Oil & Gas latest prices

London, August 06, 2024, (Oilandgaspress) ––The energy sector continues to experience price volatility as headlines over the past weeks is dominated by the poor outlook for Chinese demand as economic weakness persists in the world’s top importer of crude oil. Also the recent loss of risk appetite across key stock market sectors has also led to some long liquidation from momentum-focused hedge funds. Oil is most susceptible to shocks, but the effects differ in size and direction. Oil

prices are often volatile during shocks because supply is concentrated in regions that

are often subject to political instability, conflicts or sanctions. Recurring tensions in the Middle East have kept volatility high, particularly for oil. Oil prices have continued to fluctuate with events that threaten to disrupt supply or escalate tensions like attacks in the Red Sea, Israel-Hamas war, and attacks on energy infrastructure in Ukraine and Russia.

| Oil and Gas Blends | Units | Oil Price US$/bbl | Change |

| Crude Oil (WTI) | USD/bbl | $73.64 | Up |

| Crude Oil (Brent) | USD/bbl | $76.86 | Up |

| Bonny Light 01/08/24 | USD/bbl | $85.57 | Down |

| Saharan Blend | USD/bbl | $85.61 | — |

| Natural Gas | USD/MMBtu | $2.02 | Up |

| Murban Crude | USD/bbl | $75.67 | Up |

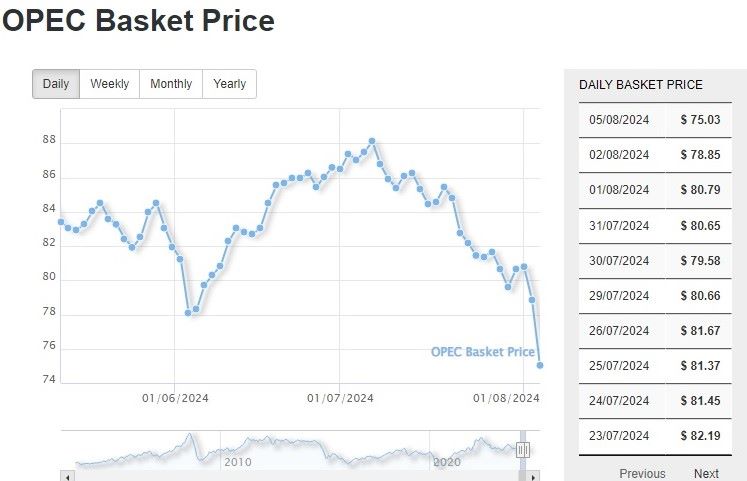

| OPEC basket 05/08/24 | USD/bbl | $75.03 | Down |

Goldman Sachs expects a $75 per barrel floor under Brent Crude prices that is unlikely to be breached due to the current macroeconomic fears of a U.S. recession. Despite the confidence in a $75 floor, Goldman Sachs acknowledges several downside risks to their $75-90 range for Brent prices, especially for 2025.