Energy / Automotive News As Reported to 24 Feb 2023

Nigerian supplies have fallen in February, for the second consecutive month, with loadings down m-o-m 170kbd from the December peak of 1.6mbd.

Angolan loadings, at 1.1mbd so far in February are marginally lower m-o-m. There is a notable absence of flows to India – the nation is second only to China in historical imports of Angolan crude but is likely seeing more value importing long-haul Russian crude Read More

Swedish brand Mo’cycle has developed a world-first pair of jeans that inflate within seconds of a fall in order to provide protection for the lower body in case of an accident. They consist of a replaceable CO2 cartridge that releases the gas when the rider starts to fall from their bike. “’The jeans are just as comfortable as any other pants, and are made with water repellent, breathable and abrasion resistant fabric,” Mo’cycle states on its website. Read More

Nikola Corporation and energy supply and infrastructure solutions, E.ON and Richter Group, announced a Letter of Intent for an initial order of 20 Class 8, heavy-duty Nikola Tre hydrogen electric vehicles and the hydrogen needed to supply them. Richter Group is a leading provider of individual logistics services comprising hub and direct transport solutions for courier, express and parcel clients. Located in Germany, it currently owns a fleet of over 160 diesel-powered trucks with loading and unloading points in the Netherlands, Belgium, France and the United Kingdom. Nikola and E.ON intend to help Richter Group decarbonize its vehicle fleet by providing hydrogen electric trucks, the required green hydrogen, and the refuelling infrastructure through the previously announced joint venture that is to be established in the upcoming weeks. The initial order of 20 Nikola Tre hydrogen electric trucks are expected to be delivered to Richter Group in 2024. Richter Group intends to transition their entire fleet to Nikola Tre hydrogen electric trucks over the next four to five years. Richter Group also plans to work with their logistics partners to transition fleets to Nikola’s zero-emission vehicles, which could equate to an additional 750 hydrogen electric trucks within that same timeframe. Read More

Nikola Corporation (Nasdaq: NKLA), announced its HYLA brand‘s fourth California hydrogen station location, building on its planned station network to advance and scale its long-term hydrogen distribution solutions to service market demand. Nikola’s integrated energy and zero-emissions truck portfolio will be underpinned by developing hydrogen supply and refueling infrastructure, an essential step in helping to decarbonize the heavy-duty transport sector.

The latest California refueling station and logistics infrastructure location will be in the city of West Sacramento. This station will further support Nikola’s truck demand, as well as third-party heavy-duty hydrogen electric vehicles. By the end of 2026, it is anticipated that Nikola, via its HYLA brand, will have 60 stations in place to support this growth.

California is a launch market for Nikola with the Class 8 Nikola Tre battery-electric vehicle, Nikola Tre hydrogen electric vehicle and the energy infrastructure underway to support key customers and advance the state’s efforts to decarbonize the transport sector. Read More

DESERT MOUNTAIN ENERGY CORP. announced that it has signed a letter of agreement to purchase raw or crude helium gas from PetroSun, subject to approval by the Company and available processing capacity at the anticipated date of delivery. The agreement calls for pricing to be set based on market pricing conditions at the time of purchase and the gaseous chemical composition of the raw or partially processed gas. This agreement does not call for nor shall it be interpreted as a dedication of helium percentages or volumes from any PetroSun well(s) to any specific current or future Desert Mountain Energy processing facility. The Company has agreed to consider opportunities to explore for hydrogen on PetroSun leaseholds.

The Company has further agreed to cooperate and assist PetroSun with future exploration for both helium and hydrogen, where feasible for seismic testing and other geophysics, in order to lower overall costs. The Company feels that when applicable, it will assist in securing rig availabilities, and trucking, coupled with other testing and operational aspects. Read More

Clean Energy Holdings signs Translucent Energy to its Renewable Energy and Technology Alliance linking Liquid Green Hydrogen with leading Solar Technologies Clean Energy Holdings and Translucent Energy LogosTranslucent Energy has been chosen to join the Clean Energy Holdings (CEH) Green Hydrogen and Technology Alliance for its strong expertise in management and leadership in renewable energy, i.e., solar development and technology, the development of facilities to be able to manufacture in the United States and from US government approved global supply chain locations or entities. Additionally Translucent Energy has an ability to lead a marketplace and brings a track record of delivering on contract. The Translucent Energy team’s knowledge and experience, history of leading-edge projects, and track record in advancing technology in large scale renewable production facilities are key components for the Alliance. A core value and focus of the Alliance is Green Hydrogen mobility and aerospace delivery, with leading edge efficiencies to our customers. The Bair Energy (BE) basis for design, allows projects to be behind the meter (BTM), or inside the battery limits (ISBL), and participate in the design and deployment of the early stage Electrolyzer, large scale projects. Additionally, the Alliance recognizes the significant responsibility to provide long-lasting (20+ year projects and vision), cost-effective, turnkey solutions, that ensure energy transformation has a basis for design that leads for generations in energy safety, security, reliability, availability, delivery and in environmental stewardship. Read More

FPT Industrial returns in its dual role of diamond premier sponsor and exhibitor at POWERGEN International in Orlando (Florida, USA), the largest networking and business event for electrical generators and solutions providers engaged in power generation. From February 21 to 23, FPT Industrial’s booth # 2404 at the Orange County Convention Center will be displaying an even more complete range 3-to-13-liter engines for Power Generation applications meeting various international emission standards – Tier 3 through Stage V –offering high performance along with flexibility, reliability, and the lowest cost of ownership, with compact engine layouts. In extreme weather events, FPT Industrial guarantees a reliable and efficient source of power. The engines on display will include the F34 40kW Tier 4 Final, F34 75kW Tier 4 Final, F36 Tier 4 Final/Stage V, NEF45 Mechanical GDrive Tier 3, NEF67 Stage V/Tier 4 Final and C9 Stage V. A dedicated customer service area, featuring the MyFPT app for real time engine diagnostics, will complete the stand.dedicated to the production of electric axles for both light and heavy commercial vehicles, and electric central drives, and to the assembly of battery packs. The new ePowertrain Plant represents the embodiment of a consolidated brand strategy which aims to fully offset the environmental impact not only of its products but also of all its industrial activities. Read More

UK100 responds as House of Lords Environment and Climate Change Committee slams “failing” Boiler Upgrade Scheme.

Responding to the House of Lords Environment and Climate Change Committee letter to the Government warning that the Boiler Upgrade Scheme (BUS) is failing to deliver, UK100 is highlighting that local leaders are the key to rescuing the scheme.

The letter from Baroness Parminter, Chair of the Environment and Climate Change Committee sent to Lord Callan on Wednesday, 22 February, Parliamentary Under Secretary of State at the Department for Energy Security and Net Zero, cites evidence from UK100 on the importance of local coordination and argues that local authorities could help increase BUS take-up.

Responding to the letter, UK100’s Interim Chief Executive, Jason Torrance, says:

“We’re pleased to see the House of Lords Environment and Climate Change Committee highlight the flaws with the current Boiler Upgrade Scheme and recognise that it is local authorities that are best placed to rescue the programme from failure.

“Low-carbon heating is essential for making our homes warmer, more liveable and cheaper to run. To turbo-boost take-up and have any chance of reaching the Government’s target of 600,000 heat pump installations by 2028, local authorities should lead on delivery. “A top-down, market-driven, individual consumer approach has proven insufficient. Instead, as the House of Lords Environment and Climate Change Committee argues, local leaders are well-positioned to work with local communities and coordinate low-carbon heat installations at scale — including on a street-by-street basis — while maximising the benefits of economies of scale. “Like the honourable members of the committee, UK100 is keen to hear the Government’s response to the question: ‘What consideration have you given — or will you give — to designing in an explicit role for local authorities within the BUS, and providing incentives for them to undertake this role?'” Read More

MailOnline readers reveal what it is really like to own an electric vehicle and why some of them will never go back. With over 680,000 battery-electric cars on UK roads – plus a further 455,000 plug-in hybrids – according to ZapMap, the demand is ever growing. Read More

Ecuador’s energy ministry issued a decree on Thursday declaring force majeure for its oil industry, a day after a bridge collapse forced the closure of crude and gas pipelines. State oil company Petroecuador and private pipeline operator OCP Ecuador suspended operations on their respective pipelines on Wednesday as a preventative measure after a nearby bridge in Napo province collapsed. Petroecuador said in a statement late on Thursday that it would gradually shut oil wells, estimating pumping would restart during the next seven days. Read More

Trinidad and Tobago next month expects to formally begin negotiations with Venezuela on a promising offshore natural gas project, the Caribbean nation’s energy minister said on Thursday Read More

Saipem’s Grip & Metal Seal Connector, a patented technology for subsea pipeline repair, has received the Statement of Qualified Technology for sour service applications from DNV, the global independent expert in assurance and risk management. The Grip & Metal Seal Connector has been developed by Sonsub, Saipem’s centre of excellence for underwater technologies, automation and digital solutions. It is a unique diver/diverless solution for pipeline repair interventions as well as for pipeline tie-ins at a water depth of up to 2,000 m. The technology has been specifically developed for clad/lined pipelines with highly corrosive fluids and can also be used on carbon steel pipes with corrosion allowance. Its key features, including permanent repair, restoration of the pipe’s full structural integrity, no internal diameter reduction, a lightweight design and the ability to manage pipelines with multiple wall thicknesses, are characteristics not available in any other commercial product on the market. Read More

NIO, the global premium smart electric vehicle company, announces its participation in the European Union’s Horizon Europe research and innovation program. NIO’s Power Products and Solutions in Europe, together with 26 partners, have successfully been awarded funding to further research and development of energy storage systems in e-mobility services. In addition, NIO is offering power grid services with its power swap stations to make energy systems more resilient, stable, and efficient. NIO will continue researching and developing innovative energy services and actively seeks partners to create a greener future.

Horizon Europe is the EU’s largest research and innovation initiative. From 2021 to 2027, the program invests a total of €95.5 billion in bringing together world-class research teams to collaborate and innovate with aims that include tackling climate change and achieving the UN’s Sustainable Development Goals. Read More

Nio 9866.HK plans to build its first battery plant to produce big cylindrical cells similar to those used by Tesla, two people familiar with the matter said, as the Chinese EV maker seeks to cut its reliance on CATL 300750.SZ for supplies. The plant underscores Nio’s ambition to ramp up its presence in the electric vehicle (EV) market at home and abroad. The Chinese company is also planning a factory in the neighbouring city of Chuzhou to make budget EVs to sell to Europe. The new battery plant will have an annual capacity to produce 40 gigawatt hours (GWh) of batteries, which can power about 400,000 units of long-range electric vehicles (EVs), the people said on condition of anonymity as the matter is private. It will be located next to its main manufacturing hub in Hefei city, in eastern China’s Anhui province, they said. Read More

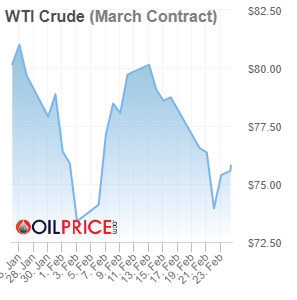

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $75.61 | Up |

| Crude Oil (Brent) | USD/bbl | $82.44 | Up |

| Bonny Light | USD/bbl | $82.25 | Up |

| Saharan Blend | USD/bbl | $82.16 | Up |

| Natural Gas | USD/MMBtu | $2.33 | Up |

| OPEC basket 23/02/23 | USD/bbl | $80.53 | Up |

Toyota Motor Corporation (TMC) honorary chairman Shoichiro Toyoda passed away on February 14 this year. A private funeral service was held with his closest relatives. We would like to express our deepest gratitude for the kindness and friendship extended to him during his lifetime.

A farewell gathering will be held as follows. We will inform those who have supported him of the time and other details when they are determined.

Date: Monday, April 24, 2023

Place: Hotel New Otani Tokyo, 4-1, Kioi-cho, Chiyoda-ku, Tokyo Read More

Tata Motors, India’s leading automobile manufacturer, today, announced the arrival of its new league of #DARK** products. Enhancing its successful SUV range even further, this new series comprises of a more upmarket rendition of India’s no. 1 SUV – the Nexon, the company’s premium SUV – the Harrier, and its flagship SUV – the Safari.

Extending the lineage of the iconic #DARK philosophy, these new products are enhanced with the most premium features seen yet, in the company’s passenger vehicles portfolio. With an adaptive User Interface boasting of a new look and feel, a desirable larger Infotainment Screen of 26.03 cm and 10 new ADAS features, the #DARK range promises to be the best companion for a progressive customer who wants to make a statement. Further complimenting the already established strong design, these SUVs exude dynamism through the newly added Carnelian Red highlights, giving its customers an exclusive feel of premium-ness combined with a bold look. Launched at an attractive price point (All-India, ex-showroom price), the new #DARK range meets the BS6 Phase II emission norms, featuring RDE and E20-compliant engines. Customers can now experience and book their favorite #DARK SUV from their nearest authorized Tata Motors dealership at a nominal amount of INR 30,000. Read More

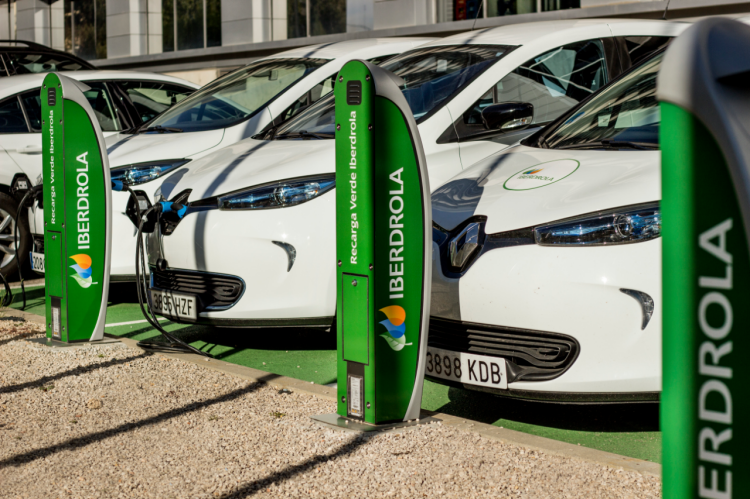

Record investments of €10.73 bn enable Iberdrola to achieve a net profit of €4.3 bn. The record investment figure has enabled the company to achieve an overall net profit of €4.339 bn, despite a 19% drop in net profit at Iberdrola España.Financial Highlights

Net Profit of €4.34 billion (+11.7%), driven by strong international performance (particularly in the United States and Brazil).

Record investments of €10.73 billion (+13%), with 90% allocated to networks and renewables.

EBITDA increased by 10% to €13.23 billion, thanks to geographic diversification, with the EU contributing 39%, the US 20%, the UK 15% and Latam 25%.

Operating Cash Flow reached €11.12 billion, up +25%.

Continued positive progression of financial ratios, with FFO / Adjusted Net Debt improving 240 basis points to 25.4% thanks to cash flow generation.

The Net Debt figure of €43.7 billion below the estimate of €45 billion presented at the Capital Markets Day in 2022.

Liquidity of €23.5 billion covering 26 months of financing needs with an average life of debt above 6 years.

Supplementary shareholder remuneration of €0.31/share to be proposed to the AGM, reaching a total dividend of €0.49/share. Read More

Baker Hughes Rig Count

Canada Rig Count is down 2 from last week to 248, with oil rigs up 2 to 163, gas rigs down 4 to 85.

U.S. Rig Count is down 1 from last week to 760 with oil rigs down 2 to 607, gas rigs up 1 to 151 and miscellaneous rigs unchanged at 2.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 17 February 2023 | 760 | -1 |

| Canada | 17 February 2023 | 248 | -2 |

| International | January 2023 | 901 | +1 |

Cheniere Energy Partners announced today that certain of its subsidiaries have initiated the pre-filing review process under the National Environmental Policy Act with the Federal Energy Regulatory Commission (“FERC”) for the proposed Sabine Pass Stage 5 Expansion Project (the “SPL Expansion Project”) adjacent to the existing Sabine Pass Liquefaction Project (the “SPL Project”). The SPL Expansion Project is being designed for total production capacity of approximately 20 million tonnes per annum (“mtpa”) of liquefied natural gas (“LNG”).

The SPL Expansion Project is being designed to include up to three large-scale liquefaction trains, each with a production capacity of approximately 6.5 mtpa of LNG, a boil-off-gas (“BOG”) re-liquefaction unit with an approximate production capacity of 0.75 mtpa of LNG, and two 220,000m3 LNG storage tanks. The SPL Expansion Project is being designed with accommodations for waste heat recovery as well as carbon capture from acid gas removal units. The SPL Expansion Project is expected to benefit from the significant existing infrastructure at the SPL Project and contemplates various enhancements to its current capabilities, including optimized ship loading at the existing marine facilities. Feed gas related to the SPL Expansion Project is expected to be transported via a combination of new and existing pipelines currently supplying the SPL Project. Read More

Cheniere Energy, Inc. (“Cheniere”) (NYSE American: LNG) today announced its financial results for the fourth quarter and full year 2022.During the three and twelve months ended December 31, 2022, Cheniere generated revenues of approximately $9.1 billion and $33.4 billion, respectively, net income1 of approximately $3.9 billion and $1.4 billion, respectively, Consolidated Adjusted EBITDA2 of approximately $3.1 billion and $11.6 billion, respectively, and Distributable Cash Flow2 of approximately $2.3 billion and $8.7 billion, respectively. Both Consolidated Adjusted EBITDA and Distributable Cash Flow totals for the twelve months ended December 31, 2022 are above the most recent guidance ranges for those metrics.

Introducing full year 2023 Consolidated Adjusted EBITDA2 guidance of $8.0 – $8.5 billion and full year 2023 Distributable Cash Flow2 guidance of $5.5 – $6.0 billion.

Pursuant to Cheniere’s comprehensive capital allocation plan, during the three months ended December 31, 2022, Cheniere prepaid approximately $2.2 billion of consolidated long-term indebtedness, repurchased an aggregate of approximately 4.4 million shares of common stock for over $700 million, and paid a quarterly dividend of $0.395 per share of common stock for the third quarter, representing a 20% increase quarter over quarter. During the twelve months ended December 31, 2022, Cheniere prepaid over $5.4 billion of consolidated long-term indebtedness, repurchased an aggregate of over 9.3 million shares of common stock for approximately $1.4 billion, and paid dividends in aggregate of $1.385 per share of common stock. In November 2022, Cheniere achieved its first investment grade issuer rating from S&P Global Ratings (“S&P”) as a result of an upgrade from BB+ to BBB with a stable outlook, and Cheniere Energy Partners, L.P. (“Cheniere Partners”) (NYSE American: CQP), Cheniere’s consolidated subsidiary, achieved its second investment grade issuer rating from S&P as a result of an upgrade from BB+ to BBB with a stable outlook. In January 2023, Cheniere achieved its second investment grade issuer rating from Fitch Ratings of BBB- with a stable outlook. In 2022, Cheniere’s subsidiaries signed new long-term contracts representing an aggregate of over 180 million tonnes of liquefied natural gas (“LNG”) through 2050 with creditworthy counterparties in the form of free-on-board and delivered ex-ship LNG sale and purchase agreements, as well as Integrated Production Marketing (“IPM”) gas supply agreements. Read More

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, energy monitors,