter reflects the increased production. BW Energy’s share of gross production was approximately 1.0 million barrels of oil, more than double of prior quarter. The net sold volume, which is the basis for revenue recognition in the financial statement, was approximately 1.0 million barrels including 65,000 barrels of Domestic Market Obligation (DMO) deliveries with an over-lift position of 312,000 barrels at the end of the period.

BW Energy had a cash balance of USD 233 million on 30 June 2023, compared to USD 166 million on 31 March 2023. The increase is primarily due to the payment received for the May lifting and drawdown on the reserves-based lending (RBL) facility. The Company had a total drawn balance of USD 300 million as of 30 June 2023 after successful completion of USD 100 million accordion committed by three additional banks.

At the start of the period, the Company had commodity price hedges for a remaining total volume of approximately 2 million barrels for 2023 and 2024, of which approximately 70% was for 2023. These were a combination of swaps and options that will allow for future cash flow stability for ongoing development projects. BW Energy has recognised crude oil hedge gains in the amount of USD 3.4 million for the second quarter of which USD 0.7 million was realised.

In early April, the Company safely achieved first oil from the Hibiscus / Ruche Phase 1 development. This was followed by successful completion and production from two additional wells through June and July. Three Hibiscus wells in combination with commissioning of the second Gas Lift Compressor (GLC) have resulted in total gross production from the field reaching up to 30,000 barrels per day in late July. The Hibiscus / Ruche Phase 1 drilling campaign targets four Hibiscus Gamba and two Ruche Gamba wells which are expected to bring total oil production on the Dussafu Marin Permit up to approximately 40,000 barrels per day on a gross basis when all wells are completed and onstream. The wells are drilled by the Borr Norve jackup rig. Read More

Occidental (NYSE: OXY) announced today that its Board of Directors declared a regular quarterly dividend of $0.18 per share on common stock, payable on October 13, 2023, to stockholders of record as of the close of business on September 8, 2023. Read More

TechnipFMC plc announced that its Board of Directors has authorized and declared a quarterly cash dividend of $0.05 per share. The Company intends to pay dividends on a quarterly basis, and this dividend represents $0.20 per share on an annualized basis.

The Board has also authorized additional share repurchase of up to $400 million. Together with the existing program, the Company’s total share repurchase authorization has increased to $800 million, of which $200 million has been completed to date. The remaining authorization to repurchase up to $600 million represents more than seven percent of the Company’s outstanding shares at today’s closing price.

Doug Pferdehirt, TechnipFMC’s Chair and CEO, stated, “The initiation of a quarterly dividend and increase to our existing share repurchase authorization further demonstrate our commitment to maximize shareholder value through the return of capital to our shareholders. This builds upon the $200 million of shares we repurchased over the last twelve months.”

“We are also announcing a new commitment to return more than 60% of our annual free cash flow(1) to shareholders through at least 2025, which reflects our confidence in the long-term outlook for our Company. We continue to believe that our shares are undervalued today, as evidenced by the doubling of our existing share repurchase authorization. Our current expectation is that the majority of shareholder distributions will come from share repurchase, with the potential to grow the dividend over time.”

The cash dividend of $0.05 per share is payable on or shortly after September 6, 2023, to shareholders of record as of the close of business on the New York Stock Exchange on August 22, 2023. The ex-dividend date is August 21, 2023. Read More

Dana Incorporated (NYSE: DAN) announced today that its board of directors has declared a dividend on its common stock. The board declared a quarterly dividend of $0.10 per share, payable Sept. 1, 2023, to holders of Dana common stock as of Aug. 11. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $79.57 | Up |

| Crude Oil (Brent) | USD/bbl | $83.58 | Up |

| Bonny Light | USD/bbl | $84.77 | Up |

| Saharan Blend | USD/bbl | $83.72 | Up |

| Natural Gas | USD/MMBtu | $2.65 | Down |

| OPEC basket 26/07/23 | USD/bbl | $84.82 | Up |

Hitachi Energy, a global technology leader that is advancing a sustainable energy future for all, today announced it has been selected as preferred technology provider of SSEN Transmission and National Grid, to supply two high-voltage direct current (HVDC) converter stations to interconnect the Scottish and English power grids.The integration of renewables requires solutions that make the grid resilient, stable, and flexible. Hitachi Energy’s innovation and long development of voltage sourced converter (VSC) power electronics and control and protection (MACHTM)(1) technologies meet the requirements alongside many other landmark grid integration projects.

Eastern Green Link 2 will consist of two 525-kilovolt (kV) bipole VSC converter stations connected by 440 kilometers of subsea cable and 70 kilometers of underground cable, making it the longest HVDC link in the UK. The link will efficiently supply a total of 2,000 megawatts (MW) of electricity, which is enough to power around two million UK homes.(2) The link will help to secure power transmission in the northern UK and support the integration of new renewable electricity generation in Scotland, as part of the UK’s Net Zero Strategy.(3) As much as 11,000 MW of offshore wind capacity is possible in Scottish waters by 2030(4), and HVDC transmission will play a large part in bringing this vast amount of renewable power to shore and south, to communities across the country. Read More

KBR, Inc. (NYSE: KBR) today announced its second quarter 2023 financial results and raised its FY 2023 financial guidance for Adjusted EBITDA2. “Once again, the people of KBR have delivered a strong quarter of financial and ESG performance, underpinned by our mission focus and exemplary operational discipline,” said Stuart Bradie, KBR president and CEO. “Revenue and cash flow were strong in the first half of 2023. Net income was negatively impacted due to recorded losses in the second quarter associated with our convertible notes and the settlement of a legacy legal matter. First half Adjusted EBITDA2 and Adjusted EPS2 were outstanding, and as a result of strong, core business performance, we are pleased to announce an increase in our FY 2023 Adjusted EBITDA2 guidance. In response to our ongoing ESG progress, we received a AAA designation in MSCI’s 2023 ESG Ratings, we were named one of America’s Climate Leaders 2023 by USA Today, and we received a gold medal rating from EcoVadis in recognition of our sustainability achievements, ranking KBR among the top 5% of assessed companies.” “Furthermore, we were pleased to announce the resolution of a legacy legal matter and the repurchase of $100 million in convertible notes and associated warrants. We anticipate these developments will help us reduce uncertainty and liquidity risk and open the door for opportunities for shareholder value appreciation as we continue to build on our strong momentum this year and the years to come.”

New Business Awards

Backlog and options as of June 30, 2023 totaled $21.1 billion. Delivered 1.1x trailing-twelve-months (TTM) book-to-bill1 as of June 30, 2023. Awarded $2.2 billion of bookings and options in the quarter.

Sustainable Technology Solutions (STS) delivered 1.4x TTM book-to-bill1 as of June 30, 2023, including awards and achievements in the quarter as follows:

Selected by Avina Clean Hydrogen to use KBR’s K-GreeN® technology for its green ammonia project in the U.S.

Signed a memorandum of understanding with Atlas Agro AG to license KBR’s innovative K-GreeN® technology for Atlas’ planned investment in a series of green nitrate plants.

Signed a joint development agreement with ISU Chemical Co. Ltd. for the design of a commercial scale lithium sulfide unit for next generation battery technology.

Awarded an engineering and design services contract from The Chemours Company to increase capacity and advance technology for its industry-leading Nafion™ exchange materials platform.

Awarded a contract by Hindustan Petroleum Corporation Limited to implement KBR’s market-leading supercritical solvent deasphalting technology, ROSE®, at a refinery in Mumbai.

Signed a feasibility study contract by Southern Rock Energy Partners to support the development of a first-of-its-kind refinery in Cushing, Oklahoma.

Announced a new fully integrated and flexible Autothermal Reforming (ATR) technology solution for the production of low carbon ammonia at mega scale.

Government Solutions (GS) delivered 0.9x TTM book-to-bill1 as of June 30, 2023, including awards and achievements in the quarter as follows:

Awarded a significant contract, Integrated Missions Operations Contract III, worth up to $1.9 billion for the continued support of NASA’s human spaceflight programs, including the International Space Station, Artemis and Low Earth Orbit Commercialization. This has not yet been booked into backlog.

Awarded a contract up to $69 million to provide mission-critical labor at three locations in the U.S. Central Command area of operations through the Air Force Contract Augmentation Program.

U.S. Small Business Administration awarded KBR’s Science and Space division the Dwight D. Eisenhower Award for Excellence in research and development.

Expanded base operations support services in the Indo-Pacific region with a $24 million task award contract by the 94th Army Air and Missile Defense Command for support of two key communications sites in Japan.

Announced that it is a subcontractor to McCallie Associates, Inc., a certified small business selected to provide mission and instrument systems engineering services at NASA’s Goddard Space Flight Center in Maryland and Wallops Flight Facility in Virginia.

Awarded several other contracts in Science & Space and Defense & Intel that have not been booked into backlog due to ongoing protest. Read More

Oil and Gas News Undiluted !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,