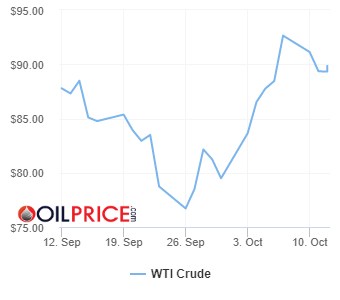

Energy News to 12/10/22. OPEC daily basket price stood at $96.03/bl, 11 Oct. 2022

Russian crude exports fell to a 12-month low in September, according to tanker tracking data. European buyers reduced their purchases of Moscow’s oil ahead ofmore sanctions on russia. Turkey, China and India are currently the largest buyer of Russia’s oil.

Russian crude exports averaged 2.99 million b/d in the month, down 290,000 b/d on the August levels according to S&P Global Commodities at Sea. Russian flows to the Netherland were cut by more than half on the month to 165,000 b/d in September, down from 390,000 b/d in August and from pre-war levels of about 525,000 b/d.

XPeng Inc., a leading Chinese smart electric vehicle (“Smart EV”) company, announced that it received an MSCI ESG rating of AA for the year 2022. Obtained on September 27, 2022, it is the Company’s third consecutive annual AA rating by MSCI ESG Research, ranking top among carmakers worldwide for ESG performance.

In addition, on September 23, XPENG received an industry-leading ESG score of 49 from the Dow Jones Sustainability Index (DJSI), representing a 48% increase from 2021 and a leading score among Chinese automakers.

“These latest ESG ratings from the world’s leading indexes represent a powerful commendation of the Company’s commitment to sustainability and best ESG practices,” said He Xiaopeng, Chairman and CEO of XPENG. Read More

XPeng recorded monthly deliveries in September of 8,468 Smart EVs, consisting of 4,634 P7s, the Company’s smart sports sedan, 2,417 P5 smart family sedans and 1,233 G3i smart compact SUVs. September deliveries also included 184 G9 Flagship SUVs, the Company’s fourth production model launched on September 21. G9 mass deliveries are on schedule to begin in late October. Total deliveries in the third quarter 2022 reached 29,570, representing a 15% increase year-over-year. As of September 30, 2022, year-to-date deliveries were 98,553, representing a 75% increase year-over-year and surpassing total deliveries in 2021.

In September, the Company reached a key milestone in its proprietary technology by rolling out City NGP (Navigation Guided Pilot), China’s most advanced ADAS for urban driving, in a Guangzhou-based pilot program. It also launched the first batch of 480 kW S4 supercharging stations in five Chinese cities, including Beijing, Shanghai, Shenzhen, Guangzhou and Wuhan. XPeng is rapidly expanding its nationwide fast charging network and aims to bring over 50 S4 supercharging stations into operation by the end of this year. Read More

As part of its plan to strengthen and diversify gas supplies to Italy, Eni has begun providing additional volumes of liquefied natural gas to the regasification terminal of Panigaglia (La Spezia) ahead of the 2022-2023 winter.

The first cargo was delivered on Sunday with supplies coming from Angola, reloaded on smaller ships at Spanish terminals for them to be compatible with the terminal in Liguria. Further LNG deliveries from Egypt and Algeria are also expected in October.

The overall contribution of additional LNG volumes to Italy, thanks to the availability of regassification terminals currently under development, will exceed 2 billion cubic meters between 2022 and 2023. It will progressively reach 7 billion cubic meters between 2023 and 2024, and will exceed 9 billion cubic meters between 2024-2025, in addition to further supplies to be delivered via pipeline. Read More

The first cargo of vegetable oil for biorefining produced by Eni in Kenya has left the port of Mombasa, on its way to Gela’s biorefinery. This marks the start of the transport and logistic system that will support the value chain in the country, starting with a production of 2,500 tons by the end of 2022 to scale up rapidly to 20,000 tons in 2023.

The vegetable oil is produced in the Makueni agri-hub, the pressing plant opened by the company in July 2022 and that actually processes castor, croton and cotton seeds. These are agri-feedstock, which are not in competition with the food chain, cultivated in degraded area, harvested from spontaneous trees or resulting from the valorization of agricultural by-products, providing income opportunities and market access to thousands of farmers. The centre also manufactures feed and bio-fertilisers from the protein component of seeds, benefiting the livestock production and thus contributing to the food security.

“Just three months after the start-up of the Makueni agri-hub, we are launching the export of the vegetable oil for the biorefineries, through a vertical integration model that enables the promotion of sustainable local development while valorizing the supply chain for biofuels production. These are the seeds of a new energy, a concrete step to decarbonize transport with an innovative approach that starting from the production in Kenya will extend to Congo in the next year, aiming at involving gradually the other African countries and geographic areas where we are carrying out these projects”, said Claudio Descalzi, Eni’s Chief Executive Officer.

Eni Kenya, its supply chain and all agri-feedstock developed are certified according to the ISCC-EU (International Sustainability and Carbon Certification) sustainability scheme, one of the main voluntary standards recognised by the European Commission for the certification of biofuels (RED II). Eni was the first company in the world to certify castor and croton and to enable an African cotton mill to achieve these assurance standards, offering new market opportunities to local farmers for this raw material.

Eni launched the project in Kenya in 2021, after the signing of the Memorandum of Understanding with the Kenyan institutions. The initiative foresees the construction of other agri-hubs, with the second one to be operational in 2023, and the production growth with the involvement of tens of thousands of farmers, contributing significantly to the country’s rural development and long-term value creation. In addition to vegetable oil, Eni also plans to export the Used Cooking Oil (UCO) collected from hotel chains, restaurants and bars in Nairobi, through a project already underway that promotes the culture of recycling, raising awareness of the environmental and health benefits that derive from the proper disposal of waste oil, and generating income from waste. Read More

Electric vehicle manufacturers globally are struggling to control costs amid supply chain disruptions and shortages of parts and raw materials

Lucid Group, which counts Saudi Arabia’s sovereign wealth fund, the Public Investment Fund, among its backers, plans to raise $8 billion through new offerings as the luxury electric vehicle maker looks to boost production.

Lucid aims to raise funds from mixed offerings and sell different types of securities “from time to time” with the size, price and terms to be determined at the time of sale, it said in a primary prospectus filed with the Securities and Exchange Commission in the US.

Lucid offerings may include selling “common stock, preferred stock, depository shares representing preferred stock, debt securities, warrants, purchase contracts or units in one or more offerings of up to $8bn in aggregate offering price”, the company said.

In addition, Lucid may issue up to 44.35 million common stocks, it said.

The company wants to boost its working capital amid supply constraints that have increased costs and crimped production. Read More

Israel and the United Arab Emirates on Tuesday penned a multi-billion dollar free trade agreement, the latest product of the two countries’ historic normalization deal in 2020 known as the Abraham Accords.

With a stated target of increasing annual bilateral trade to more than $10 billion over the next five years, the trade agreement is the largest ever between Israel and any Arab country. It covers 96% of the trade between the two Middle Eastern countries, which last year reached $885 million, according to Israel’s economy minister.

To illustrate the sheer speed and scope of trade between the UAE and Israel that’s taken place since the two established official relations in August of 2020, that bilateral figure is more than twice the volume of Israel’s trade with Egypt in 2021, which was $330 million — and Israel and Egypt have had a peace agreement in place since 1979.

Israel’s Minister of Economy and Industry Orna Barbivai and her counterpart, UAE Minister of Economy Abdulla bin Touq Al Marri, signed the deal in Dubai following months of negotiations.

The signing opened “a new chapter in the history of the Middle East,” Emirati Trade Minister Thani Al Zeyoudi wrote on Twitter. “Our agreement will accelerate growth, create jobs and lead to a new era of peace, stability, and prosperity across the region.” Read More

Microban International is thrilled to be attending K 2022, the world’s number one tradeshow for the plastics and rubber industry. The packed event is taking place from the 19th to 26th of October at Messe Düsseldorf in Germany, and will host more than 3,000 exhibitors from over 60 nations.

Microban will be showcasing its wide range of unique antimicrobial technologies for plastic and rubber materials, as well as launching two exciting next-generation products based on non-heavy-metal Read More

Jaguar Land Rover announced a global upskilling drive, in a bid to train 29,000 people in the next three years for its connected and data capabilities, and to support the rapid transition to electrification.

The company’s Future Skills Programme will see more than 10,000 Jaguar Land Rover and franchised retailer employees in the UK, and nearly 19,000 across the rest of the world trained in skills vital to electrification, digital and autonomous cars. This underlines the company’s commitment to developing its future engineering and manufacturing skills and supports the delivery of Jaguar Land Rover’s net zero targets.The Future Skills Programme is key to the success of Jaguar Land Rover’s Reimagine strategy, which will see all Jaguar and Land Rover modern luxury cars available in pure electric form by the end of the decade.

Currently around 80 per cent of nearly 1,300 franchised Jaguar Land Rover retailers around the world offer electric vehicle servicing, so to tackle the skills gaps, the company is ensuring the majority of servicing technicians will receive electrification training this year. Read More

Jaguar Land Rover reported increasing retail and wholesale volumes for the second quarter of FY23 (three-month period to 30 September 2022).

Retail sales for the quarter were 88,121 vehicles, an increase of 9,296 compared with the previous quarter ending 30 June 2022. Compared to the first quarter, retail sales were higher in China (+38%), North America (+27%) and Overseas (+14%) but were lower in UK (-7%) and Europe (-10%).

Wholesale volumes were 75,307 units in the period (excluding our China Joint Venture), up 4% compared to the previous quarter ending 30 June 2022. This improvement was lower than planned, primarily due to a lower than expected supply of specialised chips from one supplier which could not be readily re-sourced in the quarter. This was mitigated partially by further prioritisation of production to the highest margin products, while new agreements with semiconductor suppliers are expected to enable sales improvements in the second half of the fiscal year.

The production ramp up of New Range Rover and New Range Rover Sport improved with 13,537 units wholesaled in the quarter, up from 5,790 in Q1. This is expected to continue improve in the Second Half.

The Company continues to see strong demand for its products, with global retail orders again setting new records in the quarter. As at 30 September 2022, the total order book has grown to 205,000 units, up around 5,000 orders from 30 June 2022. Demand for the New Range Rover, New Range Rover Sport and Defender remain strong, accounting for over 145,000 of the 205,000 orders. Read More

Disclosure of Shareholdings by Close Associate of Primary Insiders

Oslo, 11 October 2022 – Reference is made to the stock exchange announcement made earlier today by RAK Petroleum plc (“RAK Petroleum”) on the ticker “RAKP” regarding completion of RAK Petroleum’s plan to transfer its interest in Mondoil Enterprises LLC to DNO ASA in exchange for 78,943,763 new DNO shares (the “Transfer”), following which RAK Petroleum will distribute all its DNO shares and USD 20 million in cash to its shareholders through a UK court-approved capital repayment (the “Capital Repayment”).

The completion of the Transfer and the Capital Repayment trigger several obligations to disclose shareholdings by Persons Discharging Managerial Responsibilities (“PDMRs”) in DNO and Close Associates of such persons. Both Bijan Mossavar-Rahmani, Executive Chairman of RAK Petroleum and Shelley Watson, Chief Operating Officer and Chief Financial Officer of RAK Petroleum, are PDMRs with regard to DNO in their capacity as Executive Chairman of the board of directors of DNO and board member of DNO, respectively. RAK Petroleum is considered a Close Associate of these individuals due to their roles in this company.

RAK Petroleum has subscribed for 78,943,763 new DNO shares as consideration for the Transfer (the “Consideration Shares”). Following the Transfer, RAK Petroleum will hold 517,323,181 shares in DNO, corresponding to 49.06 percent of the issued and outstanding shares of DNO.

Pursuant to the Capital Repayment, RAK Petroleum will distribute all the DNO shares to its shareholders. As a result, RAK Petroleum’s shareholding in DNO will cross below several thresholds for disclosure of large shareholdings, including the 5 percent threshold, and RAK Petroleum will following the Capital Repayment hold no shares in DNO. Read More–>

DNO ASA, the Norwegian oil and gas operator, today announced the completion of the transaction agreement entered between DNO and RAK Petroleum plc (“RAK Petroleum”) by which the Company will acquire Mondoil Enterprises LLC and its 33.33 percent indirect interest in privately-held Foxtrot International LDC, whose principal assets are operated stakes in offshore production of gas and associated liquids in Côte d’Ivoire.

Pursuant to the approval given by DNO’s Extraordinary General Meeting of 13 September 2022, the Company will issue 78,943,763 new shares to RAK Petroleum, its largest shareholder, as consideration for the transfer between the companies. RAK Petroleum will distribute by way of a capital repayment the entirety of its DNO shareholding to its shareholders, which include DNO (5.1 percent). Prior to the issuance of the consideration shares, RAK Petroleum holds 438,379,418 shares in DNO, representing 44.94 percent of shares outstanding. The capital repayment is expected to take place on or about 19 October 2022. Following the distribution, DNO will have 26,269,183 own shares which will be retained as treasury shares. Read More

GM Defense, a subsidiary of General Motors, was selected by the Defense Innovation Unit (DIU) to develop a battery pack prototype for testing and analysis on Department of Defense platforms. GM Defense will leverage GM’s most advanced battery technology, the Ultium Platform, as it works to meet DIU’s requirement for a scalable design that can be used for tactical military vehicles. DIU is a Department of Defense organization that accelerates the adoption of commercial technology across the U.S. military, which aligns with GM Defense’s mission of leveraging GM’s advanced technologies for global defense and government customers.

“This award is a critical enabler for non-traditional defense businesses like GM Defense to deliver commercial technologies that support our customers’ transition to a more electric, autonomous and connected future,” said Steve duMont, president of GM Defense. “Commercial battery electric technologies continue to mature. GM Defense offers a unique advantage with our ability to leverage proven commercial capabilities and the billions in GM investments in electric vehicle and autonomous vehicle technologies in order to help provide our customers with the most advanced capabilities the commercial market can offer.”

GM’s Ultium Platform is a combined electric vehicle (EV) battery architecture and propulsion system that can deliver power, range, and scale beyond any previous GM hybrid or extended range EV technology. Modular and scalable, the Ultium Platform uses different chemistries and cell form factors, making it adaptable to changing needs and new technology insertions as they become available. Read More

General Motors is returning to the fast lane of electrification with a new record plug-in electric vehicle sales results in the US during the third quarter of 2022.

After the history of EV1, a fresh start with the Chevrolet Volt in December 2010, multiple years of struggling and hitting the rock bottom in Q4 2021 (only 26 BEV deliveries), GM is finally back in the game.

In Q3 2022, GM’s brands (Cadillac, Chevrolet and GMC) delivered a total of 15,156 all-electric vehicles in the US, which is 236% more than a year ago and a new quarterly record. That’s also 2.7% of the company’s total volume.

GM BEV sales in Q3 2022:

Cadillac: 36 (new)

Chevrolet: 14,709 (up 226% year-over-year)

GMC: 411 (new)

Total: 15,156 (up 236%) and 2.7% share of GM’s volume

- excluding an undisclosed number of BrightDrop all-electric vans

For reference, the total volume was 555,580 (up 24.3%) in Q3 and 1,650,827 (down 7.1%) year-to-date. Read More

Chevrolet’s blitz of electric vehicle rollouts continues with a third introduction: the all-new 2024 Equinox EV — an affordable all-electric SUV tailored to help modern families make a seamless, confident and uncompromising transition to an EV.

“We are at a turning point where EVs will be the mainstream choice for the next generation of customers and Equinox EV will lead this charge for us,” said Mary Barra, Chair and CEO of General Motors. “With the flexibility of GM’s Ultium Platform, we are bringing to market vehicles at nearly every price point and for every purpose.”

With a starting price of around $30,0001 on the 1LT, the Equinox EV plugs Chevrolet into the critical compact SUV segment and is expected to be the most affordable EV in its class11. It rounds out an electrified portfolio that covers major segments, including full-size trucks (Silverado EV), midsize SUVs (Blazer EV) and compact SUVs (Bolt EV and Bolt EUV). Plus, it will also be available with up to an available GM-estimated 300 miles of range on a full charge2.

“Chevrolet is now positioned to offer a wide array of EVs,” said Scott Bell, vice president of Chevrolet. “We know truck and SUV customers better than anyone and we’ve channeled that insight and experience into our new EVs.” Read More

Signalling its imminent exit from the market, Nissan’s Executive Committee has today approved the sale of its Russian operations to NAMI, the Central Research and Development Automobile and Engine Institute.

The sale will transfer all Nissan operations in Russia under the Nissan Manufacturing Russia LLC (NMGR) legal entity to NAMI for future passenger vehicle projects. This covers Nissan’s manufacturing and R&D facilities in St. Petersburg, and Sales & Marketing centre in Moscow, which will operate under a new name.

Today’s announcement follows the suspension from March of operations in the market. Under the new ownership of the NMGR entity, all of Nissan’s employees in the market will receive employment protection of 12 months. The sale is expected to be formalised in the coming weeks following approvals from the relevant authorities. The terms of the sale would allow Nissan the option to buy back the entity and its operations within the next six years.

Nissan will take a one-off impact of approximately 100 billion yen from this exit. However, Nissan will maintain its full-year guidance. Details will be reported after further assessment as part of the regular disclosure during the second quarter results in November 2022.

“On behalf of Nissan, I thank our Russian colleagues for their contribution to the business over many years. While we cannot continue operating in the market, we have found the best possible solution to support our people,” said Nissan President and CEO Makoto Uchida. Read More

Renault Group and Nissan Motor Co., Ltd. are currently engaged in trustful discussions around several initiatives as part of continued efforts to reinforce the cooperation and the future of the Alliance.

The discussions include:

An agreement on a set of strategic common initiatives across markets, products, and technologies.

Nissan’s consideration to invest in the new Renault EV entity which will support Renault’s Renaulution strategy and will be one of the strategic steps towards Nissan Ambition 2030.

The companies continue to drive structural improvements to ensure sustainable Alliance operations and governance. Read More

Renewable energy met all of Greece’s electricity needs for the first time ever last week, the country’s independent power transmission operator IPTO announced.

For at least five hours on Friday, renewables accounted for 100 per cent of Greece’s power generation, reaching a record high of 3,106 megawatt hours.

Solar, wind and hydro represented 46 per cent of the nation’s power mix in the eight months to August this year, up from 42 per cent in the same period in 2021, according to Greece-based environmental think-tank The Green Tank. Read More

The euro area’s economy is now expected to grow by just 0.5% in 2023 as factors including the war in Ukraine, record inflation and the continued impact of the COVID-19 pandemic weigh on the outlook, the International Monetary Fund said on Tuesday.

The 19-country eurozone — which will grow to 20 members from 1 January 2023 with the adoption of the single currency by Croatia — is now projected to post the slowest growth of any region worldwide next year after the IMF cut its forecast by 0.7 percentage points from its previous outlook delivered just three months ago.

Germany, the European Union’s economic powerhouse, is now expected to post negative annual growth (-0.3%) as is Italy (-0.2%). The outlook for France and Spain remains positive although lower than the July forecast with annual GDP now seen at 0.7% and 1.2% respectively. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $89.30 | Down |

| Crude Oil (Brent) | USD/bbl | $94.37 | Down |

| Bonny Light | USD/bbl | $95.58 | Down |

| Saharan Blend | USD/bbl | $95.88 | Down |

| Natural Gas | USD/MMBtu | $6.62 | Down |

| OPEC basket 11/10/22 | USD/bbl | $96.03 | Down |

Standard Chartered says it no longer expects next year’s global oil demand to surpass the all-time highs of 2019 and has downgraded its demand growth forecast along with its U.S. GDP forecast.

In the aftermath of the OPEC+ decision to cut output by 2 million barrels per day in November, Standard Chartered has revised its oil market balances, forecasting 2023 oil demand growth at 1.26 million barrels per day, which represents a reduction of 900,000 bpd from the beginning of this year.

Standard Chartered’s model “implies” that global oil demand will fall 0.2 mb/d short. Read More

In the latest edition of its World Economic Outlook, the IMF said that global economic growth will slow from 6 percent in 2021 to 3.2 percent this year, while inflation rises from 4.7 percent to 8.8 percent this year.

As a result, “Risks to the outlook remain unusually large and to the downside. Monetary policy could miscalculate the right stance to reduce inflation. Policy paths in the largest economies could continue to diverge, leading to further US dollar appreciation and cross-border tensions. More energy and food price shocks might cause inflation to persist for longer,” the Fund said.

Central banks’ approach to handling inflation appears to be of particular concern to the International Monetary Fund, with the report suggesting that the “soft landing” promoted so actively by Fed chairman Jerome Powell and other senior officials might not, in fact, materialize. The threat of a recession in the world’s wealthiest economies is a very real one, according to the Fund, with emerging nations suffering a debt crisis as a result of these economic developments. Read More

Following discussions today with a number of trade union organizations wishing for a peaceful social dialogue to end the crisis affecting our customers, TotalEnergies invites a meeting for consultations and exchanges, tomorrow after – noon, the representative unions at the limits of the Common Social Base and which do not participate in the current strike movement. If the CGT lifts all site blockages before noon tomorrow, it will be welcome at this dialogue meeting. Read More

During the period from October 3 to October 7, 2022, Eni acquired n. 13,255,779 shares, at a weighted average price per share equal to 11.5736 euro, for a total consideration of 153,417,330.55 euro within the authorization to purchase treasury shares approved at Eni’s Shareholders’ Meeting on 11 May 2022, previously subject to disclosure pursuant to art. 144-bis of Consob Regulation 11971/1999.

On the basis of the information provided by the intermediary appointed to make the purchases, the following are details of transactions for the purchase of treasury shares on the Euronext Milan on a daily basis: Read More

Neptune Energy today announced approval from the State Mining Authority for Rhineland-Palatinate to raise the production limit at its operated Römerberg oil field in the Rhine Valley, south-western Germany, enabling Neptune to increase oil production by up to three times the current limit of 3,700 barrels of oil equivalent per day (boepd).

Neptune will continue working with its licence partner to progress plans for new wells and surface facility upgrades.

The decision comes at a crucial time for Germany’s domestic energy security, and supports Neptune Energy’s investment strategy for the Römerberg field and its wider German business portfolio. Partners: Neptune Energy (operator and 50%), Palatina GeoCon (licence owner, 50%) Read More

Africa Oil Corp. announce the appointment of Mr. Craig Knight as Chief Operations Officer (“COO”) of the Company effective October 11, 2022, in replacement of Mr. Timothy Thomas who retired from the Company in 2021 and became a consultant to the Company.

Mr. Craig Knight joined Africa Oil in August 2021 and brings with him over 16 years of industry experience. He graduated from the University of New South Wales with a Bachelor of Petroleum Engineering and joined Woodside Energy’s graduate Petroleum Engineering program. Mr. Knight moved to Denmark to join Maersk Oil in 2011 where he held various roles across petroleum, production and completions engineering, as well as in exploration and subsurface leadership. In 2017, Mr. Knight moved to Aberdeen with Maersk Oil, where his roles included Subsurface leadership and Non-Op Asset Management. From 2018 to 2021, Mr. Knight was Production Director for Spirit Energy where he was responsible for Production Management, Hydrocarbon Accounting and developing Spirit’s carbon emissions reporting processes. Read More

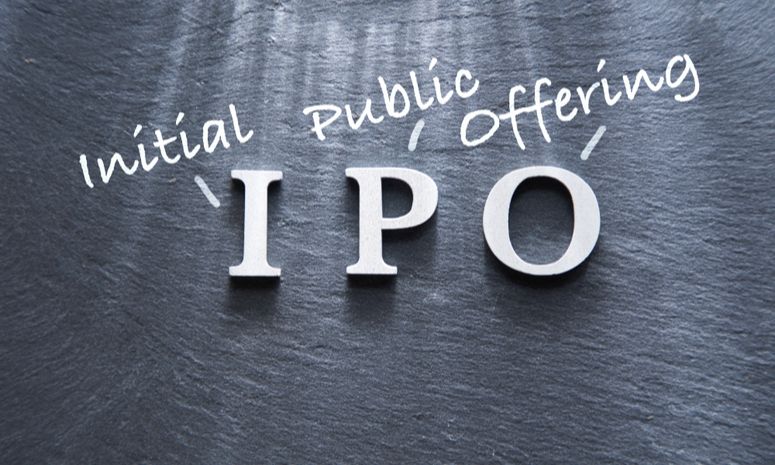

Saudi Arabia’s oil and gas drilling contractor Arabian Drilling Co. (ADC), has set the final price for its IPO at 100 riyals ($26.6) a share.

The final price is at the top end of a price range announced last month, which would value it at 8.9 billion riyals.

The book-building process generated an order book of SAR 162 billion ($43 billion) and was subscribed 61 times underscoring a strong investor appetite.

The IPO is for retail investors from October 18 – 19, according to HSBC Saudi Arabia, an advisor to the offering. Read More

South Africa is seeking investments from Saudi Arabia to overcome domestic energy challenges, Minister of Trade and Industry Ebrahim Patel recently told SABC News.

The government believes there are enormous opportunities on the energy front to do deals with Saudi Arabia, he said.

The minister said that Saudi Arabia has been investing in renewable energy as a significant part of moving away from an oil-based economy, adding that some Saudi Arabian firms are already in discussions. Read More

Baker Hughes Rig Count

International Rig Count is up 19 rigs from last month to 879 with land rigs up 10 to 660, offshore rigs up 9 to 219.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 07 October 2022 | 762 | -3 |

| Canada | 07 October 2022 | 215 | +2 |

| International | September 2022 | 879 | +19 |

Wind farms will be blocked from boosting their profits on the back of the energy crisis as part of emergency measures to bring down household bills.

Ministers plan to introduce a cap on the amount of revenue wind farms and other renewable power projects can keep from electricity sales, as part of a string of measures to try and keep costs down.

The Government insists the temporary move, due to start in 2023, is not a “windfall tax” as it will be applied to “excess revenues” as opposed to profits. Read More

A team led by led by Issam Mudawar, Purdue University’s Betty Ruth and Milton B. Hollander Family Professor of Mechanical Engineering, has developed the Flow Boiling and Condensation Experiment (FBCE) to enable two-phase fluid flow and heat transfer experiments to be conducted in the long-duration microgravity environment on the International Space Station.

FBCE was tested and delivered to the Station in August 2021 and began providing microgravity flow boiling data in early 2022. Results from these FBCE experiments will enable the design of future space systems that require temperature control, but this technology also has applications on Earth—specifically, it could make owning an electric car more appealing.

Before electric cars can become widely used, certain challenges must be overcome. First, a network of charging stations must be deployed along highways and roads to enable charging of electric vehicles. Second, the time required to charge a vehicle must be reduced. Currently, charging times vary widely, from 20 minutes at a station alongside a roadway to hours using an at-home charging station. Lengthy charging times and charger location are both cited as major concerns of people who are considering electric vehicle ownership.

An electric vehicle charging system contains a charging cable ending with a plug that is inserted into the vehicle’s charging inlet. The electrical current supplied through the charging cable is delivered to the battery inside to the vehicle, which powers the vehicle’s electric motor. The passage of electrical current through any conductor results in a finite amount of heat generation, and the higher the current, the greater the heat generated. A charging station conductor typically consists of a bundle of wires and due to temperature limits, charging cables for conventional, 350-ampere, “fast charging” systems require sizable conductors, rendering the charging cable quite heavy and inconvenient for customers to maneuver. The cable weight is also increased by the large charging connector and liquid coolant passing through the cable to remove the heat. Read More

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, News and Analysis