Energy / Automotive News As Reported

(Oilandgaspress) : Worldwide Rig Count for May 2023 was 1,783, Up 155, from the 1,628 counted in May 2022

Catalytic Converter Anti-Theft Bills

The National Automobile Dealers Association, joined by 20 industry partners, sent a letter today to the leaders of the U.S. House and Senate Commerce Committees in support of H.R. 621/S. 154, a bipartisan bill to combat rising catalytic convertor theft. The “Preventing Auto Recycling Theft (PART) Act” addresses the growing national problem of catalytic converter thefts, which are costing businesses and vehicle owners millions of dollars annually.

America’s franchised car dealers commend Sens. Amy Klobuchar (D-Minn.), Mike Braun (R-Ind.), Ron Wyden (D-Ore.), and JD Vance (R-Ohio) for introducing the Senate bill and Reps. Jim Baird (R-Ind.), Betty McCollum (D-Minn.), Angie Craig (D-Minn.), Randy Feenstra (R-Iowa), and Michael Guest (R-Miss.) for reintroducing the House companion bill. Read More

Electrifying US federal fleet could save $6 billion

ICF experts used our proprietary fleet electrification modeling technology to project the costs, savings, and climate impact of electrifying the entire federal fleet. It turns out that replacing the gas-powered cars and trucks for all U.S. federal agencies would actually save money. In fact, it would save approximately $6 billion dollars when you consider the total cost of ownership over the lifetime of the vehicle. Read More

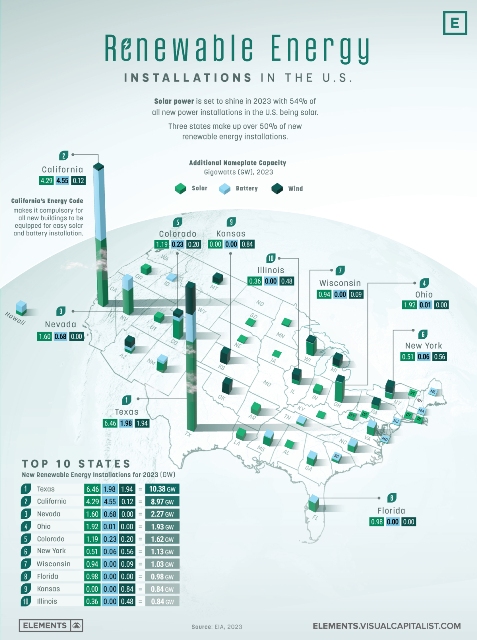

Texas and California Leading in Renewable Energy

Renewable energy, in particular solar power, is set to shine in 2023. This year, the U.S. plans to get over 80% of its new energy installations from sources like battery, solar, and wind.

Nearly every state in the U.S. has plans to produce new clean energy in 2023, but it’s not a surprise to see the two most populous states in the lead of the pack. Even though the majority of its power comes from natural gas, Texas currently leads the U.S. in planned renewable energy installations. The state also has plans to power nearly 900,000 homes using new wind energy.

California is second, which could be partially attributable to the passing of Title 24, an energy code that makes it compulsory for new buildings to have the equipment necessary to allow the easy installation of solar panels, battery storage, and EV charging.

New solar power in the U.S. isn’t just coming from places like Texas and California. In 2023, Ohio will add 1,917 MW of new nameplate solar capacity, with Nevada and Colorado not far behind. Read More

KBR Announces Agreements to Repurchase $100 Million Principal Amount of its $350 Million 2.50% Convertible Senior Notes

KBR (NYSE: KBR) announced today that it has entered into separate, privately negotiated agreements to repurchase $100 million principal amount of its outstanding $350 million, 2.50% Convertible Senior Notes due 2023 (the “Notes”) from certain holders of the Notes. In connection with the Note repurchases, KBR also entered into partial unwind agreements with Bank of America, N.A., BNP Paribas and Citibank, N.A. (collectively, the “Counterparties”) to terminate the corresponding portions of the convertible note hedge and warrant transactions KBR previously entered into with the Counterparties in connection with the issuance of the Notes. The transactions will result in a net outflow of roughly $188 million, subject to share price volatility as discussed below, and will contain the cost of this proportion of the ultimate Notes maturity in November 2023. Following the closing of the repurchases, $250 million in aggregate principal amount of Notes will remain outstanding, with terms unchanged.”Back in February, we made the commitment to resolve the maturity of the convertible notes with minimal dilution to our shareholders. With strong Q1 performance and an excellent balance sheet position, the early termination de-risks potentially higher costs of resolving the maturity later in the year as our performance momentum continues,” said Stuart Bradie, KBR president and CEO. “Being proactive and committed to improving our capital structure as we progress through 2023 opens the door for continued balanced capital deployment and shareholder value appreciation opportunities in the years ahead.”

The price that KBR pays for the repurchase of the Notes and the amount it receives on early termination of the hedge and warrant transactions will be based on the volume-weighted average price of KBR’s common stock during the agreed upon measurement periods. Based on the closing price of KBR’s common stock on June 1, 2023, the estimated net outlay for the transactions would be $188 million.

In addition, for the portion of the warrants that remain outstanding after the early termination, KBR has amended the warrant transaction agreements with each of the Counterparties to allow KBR to elect, at its option, cash settlement. Except as described herein, the portions of the convertible note hedge and warrant transactions not being terminated will remain outstanding and otherwise continue in accordance with their terms. This press release does not constitute an offer to purchase or sell or the solicitation of an offer to sell or purchase any security. Read More

Baker Hughes Rig Count:

The Worldwide Rig Count for May was 1,783, down 25 from the 1,808 counted in April 2023, and up 155, from the 1,628 counted in May 2022.

U.S. Rig Count is down 9 from last week to 711 with oil rigs down 5 to 570, gas rigs down 4 to 137 and miscellaneous rigs unchanged at 4.

Baker Hughes Rig Count: Canada is up 2 to 87 rigs.

Canada Rig Count is up 2 from last week to 87, with oil rigs up 3 to 42, gas rigs down 1 to 45.

International Rig Count is up 18 rigs from last month to 965 with land rigs up 9 to 729, offshore rigs up 9 to 236.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 26 May 2023 | 711 | -9 |

| Canada | 26 May 2023 | 87 | +2 |

| International | May 2023 | 965 | +18 |

CME Group Reports May 2023 Monthly Market Statistics

— CME Group, the world’s leading derivatives marketplace, today reported its May 2023 market statistics, showing average daily volume (ADV) increased 3% to 25 million contracts during the month, the highest May ADV in company history. Market statistics are available in greater detail at https://cmegroupinc.gcs-web.com/monthly-volume.

May 2023 ADV across asset classes includes:

• Interest Rate ADV of 13.9 million contracts

• Equity Index ADV of 6.0 million contracts

• Options ADV of 4.9 million contracts

• Energy ADV of 2.0 million contracts

• Agricultural ADV of 1.5 million contracts

• Foreign Exchange ADV of 825,000 contracts

• Metals ADV of 650,000 contracts

Additional May 2023 product highlights compared to May 2022 include:

• Interest Rate ADV increased 20%

• Record U.S. Treasury futures open interest of 17,856,235 contracts on May 23

• SOFR futures ADV increased 126% to 3.4 million contracts

• SOFR options ADV increased 935% to 1.8 million contracts

• 30 Day Fed Funds futures ADV increased 112% to 544,000 contracts

• Options ADV increased 29%

• Interest Rate options ADV increased to 50% to 2.9 million contracts

• Agricultural options ADV increased 24% to 342,000 contracts

• Energy options ADV increased 33% to 282,000 contracts

• Metals options ADV increased 39% to 85,000 contracts

• Energy ADV increased 12%

• Natural Gas options ADV increased 32% to 136,000 contracts

• Agricultural ADV increased 38%

• Record Soybean Oil options ADV of 22,633 contracts

• Soybean Oil futures ADV increased 78% to 150,000 contracts

• KC HRW Wheat futures ADV increased 108% to 68,000 contracts

• Metals ADV increased 30%

• Aluminum futures ADV increased 120% to 4,500 contracts

• Micro Products ADV

• Micro E-mini Equity Index futures and options ADV of 2.1 million contracts represented 34% of overall Equity Index ADV, Micro WTI Crude Oil futures accounted for 5.2% of overall Energy ADV, Micro Ether futures accounted for 0.2% of overall Equity Index ADV and Micro Bitcoin futures accounted for 0.2% of overall Equity Index ADV

• BrokerTec U.S. Repo average daily notional value (ADNV) increased 8% to $292B Read More

UAE is a leader in renewable energy competitive auctions – IEA

The UAE is a one of the leading countries when it comes to renewable energy competitive auctions, along with European countries, India, the USA, Korea and Brazil. The auctions, under which countries, through governments, businesses or power utilities, can procure clean power from providers who make bids, make up the largest source of policy-driven growth of renewables, according to the International Energy Agency (IEA).

Other sources of growth include market-driven growth, which accounts for 17% of the world’s utility solar and wind expansion through power purchase agreements (PPAs), which is led by the USA. The IEA’s Renewable Energy Market Update said renewable power growth is being led by solar photovoltaic (PV) power. Read More

Worldwide, governments have allocated USD 1.34 trillion to clean energy since 2020

The amount of money allocated by governments to support clean energy investment since 2020 has risen to USD 1.34 trillion, according to the latest update of the IEA’s Government Energy Spending Tracker. Around USD 130 billion of new spending was announced in the last six months – among the slowest periods for new allocations since the start of the Covid-19 pandemic.

This slowdown may be short-lived, however, as a number of additional policy packages are being considered in Australia, Brazil, Canada, the European Union and Japan. Already, government spending is playing a central role in the rapid growth of clean energy investment and expanding clean technology supply chains, and is set to drive both to set to drive both to new heights in the years ahead. Notably, direct incentives for manufacturers aimed at bolstering domestic manufacturing of clean energy technologies now total around USD 90 billion.

At the same time, governments continue to increase spending on managing the immediate energy price shocks for consumers. Since the start of the global energy crisis in early 2022, governments have allocated USD 900 billion to short-term consumer affordability measures in addition to pre-existing support programmes and subsidies. Around 30% of this affordability spending has been announced in the past six months.

These measures have had a major role in moderating price increases for end users, but the energy crisis nonetheless took a toll on many people’s budgets. According to the IEA’s latest data on end-user prices across 12 countries, which together represent nearly 60% of the global population, the average household spent a higher share of its income on energy in 2022 as energy prices outpaced nominal wage growth. On average, households in major economies spend between 3% and 7% of their incomes to heat and cool their homes, to power appliances and to cook – though shares are higher for low-income households. In most major economies, the share of income spent on energy moved up by less than 1% thanks to government interventions. Read More

BP joins Zhejiang Energy to truck more LNG in China

BP announced a joint venture contract with Zhejiang Energy Gas Group Co Ltd and its holding subsidiary on May 31 to jointly establish a marketing company and supply trucked liquefied natural gas (LNG) in China.

The joint venture will be BP’s third trucked LNG marketing and sales venture in China, following the two with JVs–Shenzhen Dapeng LNG Marketing Co Ltd and Xinying Energy Marketing Co Ltd,it said.

According to Federica Berra, BP’s senior vice-president for Integrated Gas and Power, the joint venture combines BP’s global and flexible LNG portfolio and Zhenergy Gas’ established position in this exciting and growing market.

“The joint venture represents our fourth milestone in building out an integrated gas value chain across China’s coastal line. Together, we are leveraging our strengths to better serve our Chinese customers’ strong and growing gas demand,” she said. Read More

Production Sharing contracts

Petrobras informs that it signed today the Production Sharing Contracts (PSC) of the 1st Cycle of the Permanent Offer Bidding Round, held through a public session on 12/16/2022, for the blocks of (i) Água Marinha, in partnership with TotalEnergies (30%), QatarEnergy (20%) and Petronas (20%), (ii) Norte de Brava, where Petrobras acquired the block in its entirety, and (iii) Sudoeste de Sagitário, a block that was acquired with a 60% stake in consortium with Shell (40%). The signing of these contracts reaffirms Petrobras’ focus on the exploration and production of profitable assets and strengthens the company’s profile as the main operator of oil fields located in deep and ultradeep waters, potentializing the recomposition of reserves for the future. Read More

Petrobras confirms meeting with Apollo fund and Adnoc

Petrobras, regarding the pieces of news released in the media, confirms that it met with executives from the Apollo fund and Adnoc, in which occasion it discussed Petrobras’ position in the Brazilian petrochemical sector, which is currently under analysis as part of the preparation of its Strategic Plan 2024-28.

The company reaffirms that it is not conducting any sale transaction structuring in the private market and that no decision has been made by the Executive Board or the Board of Directors in relation to the process of divesting or increasing its stake in Braskem.

In this sense, the company clarifies that decisions about investments and divestments are based on careful analyses and technical studies, in compliance with governance practices and the applicable internal procedures. Read More

Oil and Gas News Undiluted !!! �The squeaky wheel gets the oil�

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas,