Energy News to 09 June 2022. OPEC daily basket price stood at $121.54/bl, 08 June 2022

Equinor has made another oil and gas discovery in Skavl Stø, exploration well 7220/8-3.

The well was drilled five kilometres south-southeast of discovery well 7220/8-1 on the Johan Castberg field, 210 kilometres northwest of Hammerfest.

Equinor is the operator of production licence 532. The size of the discovery is preliminarily estimated at between 5-10 million barrels of recoverable oil equivalent. Together with the other licensees, Vår Energi and Petoro, Equinor will consider tying the discovery into the Johan Castberg field. Read More

Dana Incorporated (NYSE: DAN) announced it will participate in the Deutsche Bank Global Auto Industry Conference on June 15, 2022.

Beginning at 8 a.m. EDT, Dana’s Chairman and Chief Executive Officer James Kamsickas and Senior Vice President and Chief Financial Officer Timothy Kraus will provide a brief overview of the company and answer questions for approximately 35 minutes. Read More

Neste has today published its first Green Finance Report following the establishment of its Green Finance Framework in 2021 to further integrate the company’s sustainability ambitions into its financing.

The Green Finance Report, which covers financing activities in 2021, confirms that sustainability is deeply embedded in Neste’s everyday business and reiterates our ambitious climate commitments.

In March 2021, Neste issued a EUR 500 million 7-year green bond, the first of its kind for Neste, to provide investors the opportunity to support our objective of mitigating climate change globally by reducing greenhouse gas emissions through our renewable and circular solutions. This has been followed in 2022 by a EUR 500 million green term loan agreement. Read More

Eni announces secondary placement of 5.0% of existing share capital in Vår Energi ASA was successfully completed by Eni and HitecVision (selling 1.2% and 3.8% respectively) at NOK 40.2 per share, totaling USD 530 Million of proceeds. As a result, the free float will increase from 11.2% to approximately 16.2%. The sale takes place through an accelerated book building process. Read More–>

Eni S.p.A. (“Eni”) announces today its intention to launch an initial public offering (the “IPO”) for Eni Plenitude S.p.A. Società Benefit (“Plenitude” or the “Company”) for the listing of Plenitude’s ordinary shares on Euronext Milan, a regulated market which is organized and managed by Borsa Italiana S.p.A..

The IPO is expected to consist of a public offering to the general public in Italy and of a private placement reserved for qualified investors in Italy and the European Economic Area and to foreign institutional investors outside the United States of America pursuant to Regulation S of the United States Securities Act of 1933, as amended (the “Securities Act”) and in the United States of America only to “qualified institutional buyers” pursuant to Rule 144A of the Securities Act, excluding those countries in which the offer is not permitted without an authorization by the competent authorities, in accordance with applicable laws, or applicable statutory or regulatory exemptions.

The free float required for listing purposes will be reached through the sale of shares by Eni. The listing will attract new capital to Eni, maximizing the value of Plenitude and the stake owned by Eni and unlocking new resources to be allocated for the energy transition path. Read More

Eni Plenitude S.p.A., Società Benefit (the “Company,” the “Group” or “Plenitude”), today announces its intention to launch an initial public offering (the “IPO”) for the listing of its ordinary shares (the “Shares”) on Euronext Milan, a regulated market organized and managed by Borsa Italiana S.p.A. (“Euronext Milan”).

Plenitude is a company currently 100% controlled by Eni S.p.A. (“Eni” or the “Selling Shareholder”), an integrated business combining the generation of electricity from renewables, the sale of electricity, gas and energy services to households and businesses, and a European network of charging points for electric vehicles (“e-mobility”).

As of 31st March 2022, Plenitude had an installed renewables generation capacity of c.1.4 GW¹ and a pipeline of renewables projects of over 10 GW1, a retail portfolio of c.10 million clients and an electric vehicle charging network of c.7,300 proprietary installed charging points (excluding inter-operational charging points). For the twelve months ended 31st December 2021, Adjusted EBITDA and Cash Flow from Operations (“CFFO”) were €0.6 billion2 and €0.4 billion2 respectively. Read More

The critical role of business in delivering the Glasgow Climate Pact and making progress ahead of COP27 COP26 President Alok Sharma at the Confederation of British Industry’s Achieving Net Zero Conference on the vital role business has in achieving net zero by 2050 or earlier Read More–>

The Gas Exporting Countries Forum (GECF), the global platform of the leading gas producing countries, led by its Secretary General HE Eng. Mohamed Hamel held a meeting with HE Dr Mouhamed Habibou Diallo, the Ambassador Extraordinary and Plenipotentiary of Senegal to the State of Qatar during a courtesy call to the Senegalese Embassy in Doha today.

The discussion primarily centred on ramping up cooperation between the two sides, as Senegal gets ready to become an LNG exporter by the end of 2023. During the meeting, HE Hamel introduced the history, impact and function of the GECF, and explained the numerous benefits available to the GECF Member Countries. Recalling the fruitful participation of HE Aissatou Sophie Gladima, the Minister of Petroleum and Energy of Senegal, in the 22nd GECF Ministerial Meeting (2020) hosted by Algeria, he expressed the wish to have Senegal present at the 24th GECF Ministerial Meeting in Cairo (2022) Furthermore, the GECF official invited the esteemed diplomat to the Forum’s headquarters to witness first-hand the many projections and datasets available through the GECF Global Gas Model and to leverage those insights on the development of gas industry in Senegal. Read More

Chevron Corporation (NYSE: CVX), through its subsidiary Chevron Munaigas Inc. (Chevron), and JSC NC “KazMunayGas” (KMG) have announced a memorandum of understanding (MoU) to explore potential lower carbon business opportunities in Kazakhstan. Chevron and KMG plan to evaluate the potential for lower carbon projects in areas such as carbon capture, utilization, and storage (CCUS); hydrogen; energy efficiency and methane management; and carbon financial disclosure methodology.

The MoU was signed by Derek Magness, managing director for Chevron’s Eurasian Business Unit, and Magzum Mirzagaliyev, chairman of the Management Board of KMG, in Nur-Sultan on the eve of the 34th Plenary session of the Foreign Investors Council chaired by President of Kazakhstan Kassym-Jomart Tokayev and Chevron’s executive vice president of Upstream Jay Johnson. Read More

Eco Wave Power Reveals Plans for a 1MW Project in Halki Island, Greece. at the annual Israel-Greece Conference, hosted by Calcalist in Isla Brown Corinthia hotel in Agii Theodori, Greece. Ms. Braverman, Founder and Chief Executive Officer of Eco Wave Power Global AB spoke during a session titled “Innovation for Good: Facing Global Solutions Through Tech Solutions” and detailed the advantages of wave energy. She also presented the Company’s newly planned project in the island of Halki in Greece.

She stated that “The Eco Wave Power technology is smart, simple and easy to implement. The only part of the system that is in the water are the floaters, which belong in the water, and all the expensive energy conversion equipment is located on land just like a regular power station. According to the forecasts, wave energy is expected to provide around 10% of all Europe’s electricity by 2050.”

She added that “Our commercialization plan includes our upcoming project in Israel, which is co-funded by the Israeli Energy Ministry, that recognized the Eco Wave Power technology as a pioneering technology, and EDF Renewables IL. We are also planning our first U.S. project on the AltaSea premises in the Port of Los Angeles, to be followed by commercial scale projects in Spain, Portugal and other locations in the Company’s 327.7 megawatts projects pipeline. I am also here to present our newest project in Greece, in Halki Island. Basically, the island wants to be 100% green and renewable, and it recently received a recognition for being the Sustainable Initiative of the Year for its admirable efforts. The island plans on combining 1 megawatt of solar energy, 1 megawatt of wind energy and 1 megawatt of wave energy and the EU program New Energy Solutions Optimized for Island (NESOI) is providing funding for Eco Wave Power’s feasibility study in the island that we expect to complete by the end of this year, which will enable the construction of the first ever grid-connected 1 megawatt wave energy array in Greece.” Read More

In a meeting in the corporate assembly of Equinor ASA (OSE:EQNR, NYSE:EQNR) on 7 June 2022 Michael D. Lewis was elected as new member to Equinor’s board of directors and Anne Drinkwater was elected as deputy chair of the board of Equinor ASA.

Furthermore, the corporate assembly re-elected Jon Erik Reinhardsen as chair of the board in addition to re-election of Anne Drinkwater, Bjørn Tore Godal, Rebekka Glasser Herlofsen, Jonathan Lewis, Finn Bjørn Ruyter and Tove Andersen as shareholder-elected members of the board of directors.

Michael D. Lewis is CEO of E.ON UK plc. He was CEO of E.ON Climate & Renewables GmbH in the period 2015-2017 and between 2007-2015 he was Chief Operating Officer of the same company. In the period 2004-2007 Lewis held the role as Vice President Corporate Strategy in E.ON AG. He has also worked as Equity Analyst, Strategy Analyst and Environmental Specialist and Environmental Scientist in other companies. Lewis has extensive international experience and broad board experience.

Lewis is chair of the board of Energy and Utilities Skills Partnership as well as member of the Natural Environment Research Council and Imperial College Business School, Centre for Climate Finance and Investment. Lewis holds an MA in Environmental Law from De Montfort University, MSc Pollution and Environmental Control from the University of Manchester and BEng Engineering Technology from Leicester Polytechnic. The election of shareholder-elected members to the board of directors enters into effect from 1 July 2022 and is effective until the ordinary election of shareholder-elected members to the board of directors in 2023. Read More

Subsea 7 announced that Seaway 7 ASA(1) has been selected by Seagreen 1 Limited as a preferred supplier for the Seagreen 1A offshore wind project, offshore Scotland. Seagreen 1A lies adjacent to the existing Seagreen project that Seaway 7 is currently progressing and represents approximately 500MW of additional renewable energy generation capacity. Seaway 7’s scope of work is under final negotiation and may include the full engineering, fabrication, transport and installation of 36 foundations, transportation and installation of the offshore substation and the procurement and installation of inner-array cables. Execution of the scope will be led from Seaway 7’s Aberdeen office. The project is expected to commence in 2023 with offshore work commencing in late 2024 and could be operational by 2025/26. The timeframe and Seaway 7’s selection are subject to the Seagreen 1A project securing consent and a final investment decision by SSE Renewables and TotalEnergies. The value related to this very large(2) agreement is expected to be recognised in Seaway 7’s backlog after final contractual terms have been agreed. More

Norway’s prime minister Jonas Gahr Støre visited Gulen in Vestland County to see the construction of Hywind Tampen.

Four of the 11 wind turbines in Norway’s first offshore wind farm have now been installed, towering 190 metres over Fensfjorden before being towed out into the North Sea for offshore floating power generation. LO President Peggy Hessen Følsvik, NHO Director General Ole Erik Almlid, and Enova CEO Nils Kristian Nakstad, accompanied the Prime Minster to Gulen, where they could see how Hywind Tampen will supply the Gullfaks and Snorre fields in the North Sea with electricity from floating offshore wind. Read More

Israel Sends Navy To Escort Drilling Rig

At a time when the world’s gas supply is having to catch up with demand, two prospective gas majors in the eastern Mediterranean have locked horns over a disputed field that could delay the development of local resources. Israel and Lebanon have been at odds about their maritime border ever since gas was found. The issue seems to be of particular importance for troubled Lebanon: a big gas find could change the country’s quite grim fortunes. It is also important for Israel, however, as it eyes the position of a regional gas major. The focus of the rift is an offshore field called Karish. According to Israel, Karish lies in its territorial waters. According to Lebanon, it falls within a triangle of contested waters because the two cannot agree where exactly the border passes. As Reuters put it, “Israel claims the boundary runs further north than Lebanon accepts, while Lebanon claims it runs further south than Israel accepts, leaving a triangle of disputed waters.” Read More

Energean plc announced that the Energean Power FPSO has arrived on location in Israel.

The FPSO was transported by two tugs from Sembcorp Marine’s Admiralty Yard in Singapore to Israel. The 5,532 nautical mile-long journey took 35 days, crossing six seas and passing through the Suez Canal. Energean will immediately commence hook-up and commissioning operations, which includes risers and jumpers installation as well as the commissioning of the sales gas pipeline. Energean expects approximately three – four months of commissioning before first gas, which remains on track for Q3 this year.

Mathios Rigas, Chief Executive Officer of Energean, commented: “I am delighted to confirm that the Energean Power FPSO has arrived on location in Israel. This marks a major step forward in delivering first gas from Karish which remains on track for Q3 2022. We look forward to continuing our progress through Karish first gas, the commercialisation of the newly defined Olympus Area and contributing to energy security and competition of supply for the region.” Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $121.56 | Up |

| Crude Oil (Brent) | USD/bbl | $123.22 | Up |

| Bonny Light | USD/bbl | $128.44 | Up |

| Saharan Blend | USD/bbl | $127.82 | Up |

| Natural Gas | USD/MMBtu | $8.19 | Down |

| OPEC basket 08/06/22 | USD/bbl | $121.54 | Up |

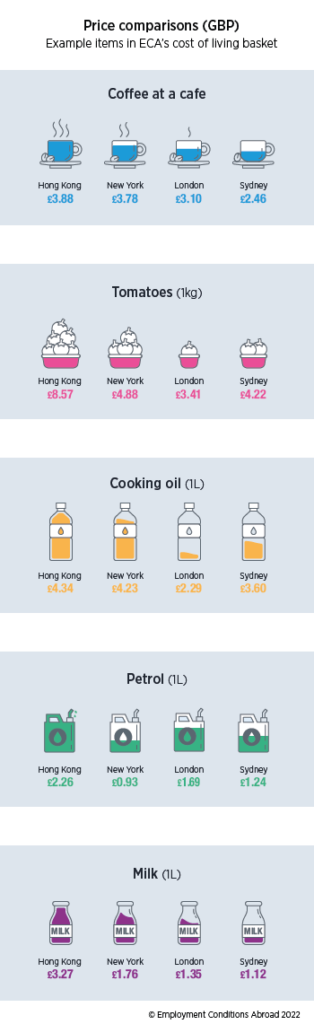

Hong Kong has maintained its position as the most expensive location in the world, bolstered by higher prices and a stronger currency over the past year. This was one of the findings of the latest cost of living research published by ECA International, the world’s leading provider of knowledge, information and software for the management and assignment of employees around the world. Read More

London jumps up one place in the ranking of the most expensive cities in the world, overtaking Tokyo to become 4th, ECA International’s (ECA) latest cost of living report reveals. Hong Kong retains its spot at number one, while New York moves further up the ranking, overtaking Geneva (3rd) to secure second place. While the cost-of-living crisis has dominated news headlines across the UK, ECA’s report reveals how costs in the UK compare to countries around the world, affected by widespread inflation rises. London and New York have seen the most significant price increases within the top ten most expensive cities, primarily due to soaring accommodation rental costs – up by an alarming 20% in London and 12% in New York.

In fact, UK locations included in the study have risen in the cost of living ranking by an average of six places, with Edinburgh now 83rd, Manchester 84th, Birmingham entering the top 100 (99th), Cardiff 101st and Belfast 106th. Read More

Lilium has been hard at work developing a high-performance aviation battery system for our jets centered on the two key drivers necessary to achieve our mission: performance and scale, while working towards anticipated certification requirements. Now that Lilium has progressed in filing patents to protect IP and independent 3rd party testing of its target cell technology has been completed. Performance: power and energy for the mission

Our team scouted more than 100 companies along the entire battery value chain from raw material suppliers through to cell developers, manufacturers, and recycling companies. More than 20 battery cells were shortlisted and analyzed considering the predicted mission profiles before selection of a specific cell technology.

Based on that research, we concluded that Zenlabs’ pouch cells, lithium-ion batteries using high-silicon anode and high-nickel cathode, offered the best solution for achieving our needs through performance, certification, and into scale production. Our engineers have been collaborating with the Zenlabs team for more than 2 years in order to develop and refine an optimal cell technology for the Lilium Jet. From a battery performance perspective, the central challenge for achieving our mission is to find a battery cell that will:

(i) deliver a high average specific power of 2500 W/kg for a short, 10 second vertical take-off; and

(ii) deliver high specific energy, combined with our low cruise power*, to maximize mission range; and

(iii) deliver a high average specific power of 2500 W/kg again for the landing phase, which is typically shorter than 45 seconds duration** Read More

Lilium N.V. (NASDAQ: LILM) (“Lilium”), developer of the first all-electric vertical take-off and landing (“eVTOL”) jet, announced today that it is accelerating its next phase of product delivery and business growth with the naming of Klaus Roewe, long-time Airbus executive, as CEO. Roewe will be joining Lilium on August 1, 2022. Daniel Wiegand, Lilium co-founder and the current CEO, will continue as Lilium’s Chief Engineer for Innovation and Future Programs and as a Board Director. “The Board ran an extensive global CEO search and are genuinely excited with the appointment of Klaus Roewe. We believe adding Klaus as CEO will give us unparalleled executional leadership to complement Lilium’s innovative DNA as we continue the development of the Lilium Jet and advance towards Type Certification and scale production – Klaus has a breadth of operational experience that is very rare in our industry” said Lilium Chairman, Tom Enders. Read More

U.S. Rig Count at 574, Canada Rig Count at 117,International Rig Count is up 11 rigs to 817

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 03 June 2022 | 727 | — |

| Canada | 03 June 2022 | 117 | +14 |

| International | May 2022 | 817 | +11 |

The U.S. Energy Information Administration (EIA) forecasts that a variety of U.S. energy prices will remain historically high through 2023, including oil, natural gas, coal, and electricity, according to EIA’s June 2022 Short-Term Energy Outlook (STEO).

“We continue to see historically high energy prices as a result of the economic recovery and the repercussions of Russia’s full-scale invasion of Ukraine,” said EIA Administrator Joe DeCarolis. “Although we expect the current upward pressure on energy prices to lessen, high energy prices will likely remain prevalent in the United States this year and next.” EIA forecasts that high natural gas and coal prices will result in an increased share of renewables in U.S. generation, largely offset by a decline in coal’s share. Wind and solar generation will likely contribute more than 11% of U.S. electricity this summer, after providing less than 10% in the summer of 2021. The natural gas share is forecast to decline over the next two years although at a slower rate than coal. Read More

Serica Energy plc (AIM: SQZ), announces that its Annual Report for the year ended 31 December 2021 has today been published, together with a notice convening the Company’s annual general meeting (the “AGM”) and the Company’s latest Environmental, Social & Governance (“ESG”) Report. The AGM is to be held on Thursday, 30 June 2022 at 2:00p.m. at the offices of Peel Hunt LLP, 100 Liverpool Street, London, EC2M 2AT. Read More

The US Department of the Interior today announced the Bureau of Ocean Energy Management (BOEM) will conduct an environmental review of the first proposed wind energy project offshore Maryland. This week, the Department will publish a Notice of Intent (NOI) to prepare an Environmental Impact Statement (EIS) for the Construction and Operations Plan (COP) submitted by US Wind, LLC (US Wind). This is the 10th offshore wind energy COP review initiated under the Biden-Harris administration.

“President Biden has set the bar high for a clean energy future with ambitious offshore wind goals that will lower costs for families, create nearly 80,000 good paying jobs and make substantive progress as we work to confront the climate crisis,” said Secretary of the Interior Deb Haaland. “The Department of the Interior is continuing to meet the moment as part of this Administration’s all-of-government approach to addressing the climate crisis, which includes early and ongoing engagement with nearby communities.”

The lease area is approximately 10 nautical miles off the coast of Ocean City, Maryland, and approximately nine nautical miles offshore Sussex County, Delaware. If approved, the development and construction phases of the US Wind project could support up to an estimated 2,679 jobs annually over seven years. Read More

The Bureau of Ocean Energy Management (BOEM) and the National Oceanic and Atmospheric Administration’s (NOAA) Stellwagen Bank National Marine Sanctuary announced the successful digital acoustic tagging of 14 sei whales in waters offshore Massachusetts. This is the first time researchers have successfully tagged an endangered species in the United States using an uncrewed aerial vehicle (UAV), or drone.

The collected data will shed important light on the whales’ acoustic behavior, which researchers will use to inform mitigation strategies – including passive acoustic monitoring – to protect this endangered species from the potential impacts of offshore wind energy activities.

“BOEM is pleased to be able to fund this important research. Our Environmental Studies Program looks for innovative solutions to resource management challenges,” said Jacob Levenson, BOEM marine biologist. “Using UAVs allows scientists to collect data in a way that is safer for both the whales and researchers.” Read More

During the period from May 30 to June 3, 2022, Eni acquired n. 3,118,553 shares, at a weighted average price per share equal to 14.1639 euro, for a total consideration of 44,170,722.66 euro within the authorization to purchase treasury shares approved at Eni’s Shareholders’ Meeting on 11 May 2022, previously subject to disclosure pursuant to art. 144-bis of Consob Regulation 11971/1999.

On the basis of the information provided by the intermediary appointed to make the purchases, the following are details of transactions for the purchase of treasury shares on the Electronic Stock Market on a daily basis: Since the start of the programme, Eni purchased n. 3,118,553 treasury shares (equal to 0.09% of the share capital) for an aggregate amount of 44,170,722.66 euro. Read More

France’s Ciel et Terre has expanded its line of Hydrelio flexible floating platforms with the new Hydrelio aiR Optim floater.

Vincent Grumetz, general manager EMEA for the Lille-based company, told pv magazine France that the new platform adheres to the Hydrelio line’s “one float, one panel” principle. “The new product is an optimized version that adapts to the increase in size and weight of photovoltaic panels,” said Grumetz.

The floater is made of high-density polyethylene (HDPE) recyclable plastic. The company adapted its size and flotation properties to support larger modules of up to 670 W in size. Read More

The AUD 40 million ($28.7 million) office tower, being constructed on a 1,043 square meter site at 550-558 Spencer Street in the Victoria capital of Melbourne will be fitted with a building integrated photovoltaic (BIPV) skin comprising almost 2,000 thin-film solar panels the same thickness as a traditional glass facade.

While the generation capacity of the BIPV system has not been revealed, Melbourne architecture firm Kennon said when complete, the array will supply almost enough power to cover all of the building’s energy needs. With extra solar panels set to be deployed on the roof, the building is expected to have almost no ongoing power costs and will be carbon-neutral after a few years.

Architect Pete Kennon said the BIPV installation will be capable of producing 50 times the energy of the average residential rooftop solar PV system and will eliminate 70 tonnes of carbon dioxide emissions each year. Read More

The board of the directors of the Company (the “Board”) is pleased to announce that Tarmac, the major UK building materials company and part of FTSE-100 constituent CRH, is commencing a significant trial of the SulNOxEco™ Fuel Conditioner. A copy of the Tarmac press release is copied below.

Tarmac trials fuel innovation to drive HGV emissions savings

Tarmac, the UK’s leading sustainable building materials and construction solutions business, has begun a trial of a ground-breaking fuel conditioner as part of its ongoing corporate commitment reducing emissions across its nationwide fleet of heavy goods vehicles.

Working with fuel technology specialist partner SulNOx Group Plc, the business is using an innovative fuel additive on selected vehicles over a three-month period while carefully monitoring fuel consumption and greenhouse gas emissions data to identify savings.

SulNOxEco Fuel Conditioner is a unique, advanced fuel additive made from natural, biodegradable ingredients that has been shown to improve fuel efficiency and reduce the production of harmful emissions including CO2 and fine particulate matter.

The technology is being evaluated across 18 of Tarmac’s vehicles, including mixer trucks, tipper trucks and articulated lorries, at two of its Hopkins concrete plants, with an expectation that it may improve fuel efficiency and reduce carbon by up to 10 per cent. Read More

The Ukraine war has caused a “gold rush” for new fossil fuel projects, threatening to lock us into irreversible global warming, according to leading climate researchers.

A new report from Climate Action Tracker (CAT) has found that soaring energy prices in the wake of Russia’s invasion have caused more investment in oil and gas projects. It spotlights a plethora of new gas projects, many of which will not be built in time to combat the current energy crisis. They will, however, increase emissions in the long term and lock us into carbon-intensive infrastructure for decades to come.

The report points to new liquified natural gas (LNG) projects in Europe, specifically in Germany, Italy, Greece and the Netherlands. Read More

OilandGasPress Energy Newsbites and Analysis Roundup |Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Oil and gas press covers, Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, News and Analysis