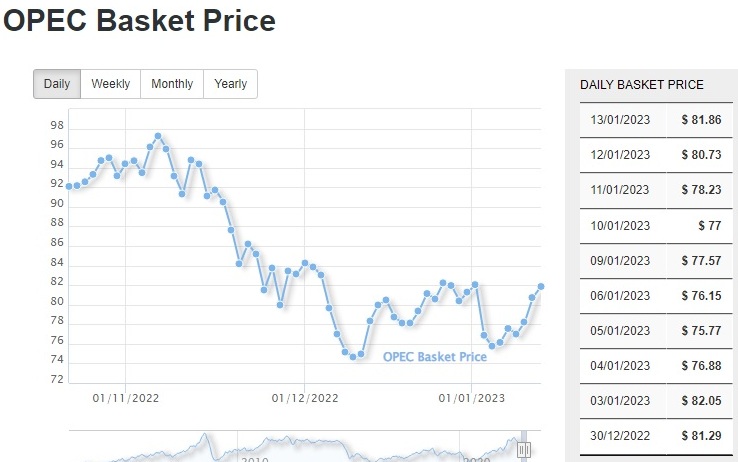

Energy News to 16/01/23 . OPEC daily basket price at US$81.86/bl, 13 Jan. 2023

DNO ASA, the Norwegian oil and gas operator, today reported the below transactions made under the Company’s share buyback program, which commenced 9 December 2022 and will end no later than 30 April 2023. For further information regarding the program, please see the Company’s stock exchange notification from 8 December 2022. Read More

Africa Oil Corp. (“Africa Oil”, or the “Company”) is pleased to announce that the Company repurchased a total of 200,000 Africa Oil common shares during the period of January 9, 2023 to January 13, 2023 under the previously announced share buyback program, having recommenced the buyback trades on January 13, 2023.

The launch of Africa Oil’s normal course issuer bid (share buyback) program, announced by the Company on September 22, 2022, is being implemented in accordance with the Market Abuse Regulation (EU) No 596/2014 (MAR) and Commission Delegated Regulation (EU) No 2016/1052 (Safe Harbour Regulation) and the applicable rules and policies of the Toronto Stock Exchange (“TSX”), Nasdaq Stockholm, and applicable Canadian and Swedish securities laws.

During the period dated January 9, 2023 to January 13, 2023, the Company repurchased 100,000 Africa Oil common shares on the TSX and/or alternative Canadian trading systems. The repurchases were carried out by Scotia Capital Inc. on behalf of the Company. During the same period, the Company repurchased 100,000 Africa Oil common shares on Nasdaq Stockholm, and these repurchases were carried out by Pareto Securities on behalf of the Company. All common shares repurchased by Africa Oil under the share buyback program will be cancelled. Read More

Equinor announced on 28 October 2022 an ordinary dividend per share of USD 0.20 and an extraordinary dividend per share of USD 0.70 for third quarter 2022.

The NOK dividend per share is based on average USDNOK fixing rate from Norges Bank in the period plus/minus three business days from record date 10 January 2023, in total seven business days. Average Norges Bank fixing rate for this period was 10.0176. Total cash dividend for third quarter 2022 of USD 0.90 per share is consequently NOK 9.0159 per share. On 25 January 2023, dividend will be paid to shareholders on Oslo Børs (Oslo Stock Exchange) and to holders of American Depositary Receipts (“ADRs”) on New York Stock Exchange. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $79.05 | Down |

| Crude Oil (Brent) | USD/bbl | $84.40 | Up |

| Bonny Light | USD/bbl | $84.99 | Up |

| Saharan Blend | USD/bbl | $85.39 | Up |

| Natural Gas | USD/MMBtu | $3.63 | Up |

| OPEC basket 13/01/23 | USD/bbl | $81.86 | Up |

TotalEnergies has approved the final investment decision of the Lapa South-West oil development located in the Santos Basin, 300 km off the coast of Brazil.

TotalEnergies operates the project with a 45% interest, in partnership with Shell (30%) and Repsol Sinopec (25%). Lapa South-West will be developed through three wells, connected to the existing Lapa FPSO located 12 km away and currently producing the North-East part of Lapa field since 2016.

At production start-up, expected in 2025, Lapa South-West will increase production from the Lapa field by 25,000 barrels of oil per day, bringing the overall production to 60,000 barrels of oil per day. This development represents an investment of approximately $1 billion. Read More

Baker Hughes Rig Count

U.S. Rig Count is up 3 from last week to 775 with oil rigs up 5 to 623, gas rigs down 2 to 150 and miscellaneous rigs unchanged at 2.

Canada Rig Count is up 38 from last week to 227, with oil rigs up 28 to 141, gas rigs up 10 to 86.

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 13 January 2023 | 775 | +3 |

| Canada | 13 January 2023 | 227 | +38 |

| International | December 2022 | 900 | -10 |

According to a report in the German daily Augsburger Allgemeine, Germany now ranks 18th out of 21 countries, falling four places in the ranking produced by the German economic research institute ZEW, Reuters reported. The institute cited higher energy costs and a labor shortage for the revision of Germany’s place in the ranking, along with the slow pace of innovation and a complicated bureaucratic environment. Soaring gas prices have shaken the German industry and prompted the government to spend billions of euros on helping businesses, as well as households, survive. Even with the state aid, however, many German businesses are curbing their activities or moving them to lower-cost energy locations such as the United States and Asia. Read More

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy Monitor, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, energy monitors,TotalEnergies, Shell, BP, Chevron