PetroNor E&P Increase Indirect Ownership of PNGF Sud to 16.83%

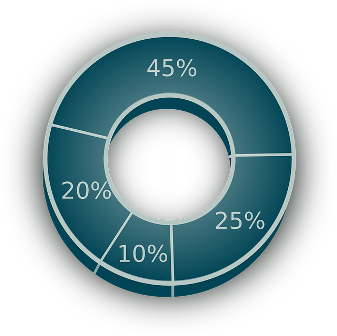

PetroNor E&P Limited announced that the Company’s net indirect interest in PNGF Sud, PetroNor’s core asset, will increase from 10.5% to 16.83% following i) a USD 18 million contingent acquisition of all of Symero Limited’s1 shares in Hemla Africa Holding AS (“HAH”) (the “Symero Transaction”), and ii) a court ruling in Congo related to parts of MGI International S.A.’s (“MGI”) indirect share in PNGF Sud (the “MGI Ruling”). Symero’s shares in HAH represent 29.293% of all issued and outstanding shares in HAH, and following completion of the Symero Transaction, the Company will own 100% of all issued and outstanding shares in HAH.

Furthermore, PetroNor announces that it is considering raising USD 50 to 60 million of new equity (the “Contemplated Equity Financing”), whereof USD 32 to 42 million in cash and USD 18 million as in-kind consideration for the Symero Transaction.

The Company has mandated Arctic Securities AS, Pareto Securities AS and SpareBank1 Markets AS as Joint Managers and Bookrunners to arrange a series of equity investor meetings and calls commencing on 19 February 2021. Petromal Sole Proprietorship LLC and related group companies (“Petromal”), the Company’s main shareholder owning 38.28% of all issued and outstanding shares in the Company, has committed to subscribe for its pro-rata share of the Contemplated Equity Financing, representing a subscription of approximately USD 19 to 23 million.

Highlights

- PetroNor’s net indirect interest in its core asset PNGF Sud to increase from 10.5% to 16.83% following the contemplated Symero Transaction and the MGI Ruling.

- ~60% increase in PetroNor’s PNGF Sud production and reserves with no impact on overhead costs;

- Net production from PNGF Sud to increase from 2,385 barrels of oil per day (“bopd”) to 3,850 bopd, based on 2020 average production;

- Net 2P reserves as of Year-end 2020 increasing from 9.9 million to 15.9 million barrels of oil (“mmbbl”);

- Reserves and resources are currently being audited, with update expected in March 2021. Based on production performance and expanded infill drilling program, the Company expects an increase in both reserves and resources.

Plans to raise USD 50 to 60 million of new equity, whereof approximately USD 37 to 41 million committed through pre-subscription from Petromal and in-kind consideration to Symero. Post the Contemplated Equity Financing, PetroNor will be in a robust financial position and fully funded for all sanctioned activities with significant flexibility to adjust its capital expenditure in a low oil price environment.

Information Source: Read Full Release ..–>

Press release by: