UK electrified vehicle output surges, up 29.6%

UK car production in 2021 fell -6.7% to only 859,575 units, according to figures released today by the Society of Motor Manufacturers and Traders (SMMT), the worst total since 1956.1 Output was 61,353 less than 2020, which itself was badly affected by coronavirus lockdowns, and -34.0% below pre-pandemic 2019.2 Despite this, British car factories produced a record number of battery electric (BEV), plug-in hybrid (PHEV) and hybrid electric vehicles (HEV), turning out almost a quarter of a million (224,011) of these zero and ultra-low emission vehicles, representing more than one-in-four (26.1%) of all cars made.

Manufacturers also wrestled with staff shortages arising from the need to self-isolate and depressed demand with car showrooms closed for months due to lockdowns and despite the success of ‘click and collect’ services. There were also non-Covid issues behind this fall, most notably the closure of a major UK car plant in July, which accounted for around a quarter of the annual decline. More positively, the shift to electrified vehicle manufacture continued apace as BEV production surged 72.0%, while hybrids rose 16.4%, as the UK industry – like the market – transforms into a low and, ultimately, zero-carbon industry.

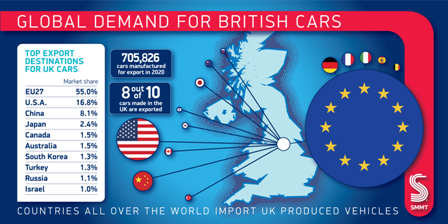

Global exports continued to be the foundation for UK car manufacturing, with some eight-in-ten cars made being shipped overseas. Although annual production for overseas markets declined -5.8% to 705,826 units, volumes for the domestic market declined even more steeply, down -10.6% to 153,749.

The European Union remained the UK’s largest market by some considerable distance, increasing to 55.0% of exports, from 53.5%, and representing 388,249 units (-3.0% vs 2020), despite frictions and costs arising from the new trading arrangements. While automotive businesses were as well prepared as they could be, an SMMT member survey in April revealed some nine-in-ten (91%) firms were spending more time and resource managing UK/EU trade than in 2020.

Shipments to several other major global markets also fell, with the US, our second ranked export destination, down -10.5% and Japan, our fourth largest export market, down -36.1%. China, in third place, fared better, with exports up 0.6% to 57,356 units, reflecting strong market conditions in the country and demand for iconic British performance, luxury and premium car brands. Exports to Canada, Australia and South Korea, however, declined, -5.3%, -31.1% and -29.7% respectively.

Information Source: Read More–>

Oil and gas, press , | Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Electric,