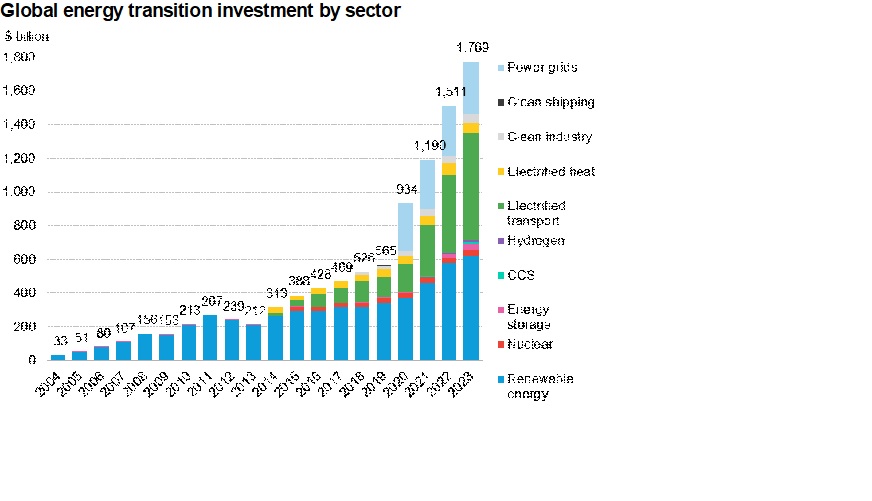

Investment in low-carbon energy transition up 17% in 2023, reaching $1.77 trillion,

Global investment in the low-carbon energy transition surged 17% in 2023, reaching $1.77 trillion, according to Energy Transition Investment Trends 2024, a report published today by research provider BloombergNEF (BNEF). This number is a new record level of annual investment and demonstrates the resilience of the clean energy transition in a year of geopolitical turbulence, high interest rates and cost inflation.

The report finds that electrified transport is now the largest sector for spending in the energy transition, growing 36% in 2023 to $634 billion. This figure includes spending on electric cars, buses, two- and three-wheelers and commercial vehicles, as well as associated infrastructure.

Electrified transport overtook the renewable energy sector, which saw an 8% increase to $623 billion. This figure reflects investment to construct renewable energy production facilities, such as wind, solar and geothermal power plants, and biofuels production plants – among other things. Power grid investment was the third-largest contributor at $310 billion. Grids are a critical enabler for the energy transition, and investment in them will need to rise in the coming years.

“Last year brought new records for global renewable energy investment. Strong growth in the US and Europe drove the global rise, even as China, the world’s largest renewables market, sputtered, recording an 11% drop. Despite a year of tough headlines, a record amount of offshore wind capacity also reached financial close,” said Meredith Annex, BNEF’s Head of Clean Power and co-author of the report.

There was also strong growth in emerging areas such as hydrogen (with investment tripling year on year), carbon capture and storage (near-doubling) and energy storage (up 76%).

Global energy transition investment by sector

Source: BloombergNEF. Note: start-years differ by sector but all sectors are present from 2020 onwards; see Methodology in the report for more detail. Most notably, nuclear figures start in 2015 and power grids in 2020. CCS refers to carbon capture and storage.

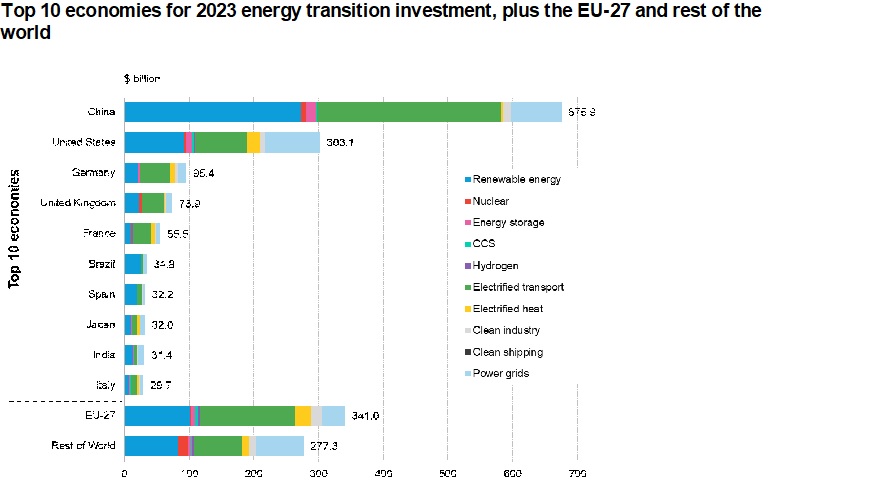

The largest country for investment by far was China, with $676 billion invested in 2023 – equivalent to 38% of the global total. Although China remains dominant, its lead has been reduced. Taken together, the European Union, US and UK outpaced China with $718 billion of investment – a feat they hadn’t managed to achieve in 2022. Investment in the US jumped 22% year-on-year, to $303 billion, as the effects of the Inflation Reduction Act started to be felt.

Top 10 economies for 2023 energy transition investment, plus the EU-27 and rest of the world

Source: BloombergNEF. Note: EU-27 bar also includes the EU member states shown. Rest of World is global investment excluding the EU and individual economies in the chart. A small amount of estimated spend for EU countries may be included in Rest of Word. CCS refers to carbon capture and storage.

The current level of investment in clean energy technologies is not nearly sufficient to set the world on track for net zero by mid-century. According to the report, energy transition investment would need to average $4.8 trillion per year from 2024 to 2030 to align with BNEF’s Net Zero Scenario, a Paris Agreement-aligned trajectory from the 2022 New Energy Outlook. This is nearly three times the total investment observed in 2023.

“Our report shows just how quickly the clean energy opportunity is growing, and yet how far off track we still are,” said Albert Cheung, Deputy CEO of BNEF. “Energy transition investment spending grew 17% last year, but it needs to grow more than 170% if we are to get on track for net zero in the coming years. Only determined action from policymakers can unlock this kind of step-change in momentum.”

In addition, BNEF’s report finds that investment in the global clean energy supply chain, including equipment factories and battery metals production for energy technologies, hit a new record at $135 billion in 2023 (up from just $46 billion in 2020), and is set to surge further over the next two years. BNEF projects this figure to rise to $259 billion by 2025, based on currently announced investment plans. In the next two years, only the wind sector needs to increase its supply chain investment to get on track for a net-zero trajectory; the other areas are investing at a sufficient pace.

Antoine Vagneur-Jones, Head of Trade and Supply Chains at BNEF, said, “Abundant supply chain investment should continue to tamp down equipment prices across most sectors, which is good news for the energy transition. But the ensuing oversupply heralds an era of squeezed margins for solar and battery manufacturers.”

Aside from tracking the funding for clean energy deployment and clean energy supply chain investment, the Energy Transition Investment Trends 2024 report also tracks two other types of funding:

Climate-tech equity raising: Equity raised by companies focused on climate and the energy transition ($84 billion in 2023)

- This figure has fallen for the past two years, as rising interest rates have made it harder for companies to raise capital. Companies had raised $168 billion in 2021 and $127 billion in 2022.

- Clean energy-focused companies raised more equity than any other sector in 2023, at $49 billion.

- Companies in the clean transport sector saw funding drop the most sharply, from $47 billion raised in 2022 to just $18 billion in 2023. Transport remained the second-largest funding sector, followed by Industry, Buildings, Agriculture and ‘Climate and Carbon’.

Energy transition debt issuance: Debt issued by companies and governments to fund the energy transition ($824 billion in 2023)

- This figure rose by 4% in 2023 after dropping 10% in 2022. Stabilizing or falling interest rates in various markets helped companies and governments raise debt for energy transition purposes and these trends are reflective of the broader market.

- Utilities raised the most debt for the energy transition ($328 billion), followed by financial institutions ($176 billion) and governments ($141 billion)

- Oil and gas companies’ energy transition debt issuance fell to $8.3 billion, down from $17.5 billion in 2022.

-ENDS-

Contacts

Hudson Sandler

Emily Dillon/Rebekah Chapman/Leah Albohayre

+44 (0) 207 796 4133

bloombergnef@hudsonsandler.com

BloombergNEF

Oktavia Catsaros

+1 212 617 9209

ocatsaros@bloomberg.net

About Bloomberg

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration. For more information, visit Bloomberg.com/company or request a demo.

About BloombergNEF

BloombergNEF (BNEF) is a strategic research provider covering global commodity markets and the disruptive technologies driving the transition to a low-carbon economy. Our expert coverage assesses pathways for the power, transport, industry, buildings and agriculture sectors to adapt to the energy transition. We help commodity trading, corporate strategy, finance and policy professionals navigate change and generate opportunities.