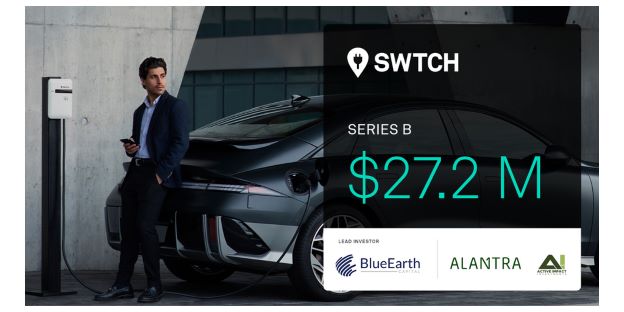

SWTCH Energy Secures $27.2M in Series B Funding to Eliminate EV Charging Gaps in Buildings

EV charging solutions provider achieves 10x year-over-year growth of its charging network and secures funding to further scale charger deployments in multifamily and commercial buildings across North America

TORONTO & BAAR-ZUG, Switzerland–(BUSINESS WIRE)–SWTCH Energy (“SWTCH”), a company pioneering electric vehicle (EV) charging solutions for multi-tenant buildings across North America, today announced that it raised $27.2 million in Series B funding. The round was led by Blue Earth Capital (“BlueEarth”), the specialist global impact investor, on behalf of its investment vehicles with participation from Alantra’s Energy Transition Fund, Klima. Additional Series B investors include Active Impact Investments and GIGA Investments Corp. This new funding will enable SWTCH to accelerate charging in multi-tenant buildings, following a tenfold increase in the company’s charging network since its Series A, and advance its innovative EV charging and integrated energy management solutions for real estate customers.

SWTCH is meeting the massive demand for multifamily EV charging as EV sales hit an inflection point and governments amend building codes and zoning ordinances to require properties to be EV-ready. SWTCH’s turnkey EV charging solutions tackle the main deployment challenges for new and aging multifamily buildings from upfront costs and limited electrical capacity to charger reliability. The company’s energy management solution, SWTCH Control™, for example, provides unmatched visibility into building electrical loads and available capacity for EV charging. It allows building owners to install and manage 10 times more EV chargers with existing electrical infrastructure, future-proofing properties while avoiding costly upgrades.

With this raise, SWTCH is leveraging machine learning and artificial intelligence to advance SWTCH Control and its other market-leading EV charging solutions. The company is also expanding integrations with industry-leading software solutions to create a seamless experience for both property managers and tenants who drive EVs.

“Today, a third of Americans live in multifamily buildings, largely without home charging access. As right-to-charge laws and energy efficiency mandates continue to gain traction, SWTCH is in a unique position to help real estate customers close this gap,” says SWTCH CEO Carter Li. “We’re always looking for ways to push our solutions forward to make EV charging a no-brainer. With this new capital, we will scale our EV charging solutions to ensure no building, and no driver, is left behind in the EV future.”

“As a mission-driven, global investment firm with a strategy of scaling companies addressing climate change, Blue Earth Capital is proud to invest in SWTCH’s work to expand EV charging access,” says Kayode Akinola, Head of Private Equity at Blue Earth Capital. “We’re pleased to see SWTCH’s innovative deployments and technological leadership to date, and are excited to partner with the company to support their pivotal growth stage. Electrification and supporting the energy transition is a key investment theme for our climate growth strategy, and an important component of this is the continued expansion of EV infrastructure. The multifamily space served by SWTCH offers a valuable market opportunity to grow our clean energy economy.”

“We think the multifamily housing market in North America is under-served with EV charging infrastructure. SWTCH’s capital efficient, building integrated model is the best we have seen in this space. We are proud to support SWTCH’s expansion, so it can make EV charging a better experience for drivers and property managers,” says Manuel Alamillo, Partner at Alantra’s Energy Transition Fund, Klima.

Notes to editors

About SWTCH Energy

Headquartered in Toronto, Ontario, with offices in Brooklyn and Boston, SWTCH is pioneering EV charging solutions for multifamily, commercial, and workplace properties across North America. SWTCH leverages the latest technology available to help building owners and operators deploy EV charging by tapping into their existing grid infrastructure. Through constant innovation and an extensive partnership network, SWTCH provides the most profitable and unique business model for multi-tenant buildings to stay competitive. For more information, visit www.swtchenergy.com.

About Blue Earth Capital

Blue Earth Capital is a global, independent, specialist impact investor, headquartered in Switzerland, with operations in New York, London, and Konstanz. Blue Earth Capital seeks to address the world’s most pressing social and environmental challenges by delivering measurable impact alongside aiming for attractive and market-rate financial returns. The company operates dedicated private equity, private credit, and fund solutions. Blue Earth Capital is owned by the Blue Earth Foundation, a Stiftung (charity/trust) registered in Switzerland that focuses on deep impact to support initiatives and business ventures to help deliver a more equitable and sustainable future.

About Alantra and Klima Energy Transition Fund

Alantra is an independent global mid-market financial services firm providing investment banking, asset management, and private capital services. In Alternative Asset Management, Alantra offers its clients unique access to a wide range of investment strategies in five highly specialized asset management classes (private equity, active funds, private debt, energy, and venture capital). As of 31 December 2023, assets under management from consolidated and strategic businesses stood at €15.6bn.

Alantra’s Energy Transition fund, Klima, is a 210M€ late-stage VC fund. Alongside Enagas, as cornerstone investor, Klima is backed by relevant investors such as the European Investment Fund, Axis ICO and CPPI. Klima partners with companies located in Europe and North America that have high growth potential in sectors such as smart power grids and markets, energy storage and technologies.

Contacts

Media

SWTCH

Chelsea Nolan

Antenna Group for SWTCH

Blue Earth Capital

Kekst CNC

Simon Markebeck

+46 76 127 90 72