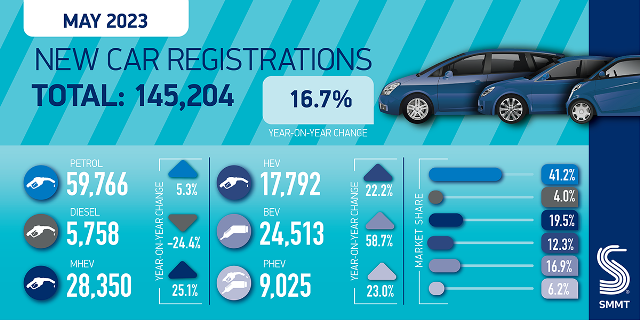

UK’s New car registrations up 16.7%

(Oilandgaspress) The UK new car market has posted its longest uninterrupted period of expansion for eight years, as registrations grew 16.7% in May to reach 145,204 units according to the latest figures from the Society of Motor Manufacturers and Traders (SMMT).1 The performance marks 10 consecutive months of growth, although registrations remain -21.0% below pre-pandemic 2019 levels.2

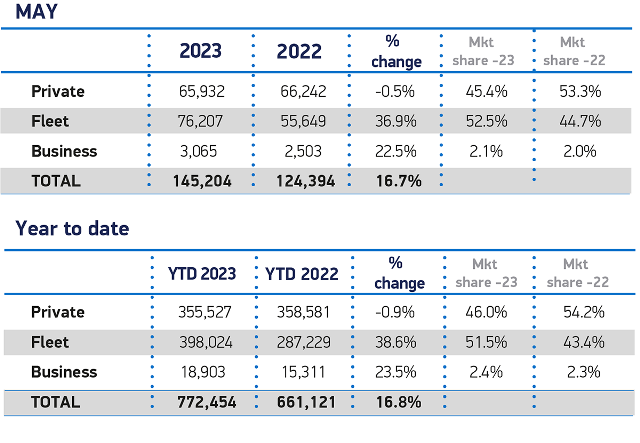

Large fleet registrations continued to drive the growth, up by 36.9% to 76,207 units, reflecting a regularisation of supply following challenging supply issues in 2022. Registrations to private buyers fell slightly by -0.5% to 65,932 cars, while smaller business fleets registered 3,065 units, a year on year rise of 22.5%.

Petrol-powered cars remain Britain’s best sellers, accounting for 57.1% of all registrations.3 Alternatively powered vehicles, however, continue to make up an ever-larger share of the market, with plug-in hybrids (PHEVs) rising 23.0% to reach a 6.2% market share and hybrids (HEVs) growing 22.2% to comprise 12.3% of all registrations. Reflecting the dramatic transformation of the market over the last three years, May saw battery electric vehicles consolidate their position as the UK’s second most popular power train. A further 24,513 joined the road during the month, up 58.7% on May last year to secure a 16.9% market share.

Of the new cars registered in May, lower mediums, superminis and dual purpose were the most popular, comprising 86.3% of the market. There are now zero emission options available in every single segment of the market, with more than 80 models – around a quarter of all new car models available – from which to choose. Furthermore, these new BEVs have an average battery range of 236 miles, well in excess of UK drivers’ average weekly mileage of around 100 miles.4

Information Source: Read More “

Energy Monitors , Electric Power , Natural Gas , Oil , Climate , Renewable , Wind , Transition , LPG , Solar , Electric , Biomass , Sustainability , Oil Price , Electric Vehicles,