Energy News Digest to 15th Mar. 2022. OPEC daily basket price stood at $110.67/bl, Mon, 14th Mar. 2022

European natural gas prices dropped further as Russian and Ukrainian negotiations continue. Benchmark gas futures fell as much as 16%.

KBR, Inc. will provide an update to its 2025 long-term financial targets to reflect the anticipated financial benefits of its HomeSafe Alliance joint venture with Tier One Relocation (“HomeSafe”). KBR has a 72% ownership interest in HomeSafe, which was awarded the global household goods contract by U.S. Transportation Command in November 2021. Expected financial and strategic benefits to KBR include:

Exclusive, long-term contract: HomeSafe was awarded the exclusive contract to be the global household goods move-management service provider for the U.S. Armed Forces, Department of Defense civilians and their families for a term of up to 9.5 years. HomeSafe will be the exclusive move manager for approximately 325,000 global moves annually.

Strategically aligned with KBR’s platform and core capabilities: HomeSafe will upgrade, modernize, and transform the relocation experience by embedding digital technology, efficiency, and widescale program management into the current platform, utilizing an innovative, scalable and sustainability-focused end-to-end digital solution – all through a predictable, enduring business model.

Attractive program profile: HomeSafe benefits from a steady, gradual operational ramp-up, contractually provided fuel and economic price indexing adjustments, low capital intensity, and a performance-based incentive profile.

Compelling economics: The contract has a ceiling value of $20 billion and is expected to provide KBR with strong earnings and cash accretion, increased funding source diversification, and enhanced long-range visibility. Read More

Mercedes-Benz Halts Exports to Russia

Mercedes-Benz decided to halt exports to Russia. Mercedes-Benz thus becomes the latest European brand to withdraw business from a sanctions-hit Russia following the eastern state’s invasion in Ukraine.

“Mercedes-Benz will suspend the export of passenger cars and vans to Russia, as well as the local manufacturing in Russia”, the company announced. Furthermore, Daimler Truck Holding AG announced the end of all business activities in Russia and of the 12-year partnership with the local truck builder Kamaz. The Russian company also builds armored vehicles. Mercedes sees its activity in Sindelfingen affected by the war in Ukraine, due to lack of cable harnesses. A facility in the country now invaded by the Russian troops build the parts. Read More

A Swedish company is developing a floating wind turbine system made up of 126 small turbines spinning in unison. An American designer has created a wind turbine wall that could be used on the side of a highway. And now, a Dutch company is looking at helicopter blade technology to reinvent wind turbines.

Seawind Ocean Technologies has developed a twin-blade wind turbine that is 25% cheaper to install and operate than its conventional three-blade counterpart, yet produces virtually the same amount of energy. Read More

Pacific Gas and Electric Company and General Motors announced a breakthrough collaboration to pilot the use of GM electric vehicles as on-demand power sources for homes in PG&E’s service area. PG&E and GM will test vehicles with cutting-edge bidirectional charging technology that can help safely power the essential needs of a properly equipped home. EVs play a critical role in achieving California’s goals for reducing greenhouse gas emissions and already provide customers with many benefits. Bidirectional charging capabilities add even further value by improving electric resiliency and reliability.PG&E and GM aim to test the pilot’s first vehicle-to-home capable EV and charger by summer 2022. The pilot will include the use of bidirectional hardware coupled with software-defined communications protocols that will enable power to flow from a charged EV into a customer’s home, automatically coordinating between the EV, home and PG&E’s electric supply. The pilot will include multiple GM EVs. More

General Motors Co. (NYSE: GM) and POSCO Chemical announced that they are working with the governments of Canada and Quebec to build a new facility in Bécancour, Quebec, estimated at $400 million (C$500 million). The new facility will produce cathode active material (CAM) for GM’s Ultium batteries, which will power electric vehicles such as the Chevrolet Silverado EV, GMC HUMMER EV and Cadillac LYRIQ.

The companies previously announced plans to form a CAM processing joint venture in December 2021, majority owned by POSCO Chemical. Construction on the new facility, which the joint venture will operate, will begin immediately and will create approximately 200 jobs. The site’s construction will allow for future expansion opportunities as GM continues to pursue many potential future EV supply chain projects. Read More

Hamburg’s harbour provides the backdrop for the world premiere of the ID. Buzz and ID. Buzz Cargo.

It is the first generation of a new kind of mobility at Volkswagen Commercial Vehicles. The first fully electric vehicles: the ID. Buzz and ID. Buzz Cargo. Whether for the whole family or for use as a delivery vehicle: get to know the new, iconic design that combines modern proportions with innovative technology in more detail. Full connectivity, digital features, a redefined sense of space and your new, climate-conscious mobility – with the two models ID. Buzz and ID. Buzz Cargo. Read More

| Oil and Gas Blends | Units | Oil Price $ | change |

| Crude Oil (WTI) | USD/bbl | $97.13 | Down |

| Crude Oil (Brent) | USD/bbl | $100.70 | Down |

| Bonny Light | USD/bbl | $106.80 | Down |

| Natural Gas | USD/MMBtu | $4.56 | Down |

| OPEC basket 14/03/22 | USD/bbl | $110.67 | Down |

COT: Oil longs in major retreat as volatility jumps

Summary: The COT reports published weekly by the US CFTC highlight futures positions and changes made by hedge funds across commodities, forex and financials during the latest reporting week to last Tuesday, March 8. A week where the war in Ukraine and increased sanctions against Russia dictated most of the market swings, especially in commodities where spiking prices and rising volatility helped drive a second week of long and short liquidations.

Energy: Despite rallying by around 20%, speculators cut their combined length in WTI and Brent crude oil by 100.3k lots to a three-month low at 435k lots, the largest one-week reduction since last July. Brent, which jumped 22% during the week, saw the biggest impact with the 38% to 158k lots being the biggest reduction made by money managers in a single week since ICE started publishing the data in 2011. The slump took the net in Brent close to the December low at 154k lots, a low point when oil briefly traded below $70/b in response to the rapidly spreading Omicron variant. The move was driven mostly by a pullback in outright longs of 63.5k lots, but also by the biggest addition in short bets (+33.6k lots) since 2016.

Long liquidation across all three fuel futures added to the story of speculators booking some profit after a one-week gains up to 42% had taken all three to record highs. By Ole Hansen, Head of Commodity Strategy at Saxo Bank Read More

CME Group announced that it is introducing event-based contracts designed for the retail audience that will make it easier for everyone to trade their views on daily up or down price moves in some of the world’s most widely quoted benchmark futures markets, including gold, oil, equity indices and foreign currencies. These new daily options on futures contracts will offer short-term trading opportunities for individuals seeking to take a position on daily price moves using smaller-value trades of up to $20 per contract.

Individuals will be able to trade their view on whether the price of key futures markets will move up or down by the end of each day’s trading session, beginning with gold, silver, copper, crude oil, natural gas, E-mini S&P 500, E-mini Nasdaq-100, E-mini Dow Jones Industrial Average, E-mini Russell 2000 and euro-U.S. dollar foreign exchange. Each event-based contract will be fully collateralized, with limited risk, meaning investors can choose their maximum profit or loss at the time of the trade. Read More

ExxonMobil said that Matt Furman has been elected vice president of public and government affairs, effective April 1, replacing Suzanne McCarron, who has elected to retire after 24 years of service.Furman joins ExxonMobil from Best Buy Co. Inc., where he was chief communications and public affairs officer since 2012. At Best Buy, he oversaw internal and external communications, government affairs, corporate responsibility and sustainability, as well as the company’s corporate and foundation giving. Furman joined the company as it began its turnaround, widely viewed as one of the most successful in U.S. retail history. Read More

After seven years at the helm of Odfjell SE, Kristian Mørch has informed the Board of Directors that he will step down as CEO. He will continue in his current role until his successor is in place. The Board has initiated a process to identify the next CEO of the Company.Kristian Mørch comments that “it has been a privilege to lead the highly professional and dedicated Odfjell team during the past seven years, and I am proud of what we have achieved during this turnaround period. Odfjell is today standing on a very strong competitive platform and is well-positioned to take advantage of the opportunities ahead of us, so it is now the right time for the company to identify who will be leading Odfjell into the future.”

The Board of Directors has engaged Russell Reynolds Associates in Oslo as an advisor in the process. Read More

Union Jack Oil plc (AIM: UJO) a UK focused hydrocarbon production, development and exploration company advises that an application to extend the existing planning to drill the North Kelsey-1 exploration well was refused at the meeting of the Lincolnshire County Council Planning Committee. Union Jack holds a 50% economic interest in PEDL241 which contains the North Kelsey-1 well site. Executive Chairman of Union Jack, David Bramhill commented: “A rather odd and disturbing decision taking into consideration current world events and the clear need for the UK to secure new indigenous energy supplies. “A compelling case was presented by the Operator and a positive recommendation was made by Lincolnshire County Council’s Planning Officer. “An appeal will be made against this decision and further updates will be provided in due course”. Read More–>

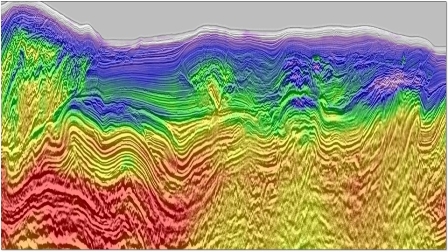

Helium One’s ongoing interpretation of Phase II 2D Seismic data has identified multiple areas of interest with potential closure at both the Lake Bed and Karoo Group levels. The area surveyed was not previously covered by historic 2D seismic, so any newly identified closures would be additional to the Company’s current resource base and prospect portfolio.

The Company intends to complete additional work on the areas of interest to identify drill-ready prospects. This will be done through ongoing 2D Seismic interpretation integrating data from Airborne Gravity Gradiometry, Multispectral Satellite Spectroscopy, Electrical Resistance Tomography and QEMSCAN data. This information will feed into risk weighting and volumetric analysis which will, in turn, feed into prospect prioritisation ahead of our planned 2022 drilling campaign.

Drilling Rig Update

Helium One is in advanced discussions with a leading global drilling company for the provision of a containerised rig solution. A containerised rig has the drawworks capacity and capabilities of a conventional drilling rig but can be broken into modules with the dimensions of standard ISO containers. This enables the rig to be transported quickly and economically by any container ship, train or truck and is ideal for drilling in Africa with reduced transportation costs. Read More–>

Aker Offshore Wind and Mainstream Renewable Power Close Transaction for Offshore Wind Development in Japan

With reference to the stock exchange notice on 12 August 2021, Aker Offshore Wind and Mainstream Renewable Power (“Mainstream”) have closed the transaction which will see them take an initial 50 percent ownership stake in Progression Energy’s 800 MW floating offshore wind project in Japan. The project is a well -formed early-stage development opportunity, and the site has been identified as ideal for floating wind.

With the successful closing of the transaction, the parties will now collectively continue to mature the project. As a consortium, the three companies bring together highly complementary capabilities and experience. Aker Offshore Wind, as a part of the Aker group of companies, is able to leverage decades of offshore and floating expertise, whilst Mainstream brings a global leadership position in offshore wind development. Progression Energy has a successful track record in recognizing markets with strong fundamentals early and positioning itself for success. Progression Energy has a team established in Japan with experience in engaging stakeholders such as fishing unions and securing permits for its multiple projects. Read More

| Region | Period | Rig Count | Change from Prior |

| U.S.A | 11th March 2022 | 663 | +13 |

| Canada | 11th March 2022 | 206 | -11 |

| International | February 2022 | 813 | -28 |

APA Corporation announced the closing of two transactions, generating net proceeds of approximately $1 billion. On March 7, subsidiaries of the company completed the sale of a Delaware Basin mineral package to an undisclosed buyer for approximately $805 million, subject to post-closing adjustments. The divested assets primarily comprise non-operated properties across west Texas and southeast New Mexico, with estimated production of approximately 7,000 barrels of oil equivalent per day. Read More

Apache Corporation announced that it has commenced cash tender offers (each, an “Offer” and collectively, the “Offers”) to purchase up to $500 million in aggregate principal amount (the “Maximum Purchase Amount”) of its outstanding notes listed in the table below (the “Notes,” and each, a “Series” of Notes). Subject to the Maximum Purchase Amount, the amount of a Series of Notes that is purchased in the Offers will be based on the Acceptance Priority Levels set forth below. The Offers are being made on the terms and subject to the conditions set forth in the offer to purchase dated March 14, 2022 (the “Offer to Purchase”). Capitalized terms used in this release but not otherwise defined have the meaning given in the Offer to Purchase. Read More

DNO ASA, the Norwegian oil and gas operator, announced that the Company’s shares will be traded ex-dividend effective 14 March 2022. A dividend payment of NOK 0.20 per share will be made on or about 21 March to all shareholders of record as of 15 March 2022. Read More

OilandGasPress Energy Newsbites and Analysis Roundup |Compiled by: OGP Staff, Segun Cole @oilandgaspress.

Disclaimer: News articles reported on OilAndGasPress are a reflection of what is published in the media. OilAndGasPress is not in a position to verify the accuracy of daily news articles. The materials provided are for informational and educational purposes only and are not intended to provide tax, legal, or investment advice.