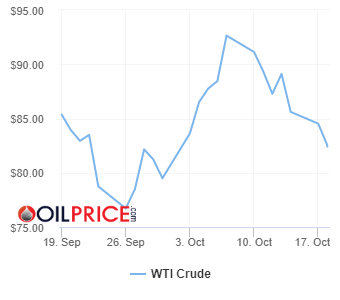

Evening Energy News | October 18th, WTI Crude stood at $82.34/bl

Brent Crude Drops slightly Below $90/bl On Recession Fears

Transocean Ltd. (NYSE: RIG) issued a quarterly Fleet Status Report that provides the current status of, and contract information for, the company’s fleet of offshore drilling rigs.

This quarter’s report includes the following updates:

Deepwater Conqueror – Awarded a two-year contract in the U.S. Gulf of Mexico at $440,000 per day.

Deepwater Asgard – Awarded a one-well contract in the U.S. Gulf of Mexico at $395,000 per day plus a one-well option.

Deepwater Asgard – Awarded a one-year contract in the U.S. Gulf of Mexico at $440,000 per day.

Petrobras 10000 – Awarded a 5.8-year contract in Brazil at $399,000 per day escalating annually to $462,000 per day.

Development Driller III – Awarded a one-well contract in Suriname at $345,000 per day plus two one-well options.

Transocean Norge – Awarded a 17-well contract in Norway at dayrates between $350,000 and $430,000.

Dhirubhai Deepwater KG1 – Customer exercised a one-well option in India at $330,000 per day.

Paul B Loyd Jr – Customer exercised two 100-day options in the U.K. at $175,000 per day.

Transocean Spitsbergen – Customer exercised a one-well option in Norway at $316,000 per day.

The aggregate incremental backlog associated with these fixtures is approximately $1.6 billion. As of October 13, the company’s total backlog is approximately $7.3 billion. Read More

Transocean Ltd. (NYSE: RIG) announced that it will report earnings for the third quarter of 2022, after the close of trading on the NYSE on Wednesday, November 2, 2022.

The company will conduct a teleconference to discuss the results starting at 9 a.m. EDT, 2 p.m. CET, on Thursday, November 3, 2022. Individuals who wish to participate should dial +1 785-424-1205 and refer to conference code 260431 approximately 15 minutes prior to the scheduled start time. Read More

Oil and gas contracts in Asia-Pacific registered a decrease of 25% in Q3 2022 with 405 contracts, when compared with 537 contracts in the previous quarter, according to GlobalData’s oil and gas contracts database. The activity marked a decrease of 23%, when compared with the last four-quarter average of 528 contracts. Read More

Russia has removed Exxon as a shareholder from the Sakhalin-1 oil and gas project and transferred its stake to a Russian business entity.

Exxon said this amounted to expropriation and that it had pulled out from Russia as a whole, the Wall Street Journal reported.

Exxon had a 30-percent stake in Sakhalin-1 but a week ago President Vladimir Putin signed a decree with which a new entity was set up to manage the operations of the Far East oil and gas project. The decree allowed the Russian government to distribute the stakes in the project and kick out foreign partners if they saw fit.

Exxon was on its way out anyway, however. Shortly after Russian troops entered Ukraine in February, Exxon said it was going to pull out from Russia and make no more investments there. Read More

Households across Britain could face three-hour rolling blackouts in January and February if gas stocks run low, the head of the National Grid has claimed.

Chief executive John Pettigrew said the firm may need to introduce rolling power cuts in January and February, specifying the blackouts would occur on ‘really, really cold days’ during the week should Britain fail to secure enough gas supplies from Europe.

Speaking at the Financial Times’s Energy Transition Summit, Pettigrew warned that Britain’s gas-fired power stations, which generate a large portion of the nation’s power, are facing a considerable scarcity of fuel. Read More

Joe Biden is planning to release up to 15million barrels of oil from the US’s emergency oil reserves as he tries to stem soaring gasoline prices.

The oil release would be the latest portion of a deal Biden struck last spring to release 180million barrels of oil from energy companies.

His administration is planning to announce the latest reserve release later this week, according to Bloomberg. Average US gasoline prices hit about $3.89 a gallon on Monday, up about 20 cents from a month ago and 56 cents higher than last year at this time, according to the AAA motor group. Read More

Hitachi Energy, a global technology leader that is advancing a sustainable energy future for all, today announced it has signed a long-term service agreement with Société Nationale d’Electricité (SNEL), the national electricity company of the Democratic Republic of Congo, to secure power supply in the country’s most important power transmission asset: the Inga-Kolwezi high-voltage direct current (HVDC) link.

The link supplies up to 1,000 megawatts of emission-free electricity from the Inga Falls hydropower plant in the far west of the country to the Kolwezi mining region in the south. With a length of 1,700 kilometers, it is the longest HVDC link in Africa. It also enables the Democratic Republic of Congo to export surplus power to the member countries of the Southern African Power Pool.

The agreement continues the close collaboration between SNEL and Hitachi Energy over the past 40 years to ensure the link operates at maximum availability and reliability over its long operating life. Hitachi Energy supplied the two converter stations at either end of the link in 1982 and has subsequently upgraded them and doubled transmission capacity.*1

As part of the agreement, Hitachi Energy will assess the precise service needs of the converter stations and develop a preventive maintenance program and supervise its implementation over the next five years. The agreement includes training, knowledge sharing and expertise enhancement of SNEL service personnel. Read More

Hitachi Energy announced plans to invest more than US$37 million in the expansion and modernization of its power transformer manufacturing facility in South Boston, Virginia to address fast-growing demand from utility customers and for applications such as renewable energy generation and data centers. In addition to its own investments, Hitachi Energy is leveraging financial support from the Commonwealth of Virginia and Halifax County where the facility is located.

Transformers adjust and stabilize the voltage of electricity to ensure an efficient, reliable power supply across the region. This location produces both distribution and power transformers for the nation’s power grid, commercial buildings, and industrial facilities, as well as traction transformers for use in railway applications. The South Boston factory currently covers an area of approximately 607,000 square feet, and hosts about 450 employees.

These latest investments in the facility are for an additional 26,000 sq. ft. of production space in its power transformer building, which will support the manufacturing of larger transformers specifically designed for utility and renewable energy markets. The project also includes investments in automated equipment and changes in factory processes to reduce factory cycle times and improve operational performance. This is particularly critical in the face of current supply chain challenges brought on by the pandemic and other factors. Read More

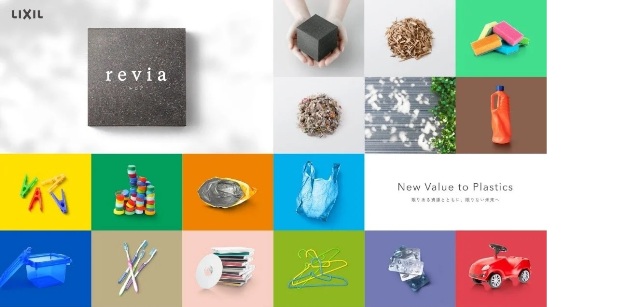

LIXIL Corporation introduces revia, which combines plastic waste and wood waste to create a material suitable for a wide range of applications. Bringing a new value to plastics, the first revia product will be “revia pave,” a paving material for sidewalks, plazas, parks and building exteriors, which will be available for sale in Japan¹ starting January 10, 2023.

Leveraging LIXIL’s expertise in pulverizing and molding plastics in combination with waste wood that is typically generated from the demolition of buildings, revia can be made from most household and commercial plastic waste including the composite types or even marine plastics. Utilizing plastic and wood waste to create one ton of revia that would have otherwise been incinerated after use can result in 82% reduction in CO₂ emissions.² The material itself can also be recycled³—collected to become revia products again.

Therefore, revia contributes to the environment in two key ways: by cutting the amount of CO2 generated by conventional waste processing and by enabling the responsible re-use of plastics as a raw material.

Plastic waste has more than doubled globally over the last twenty years, largely comprised of single-use plastics, yet only 9% is recycled.⁴ Most plastic waste is incinerated⁵ or become landfill, polluting the air and leaking into ecosystems. This represents an urgent and growing environmental issue around the world. Designed as paving material “revia pave” is suitable for sidewalks, nature trails in national parks, plazas between office buildings and commercial facilities, and smart cities.

“revia pave” resembles the appearance of wood that blends with nature and its surrounding scenery, and has a textured surface that plays with light and shadow to create a pleasant ambience to spaces. Incorporating universal design principles, “revia pave” is comfortable to walk on, highly durable, weather resistant, and strong. Its weight is half of that of concrete paving material that helps alleviate the burden to install. Read More–>

South Pole’s 2022 Net Zero report found that an increasing number of climate-aware companies are supporting their net zero commitments with science-based targets, yet surprisingly, one in four do not plan to talk about them. This means many companies with robust targets are going green and then going dark.

Doing so makes corporate climate targets harder to scrutinise and limits knowledge-sharing on decarbonisation, potentially leading to less ambitious targets being set, and missed opportunities for industries to collaborate. Read More

Nigeria LNG (NLNG) has declared force majeure as flood disrupts supply, a spokesman for the company said on Monday.

The declaration could worsen Nigeria’s cash crunch and will curtail global gas supply as Europe and others struggle to replace Russian exports due to the invasion of Ukraine in February, Reuters reports.

NLNG said all of its upstream gas suppliers had declared force majeure, forcing it to make the declaration as well.

“The notice by the gas suppliers was a result of high floodwater levels in their operational areas, leading to a shut-in of gas production which has caused significant disruption of gas supply to NLNG,” spokesperson Andy Odeh said. Read More

px Group awarded SEAL pipeline contract in North Sea. The contract was awarded to Energy24, a px Group business, by TotalEnergies E&P UK Limited, and px Group began taking on operations on August 1st 2022. The pipeline is 474km long with a diameter of 34 inches and has been operational for more than 20 years. The SEAL pipeline transports sales quality gas from the Elgin Franklin platform in the Central Graben Area of the North Sea to the dedicated SEAL module at the Bacton gas terminal on the Norfolk coast.

With the addition of this contract, px is now responsible for managing commercial operations of approximately 40% of the UK gas supply. Using the latest IT cloud technology, px Group will operate and manage the SEAL pipeline

via a number of cloud applications. The project also included the recruitment and training of a full complement of shift personnel along with the project management of building, testing and operating the new control infrastructure. Read More

px Group, the leading infrastructure solutions business and operator of several critical UK energy sites, can announce that it has been appointed as Operator at GIDARA Energy’s flagship Bio-Methanol plant in Amsterdam.

The plant, plans for which were revealed last year by GIDARA Energy and is due to become operational in 2024, is GIDARA Energy’s advanced biofuels facility and will convert non-recyclable waste into advanced methanol. The plant is known as Advanced Methanol Amsterdam (“AMA”) and is located in the BioPark, an industrial location in the Port of Amsterdam developed especially for producers of renewable fuels.

Advanced Methanol Amsterdam will produce Bio-Methanol that creates significant carbon savings compared to fossil-based fuels. Advanced methanol is a versatile renewable transportation fuel that, amongst others, can be used in the road transport, marine and aviation sectors, helping these sectors to reduce their carbon emissions and become more sustainable. Read More

CB&I, McDermott’s storage business line, and Daewoo Shipbuilding & Marine Engineering Co., Ltd. (DSME) have signed a memorandum of understanding (MoU) for a feasibility study of a large liquid hydrogen (LH2) carrier including an LH2 storage tank design.

The ability to ship large quantities of hydrogen across the ocean is an increasing need to help countries, like South Korea, achieve carbon reduction goals in a hydrogen economy. CB&I and DSME bring unique expertise to the study. CB&I will evaluate its LH2 storage tank design for ocean-going ships and DSME will investigate and develop the ship’s general design to install the LH2 storage tank. The output of the feasibility study is expected to contribute to the future design of a large-scale LH2 carrier.

“The development of LH2 storage for ocean-bound vessels is essential to South Korea’s focus on a carbon-neutral environment,” said Cesar Canals, Senior Vice President of CB&I. “Our expertise in designing and building field-erected pressure spheres for LH2 storage is a perfect combination with DSME’s technical excellence.”

CB&I spheres can store LH2 at temperatures of minus 423 degrees Fahrenheit, and the company is nearing completion of the world’s largest LH2 sphere in Cape Canaveral, Fla., USA. Their history in this field spans more than 60 years. Read More

DNO ASA will publish its Q3 2022 operating and interim financial results on 3 November 2022

During the quarter, DNO received USD 220.2 million net from the Kurdistan Regional Government, of which USD 133.8 million represents the entitlement share of April and May 2022 Tawke license crude oil deliveries. Of the balance, USD 18.0 million represents override payments equivalent to three percent of gross April and May 2022 Tawke license revenues and USD 68.4 million represents payments towards arrears built up from non-payment of certain invoices in 2019 and 2020.

DNO paid one tax instalment of USD 1.8 million in Norway, the first of six instalments related to estimated 2022 results on the Norwegian Continental Shelf (NCS).

Other items

DNO participated in four exploration wells in the North Sea in the quarter. The Ofelia well in PL 929 on the NCS (10 percent working interest) was spudded on 24 July and completed on 25 August and has been announced as a discovery. The Edinburgh well in P255 on the UK Continental Shelf (45 percent working interest) was spudded on 15 March and completed on 5 August. The Brage South well in PL 055 (14.3 percent working interest) on the NCS was spudded on 10 June and completed on 26 July. Both Edinburgh (fully expensed in Q2) and Brage South have been announced as dry wells. The Uer well in PL 943 on the NCS (30 percent working interest) was spudded on 21 September and drilling was still ongoing as of end of Q3 2022.

DNO announced on 22 August an agreement to acquire assets in West Africa in an all-share transaction with RAK Petroleum plc. The transaction was completed on 11 October, and does as such not impact the Q3 2022 results. Read More

PGS’ new Cyprus Vision product covers most discoveries and exploration wells offshore Cyprus. The most recent Cronos-1 well in Block 6 underlines the continued success of the pre-salt Miocene-Cretaceous carbonate play in the area, building on the Calypso discovery and the Glaucus field.

According to the operator ENI and partner TotalEnergies, the successful Cronos-1 well encountered several good-quality carbonate reservoir intervals and confirmed an overall net gas pay of more than 260 meters. Preliminary estimates indicate about 2.5 TCF of gas in place, with significant additional upside. The same block contains the Calypso discovery made in 2018, and a further exploration well (Zeus-1) is currently being drilled on the block.

PGS MultiClient data in this part of the Mediterranean is dominated by the regional Cyprus Vision product, benefiting from 3D GeoStreamer broadband quality that will surely provide additional insights and enable analogs to be drawn on other blocks in this highly prospective area. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $82.36 | Down |

| Crude Oil (Brent) | USD/bbl | $89.21 | Down |

| Bonny Light | USD/bbl | $92.56 | Down |

| Saharan Blend | USD/bbl | $92.73 | Down |

| Natural Gas | USD/MMBtu | $5.69 | Down |

| OPEC basket 17/10/22 | USD/bbl | $92.16 | Down |

Sasol and ArcelorMittal South Africa have announced a partnership to develop carbon capture technology to produce sustainable fuels and chemicals, and green steel production through green hydrogen and derivatives.

Under a joint development agreement (JDA), they will advance studies into two potential projects: the Saldanha green hydrogen and derivatives study which will explore the region’s potential as an export hub for green hydrogen and derivatives, as well as green steel production; and the Vaal carbon capture and utilisation (CCU) study to use renewable electricity and green hydrogen to convert captured carbon from ArcelorMittal South Africa’s Vanderbijlpark’s steel plant into sustainable fuels and chemicals.

In addition, Sasol signed a Memorandum of Understanding (MOU) with Freeport Saldanha Industrial Development Zone to develop a globally competitive green hydrogen hub and ecosystem within Saldanha Bay.

“We are very excited to be leading the pre-feasibility and feasibility studies on these two potential projects that hold promise to unlock South Africa’s potential to be a global green hydrogen and derivatives player. These studies are anchored by the local need for green hydrogen and sustainable products, cementing Sasol as the leading contributor to the development of southern Africa’s green hydrogen economy,” said Priscillah Mabelane, Executive Vice President for Sasol’s Energy Business. Read More

OilandGasPress Energy Newsbites and Analysis Roundup | Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.

Information posted is accurate at the time of posting, but may be superseded by subsequent press releases

Please email us your industry related news for publication info@OilAndGasPress.com

Follow us: @OilAndGasPress on Twitter |

Oil and gas press covers, Energy, Climate, Renewable, Wind, Biomass, Sustainability, Oil Price, LPG, Solar, Marine, Aviation, Fuel, Hydrogen, Electric ,EV, Gas, News and Analysis