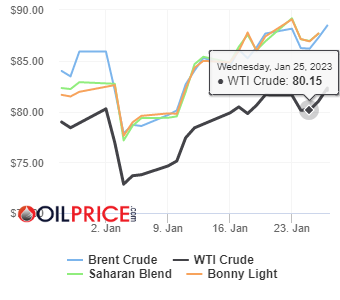

Energy News | January 27th, WTI Crude stood at $82.13/bl

Crude oil trades near unchanged on the month after spending most of that time recovering from an early January selloff. In the short-term resistance in the $90 area in Brent is likely to remain firm with recession risks offsetting an expected rebound in Chinese demand and supply concerns related to the February 5 introduction of an EU embargo on Russian seaborne sales of fuel products. We maintain a patient but bullish outlook for crude oil driven by strength in the product market.

Crude oil trades near unchanged on the month after spending most of that time recovering from an early January selloff that was driven by IMFs global recession warning. While that risk remains and, in some places, have strengthened, the market has managed to find support from an expected increase in Chinese demand and supply concerns related to the February 5 introduction of an EU of an embargo on Russian seaborne sales of fuel products.

Developments that together with a temporary disruption in the US following the late December winter storm, and low inventories of middle distillates such as diesel, have seen the bounce across the energy sector being led by the fuel sector where diesel and gasoline futures trade up between 2% and 5.3%.

Once the EU embargo on Russian seaborne fuel exports kicks in we are likely to see prices for gasoline and especially diesel remain supported by tightening supply. Russia may struggle to offload its diesel to other buyers with key customers in Asia being more interested in feeding their refineries with heavily discounted Russian crude, which can then be turned into fuel products selling at the prevailing global market price.

Supply of diesel to Europe from the US and the emerging refinery hub in the Middle East, may make up some of the missing barrels from Russia, but a shortfall seems likely, not least considering the prospect for a strong recovery in China leading to lower export quotas. In addition, the recovery in jet fuel demand will likely pressure diesel yields, thereby creating another layer of support for distillate cracks on either side of the Atlantic. Read More

ChatGPT, the most advanced AI language model to date, has captured the public’s attention since it was launched in November last year.Sam Altman, co-founder and CEO of Open AI, the company behind the popular new chatbot ChatGPT, says we should expect AI to transform the world in a way we haven’t seen since the iPhone revolution 15 years ago. Read More

AI will become more intelligent than us

Experts from Oxford University said when AI eventually becomes more intelligent than us it is likely to pose as great a threat as mankind did to the dodo, dailmail.co.uk reports.

Reaching this stage – known as superhuman AI – could be achieved by the end of the century, they told the Science and Technology Select Committee. Warning of a ‘literal arms race’ among nation states and tech firms, Michael Osborne, professor of machine learning, called for global regulation to stop tech firms creating out-of-control systems that could end up ‘eliminating the whole human race’. The evidence was heard as part of a Government inquiry into the risks posed by AI and how it can be used in an ethical and responsible way. Read More

Businesses will receive reduced support with their energy bills from April as the UK government attempts to cut the cost of compensating for soaring gas and electricity prices, the Treasury has confirmed. Under the new scheme, firms will get a discount on wholesale prices rather than costs being capped as under the current one. Heavy energy-using sectors, like glass, ceramics and steelmakers, will get a larger discount than others. But firms will only benefit from the scheme when energy bills are high. Read More

Evaluation and Establishment of CCS Value Chains in the Asia Pacific Region

Nippon Steel Corporation, Mitsubishi Corporation and ExxonMobil Asia Pacific Pte. Ltd. have signed a Memorandum of Understanding to jointly study carbon capture and storage (CCS) and the establishment of potential CCS value chains in the Asia Pacific regions on January 25, 2023.

Based on the Memorandum, the three companies will conduct research on the capture of CO2 emissions from Nippon Steel’s domestic steelworks and evaluate the necessary infrastructure development required, with a view to establishing CCS value chains in the Asia-Pacific region. It would also include a detailed evaluation of Asia Pacific storage opportunities, including in Malaysia, Indonesia and Australia. Mitsubishi Corporation plans to evaluate the overseas CO2 transportation and the development of CCS value chain. This is the first study to develop value chains for carbon capture in Japan with the aim to store elsewhere overseas in the region.

Nippon Steel set forth the “Nippon Steel Carbon Neutral Vision 2050” in its medium- to long-term management plan announced in March 2021 and positioned CCS as one of the key technologies to realize this vision. Through this study, Nippon Steel will progress the implementation of CCS including securing storage sites for overseas storage of CO2 generated from steel works, developing storage infrastructure, advocating for policies and regulation, and examining its cost adequacy. Read More

Mitsubishi Motors announced that the all-new eK X EV, an all-electric kei-car1, 2, has earned the Five Star Award, the highest rating, in the Vehicle Safety Performance 2022 car assessment by Japan New Car Assessment Program (JNCAP)3. Mitsubishi Motors remains committed to its safety-oriented philosophy of achieving a mobility society with zero traffic accidents through continued efforts to develop and spread safety technology, and to spread knowledge about traffic safety.In order to make it easier for buyers to choose cars with better safety while also promoting the development of safe vehicles by automakers, the Ministry of Land, Infrastructure, Transport and Tourism (MLIT) and the National Agency for Automotive Safety & Victims’ Aid (NASVA) perform various assessment tests each year for car safety performance mainly on high sales volume cars and publish the results. Only the cars that earn the highest evaluation (A rank) in both collision safety performance and preventive safety performance, and are equipped with an automatic accident emergency call system subsequently receive the Five Star Award, representing the highest assessment. Read More

UK commercial vehicle (CV) production grew 39.3% in 2022, with 101,600 vans, trucks, taxis, buses and coaches leaving factory lines, according to the latest figures published today by the Society of Motor Manufacturers and Traders (SMMT). Closing off the year, turbulence in global supply chains and logistics issues saw December post 2022’s first monthly decline, as output fell -23.6% to 4,710 units after 11 months of consecutive growth.

Nevertheless, the sector recorded its best annual output since 2012, up 29.8% on 2019’s pre-pandemic production figures – testament to the resilience of CV manufacturers in meeting demand despite global part and component shortages, logistics challenges, and economic and political disruption.1 Read More

U.S. commercial sector total energy consumption equaled 1.4 quadrillion British thermal units, a 2% increase from October 2021. The commercial sector accounted for 18% of total U.S. energy consumption. Electricity sales and associated electrical system energy losses accounted for 76% of U.S. commercial sector total energy consumption.

Natural gas accounted for 17% of U.S. commercial sector total energy consumption, petroleum for 5%, renewable energy for 2%, and coal for less than 1%. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $82.13 | Up |

| Crude Oil (Brent) | USD/bbl | $88.54 | Up |

| Bonny Light | USD/bbl | $87.69 | Up |

| Saharan Blend | USD/bbl | $87.67 | Up |

| Natural Gas | USD/MMBtu | $2.91 | Up |

| OPEC basket 25/01/23 | USD/bbl | $84.59 | — |

Dana Incorporated (NYSE: DAN) will release its 2022 fourth-quarter and full-year financial results on Tuesday, Feb. 21, 2023. A press release will be issued at approximately 7 a.m. EST, followed by a conference call and webcast at 9 a.m. EST. Members of the company’s senior management team will be available at that time to discuss the results and answer related questions Read More

Electric car revolution goes into reverse

The UK’s electric car charging infrastructure remains at crisis point with just 800 new devices being added per month, according to the latest official figures published by the Department for Transport.

It confirmed there were 37,055 public charging points in total on 1 January 2023, up from 34,637 devices at the start of October 2022.

This means that, on average, just 806 new chargers are being added to the public network per month – an installation rate that needs to increase to 3,130-a-month (a rise of 288%) if the Government is to meet its promised target of having 300,000 devices nationwide by 2030. Read More

Figures from the Department for Transport show that fewer than 9,000 public charging devices were installed in the past year — just a 31 per cent increase on the previous year. There are now 30 electric vehicles for every charge point, compared with 16 at the start of 2020, fuelling fears that infrastructure is failing to keep up with demand. Read More

Baker Hughes Rig Count

U.S. Rig Count 771 with oil rigs down 10 to 613, gas rigs up 6 to 156 and miscellaneous rigs unchanged at 2. Canada Rig Count 241, with oil rigs up 12 to 153, gas rigs up 2 to 88.

The majority of Britishvolt’s 300 staff have been made immediately redundant as the troubled electric car battery maker fell into administration.

The company, which had planned to build Britain’s biggest electric car battery plant in Northumberland, had been on the brink for months. Administrators at EY said Britishvolt collapsed ‘due to insufficient equity investment’ for both its ongoing research, and the development of its £3.8billion ‘gigafactory’ in the North East and its scale-up hub in the Midlands. Read More

Chevron Corporation (NYSE: CVX) today reported earnings of $6.4 billion ($3.33 per share – diluted) for fourth quarter 2022, compared with $5.1 billion ($2.63 per share – diluted) in fourth quarter 2021. Included in the current quarter were $1.1 billion of international upstream write-off and impairment charges, and pension settlement costs of $17 million. Foreign currency effects decreased earnings by $405 million. Adjusted earnings of $7.9 billion ($4.09 per share – diluted) in fourth quarter 2022 compared to adjusted earnings of $4.9 billion ($2.56 per share – diluted) in fourth quarter 2021.

Chevron reported full-year 2022 earnings of $35.5 billion ($18.28 per share – diluted), compared with $15.6 billion ($8.14 per share – diluted) in 2021. Adjusted earnings of $36.5 billion ($18.83 per share – diluted) in 2022 compared to adjusted earnings of $15.6 billion ($8.13 per share – diluted) in 2021. For a reconciliation of adjusted earnings, see Attachment 6. Sales and other operating revenues in fourth quarter 2022 were $55 billion, compared to $46 billion in the year-ago period. Read More

Shareholders’ Nomination Board, established by Neste Corporation’s Annual General Meeting (AGM) on 4 April 2013, has forwarded to the Board of Directors of the Company its proposals to the 2023 AGM.

Board Members The Nomination Board proposes that Matti Kähkönen shall be re-elected as the Chair of the Board of Directors. In addition, the current members of the Board, John Abbott, Nick Elmslie, Martina Flöel, Just Jansz, Jari Rosendal, Eeva Sipilä and Johanna Söderström are proposed to be re-elected for a further term of office. The Nomination Board proposes that Eeva Sipilä shall be elected as the Vice Chair of the Board.

Further, the Nomination Board proposes that the Board shall have ten members and that Heikki Malinen and Kimmo Viertola shall be elected as new members. All persons proposed for Board service have given their consent to serving on the Board and are considered to be independent of the Company and its major shareholders, with the exception of Director General Kimmo Viertola of the Ownership Steering Department in the Prime Minister’s Office of Finland, who is, based on his employment/service relationship, non-independent of the company’s significant shareholder (the State of Finland). Read More

TotalEnergies EP Canada Ltd announces that it has exercised its preemption right to acquire an additional 6.65% interest in the Fort Hills Energy Limited Partnership and associated sales and logistics agreements from Teck Resources Limited, for a consideration of 312 million Canadian Dollars.

Fort Hills is located 90 kilometers North of Fort McMurray in the Province of Alberta. Prior to the transaction, TotalEnergies EP Canada held a working interest of 24.58% in the Fort Hills project, and after the transaction it will hold 31.23%. TotalEnergies EP Canada also holds a 50% working interest in the Surmont project located in the region.

In line with its low-carbon strategy, TotalEnergies announced in September 2022 its intention to exit Canadian oil sands by spinning off TotalEnergies EP Canada in 2023. Through the acquisition of an additional interest in Fort Hills, TotalEnergies EP Canada is building the future for the spin-off entity in an asset with long-term growth potential. The spin-off is planned to be submitted to vote at TotalEnergies’ annual Shareholders’ Meeting in May 2023.

“By seizing this opportunity to grow its business under attractive conditions, TotalEnergies EP Canada will deliver value to the future shareholders of the spin-off entity”, said Jean-Pierre Sbraire, CFO of TotalEnergies. Read More

The Electrification of Everything

Indicators of the all-electric future surround us. California, the EU, and other governments will phase out the sale of gasoline-powered cars and trucks by 2035 and President Biden is planning to transition federal fleets to all-electric vehicles. Space exploration and research will become more common; robots will be used for personal and commercial use; the proliferation of artificial intelligence (AI) and mobile/wearable tech will continue to see exponential growth. Powered by consumer demand, technological advancements, government mandates, and environmental variables, it’s clear that the next ten years will see warp-speed growth into the electrification of everything era. Unfortunately li-ion battery chemistries using graphite anodes currently power all things electric and have reached the ceiling for their potential and no longer meet market expectations, requiring a deep rethink of li-ion chemistry.

To date, energy storage advancements have been incremental for li-ion, resulting in a potential performance that has topped out, approaching the practical limit of current state batteries. However, to meet the forecasted demand, as well as the realities of modern industry, incremental change doesn’t work anymore. We need to shift current li-ion chemestries toward energy storage technologies with better performance: lasting longer (high energy density), charging faster (eliminating charge anxiety), having a lower cost (ensuring widespread adoption), and achieving all of this today, not in five years (immediate scale with drop-in solutions).

While big advances have been made in lithium-ion battery technology, the “it” chemistry platform underlying nearly all things electric, the biggest hurdle to achieving the true goal persists—a transformational drop-in li-ion battery technology that helps bring EVs to cost parity with internal combustion engine cars and enables a new era of efficiency and power for all electronics. The electrification of everything “it” chemistry lies with silicon-based anodes, immediately turning today’s li-ion batteries into lithium-silicon batteries.Blink Charging and EdgeEnergy Collaborate on Delivering Ultra-Fast EV Charging Read More

As a means of storing and transporting renewable energy, green hydrogen is now considered a critical technology in the transition to renewable energy and the move toward a global net zero economy.There are numerous challenges to effecting such a monumental change in the energy sector, but one that requires a unique and digital response is tracking green hydrogen. Differentiating it from the other color grades — including blue, gray, and pink, which represent production methods with CO2e emissions or using nuclear power or fossil fuels — is critical to the success of decarbonization with green hydrogen. Read More

Chevron Names Mark A. Nelson Vice Chairman

Chevron Corporation (NYSE: CVX) today announced Mark A. Nelson, executive vice president, Strategy, Policy & Development, has been named vice chairman and executive vice president, Strategy, Policy & Development, effective February 1, 2023. In this new corporate officer role, Nelson will continue leading Chevron’s Strategy & Sustainability, Corporate Affairs, and Business Development functions, and take on additional corporate responsibilities. Read More

Expro Group Holdings N.V. has announced a long-term Production Solutions contract with Eni Congo S.A. a subsidiary of multinational energy company Eni S.p.A. (“Eni”) for a liquified natural gas (LNG) pre-treatment facility in Congo.

As initially discussed on the company’s third quarter earnings conference call on November 3, 2022, the 10-year contract is expected to generate more than $300 million of revenue for Expro.

Expro will design, construct, operate and maintain a fast-track onshore LNG pre-treatment facility (OPT), part of the Marine XII development offshore Congo. The facility will be built near to the Litchendjili gas plant – which supplies gas to the adjacent Centrale Electrique du Congo (CEC) Pointe-Noire Power Plant – and will enable the production of LNG to significantly increase from the West Africa area.

The facility is designed to allow incremental gas production for low carbon electricity generation. It will link to Eni Congo’s offshore floating LNG (FLNG) operations, supporting both the local energy market and increased global demands for LNG to support secure energy supplies.

The OPT facility is designed to process approximately 80 million cubic feet of gas a day. Read More

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, energy monitors,TotalEnergies, Shell, BP, Chevron