UK new car market dips -1.3% to 84,575 units in August

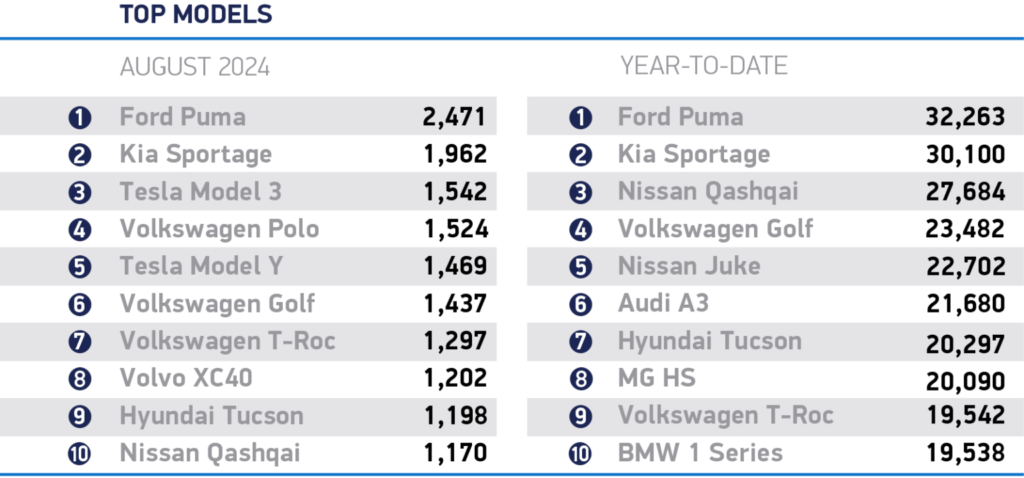

The UK new car market remained stable in August, down just -1.3%, according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT). In what is traditionally one of the quietest months of the year for new car sales, with many buyers preferring to wait until September’s new number plate, 84,575 units were registered, just 1,082 fewer than in the same month last year.

Continuing the recent trend, fleet purchases drove the market, accounting for six in 10 cars registered last month, or 51,329 units, despite a -1.2% drop compared with the same month last year, Registrations by private buyers, meanwhile, were flat, up 0.2% units to 32,110. Business registrations were down by -30.3% to 1,136 units.

Petrol and diesel uptake fell by -10.1% and -7.3% respectively, but together these fuel types still represented more than half (56.8%) of all new car uptake in August. Plug-in hybrid (PHEV) registrations declined -12.3%, with a 6.8% share, but hybrid electric vehicle (HEV) uptake increased, by 36.1%, to take 13.8% of the market.

Battery electric vehicle (BEV) registrations, meanwhile, rose 10.8% thanks to heavy discounting by manufacturers over the summer and a raft of new models attracting buyers. Market share in August reached 22.6%, the highest for a month since December 2022, when BEVs commanded 32.9% of all new cars reaching the road.1

Year to date, BEV market share has edged up to 17.2% and is expected to rise further to 18.5% by the end of the year thanks to increasing model choice – with some 364,000 BEVs registrations forecast for the year.2 Despite this growth, this will still be shy of the 22% required by the Zero Emission Vehicle Mandate.

Ahead of the Autumn Budget due on 30 October, the industry is calling for urgent action to bolster the market for new EVs, including binding targets on public chargepoint provision commensurate with those placed on industry, the reintroduction of incentives for private buyers and removal of disincentives, including the Vehicle Excise Duty expensive car supplement, set to be introduced in 2025.

Information Source: Read More

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,